In the preceding three months, 5 analysts have released ratings for NBT Bancorp NBTB, presenting a wide array of perspectives from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 2 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

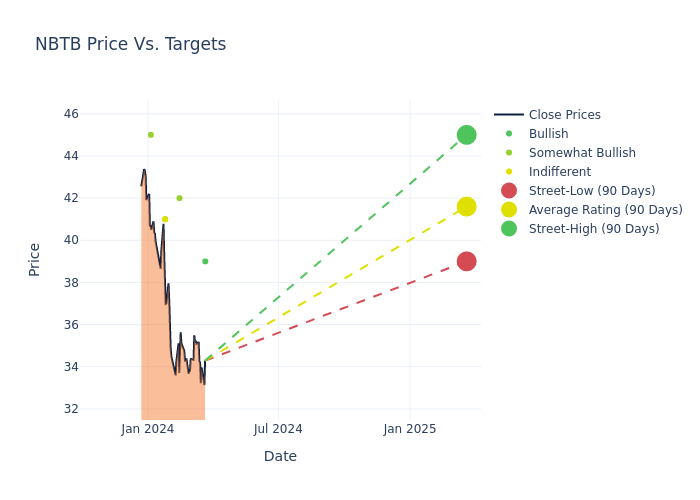

Analysts have recently evaluated NBT Bancorp and provided 12-month price targets. The average target is $41.6, accompanied by a high estimate of $45.00 and a low estimate of $39.00. Highlighting a 1.72% decrease, the current average has fallen from the previous average price target of $42.33.

Decoding Analyst Ratings: A Detailed Look

A comprehensive examination of how financial experts perceive NBT Bancorp is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jake Civiello | Janney Montgomery Scott | Announces | Buy | $39.00 | - |

| Matt Breese | Stephens & Co. | Announces | Overweight | $42.00 | - |

| Christopher O'Connell | Keefe, Bruyette & Woods | Lowers | Market Perform | $41.00 | $45.00 |

| Alexander Twerdahl | Piper Sandler | Lowers | Overweight | $41.00 | $42.00 |

| Steve Moss | Raymond James | Raises | Outperform | $45.00 | $40.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to NBT Bancorp. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of NBT Bancorp compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for NBT Bancorp's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of NBT Bancorp's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on NBT Bancorp analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About NBT Bancorp

NBT Bancorp Inc is a financial holding company that operates through its subsidiaries. The company's principal sources of revenue include management fees and dividends it receives through its subsidiaries. NBT Bank is a full-service community bank offering a full range of retail and commercial banking products and trust and investment services. Loan products include consumer, home equity, mortgage, business banking, and commercial loans. Nearly half of its loan portfolio is in commercial loans. The bank serves individuals, corporations, and municipalities, and operates scores of locations throughout New York, Pennsylvania, Vermont, Massachusetts, New Hampshire, and Maine.

NBT Bancorp's Financial Performance

Market Capitalization: Positioned above industry average, the company's market capitalization underscores its superiority in size, indicative of a strong market presence.

Revenue Growth: NBT Bancorp's remarkable performance in 3 months is evident. As of 31 December, 2023, the company achieved an impressive revenue growth rate of 3.19%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Financials sector.

Net Margin: NBT Bancorp's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 22.2% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): NBT Bancorp's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 2.18%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): NBT Bancorp's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.22%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: NBT Bancorp's debt-to-equity ratio is below the industry average. With a ratio of 0.38, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.