Financial giants have made a conspicuous bullish move on Stellantis. Our analysis of options history for Stellantis STLA revealed 8 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $146,890, and 6 were calls, valued at $399,092.

Projected Price Targets

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $22.0 to $40.0 for Stellantis over the last 3 months.

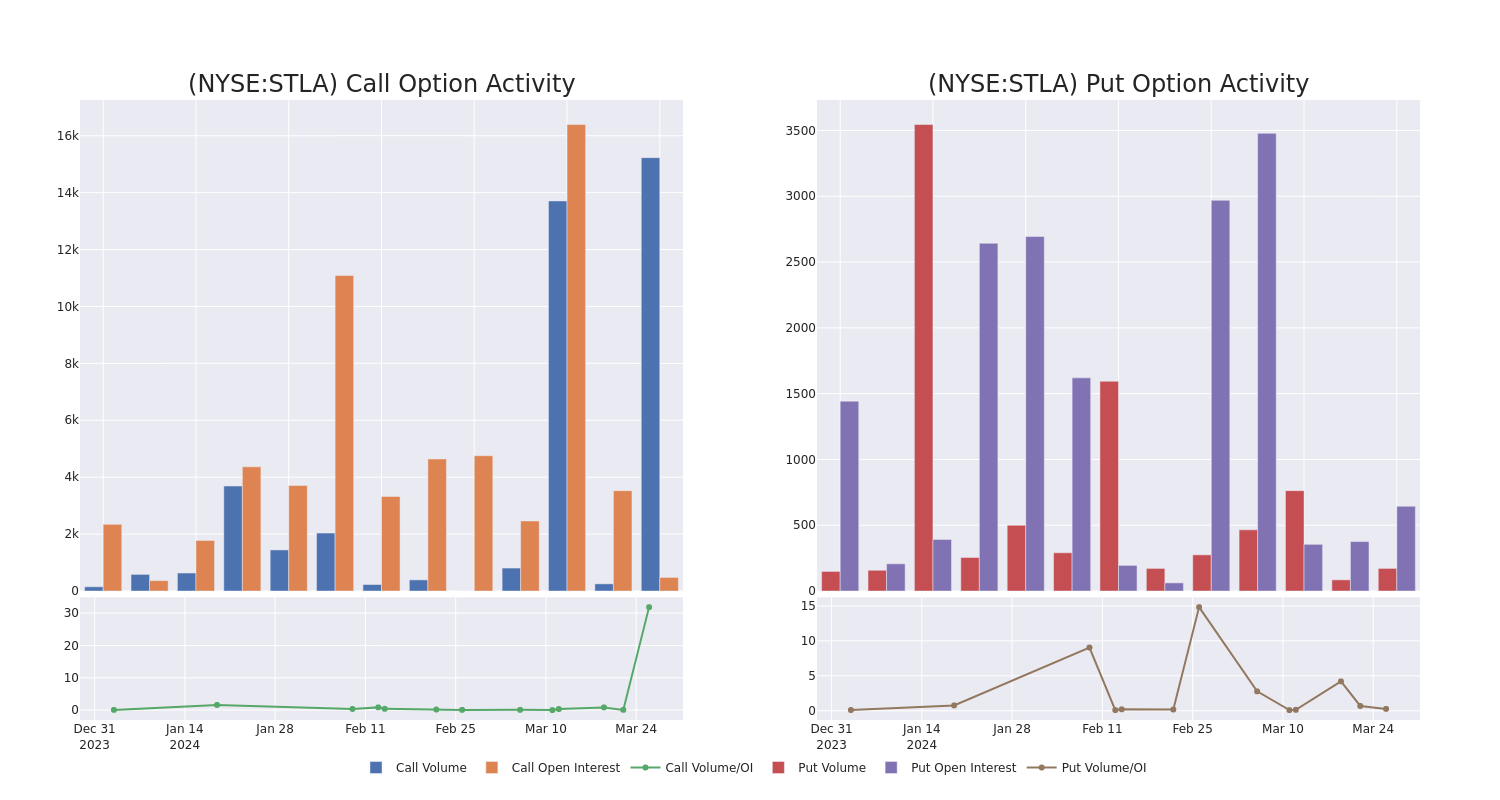

Volume & Open Interest Trends

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Stellantis's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Stellantis's significant trades, within a strike price range of $22.0 to $40.0, over the past month.

Stellantis 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| STLA | CALL | TRADE | BEARISH | 01/16/26 | $22.00 | $116.2K | 783 | 300 |

| STLA | CALL | SWEEP | BEARISH | 01/16/26 | $22.00 | $98.5K | 783 | 100 |

| STLA | PUT | TRADE | BULLISH | 05/17/24 | $31.00 | $77.7K | 0 | 210 |

| STLA | CALL | SWEEP | BEARISH | 01/16/26 | $22.00 | $76.8K | 783 | 0 |

| STLA | PUT | SWEEP | BULLISH | 05/17/24 | $31.00 | $69.1K | 0 | 398 |

About Stellantis

Stellantis NV was formed on Jan. 16, 2021, from the merger of Fiat Chrysler Automobiles and PSA Group. The combination of the two companies created the world's fifth-largest automaker, with 14 automobile brands. In 2022, pro forma Stellantis had sales volume of 6.0 million vehicles and EUR 179.6 billion in revenue, albeit affected by the microchip shortage. Europe is Stellantis' largest market, accounting for 44% of 2022 global volume while North America and South America were 31% and 14%, respectively.

Having examined the options trading patterns of Stellantis, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Current Position of Stellantis

- Currently trading with a volume of 724,002, the STLA's price is up by 0.84%, now at $28.94.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 119 days.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Stellantis options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.