In the preceding three months, 20 analysts have released ratings for Lam Research LRCX, presenting a wide array of perspectives from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 8 | 2 | 10 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 2 | 0 | 0 |

| 3M Ago | 7 | 2 | 5 | 0 | 0 |

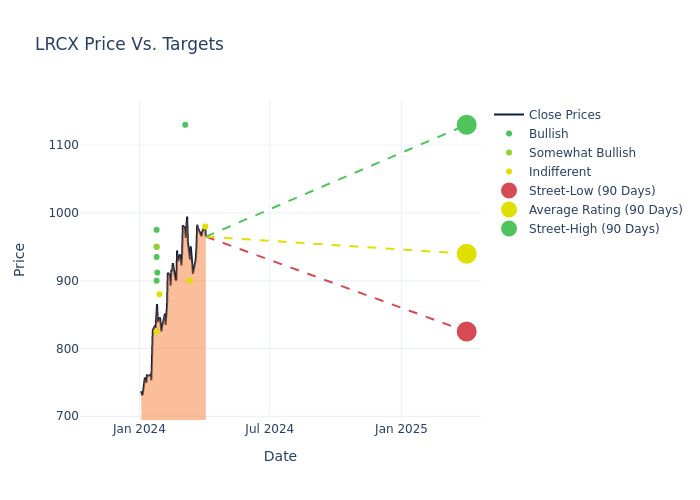

In the assessment of 12-month price targets, analysts unveil insights for Lam Research, presenting an average target of $906.45, a high estimate of $1130.00, and a low estimate of $750.00. This current average has increased by 16.48% from the previous average price target of $778.21.

Understanding Analyst Ratings: A Comprehensive Breakdown

The analysis of recent analyst actions sheds light on the perception of Lam Research by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joseph Quatrochi | Wells Fargo | Raises | Equal-Weight | $980.00 | $930.00 |

| C J Muse | Cantor Fitzgerald | Maintains | Neutral | $900.00 | - |

| Timothy Arcuri | UBS | Raises | Buy | $1130.00 | $885.00 |

| C J Muse | Cantor Fitzgerald | Maintains | Neutral | $900.00 | - |

| C J Muse | Cantor Fitzgerald | Maintains | Neutral | $900.00 | - |

| C J Muse | Cantor Fitzgerald | Maintains | Neutral | $900.00 | - |

| C J Muse | Cantor Fitzgerald | Maintains | Neutral | $900.00 | - |

| Mehdi Hosseini | Susquehanna | Raises | Neutral | $880.00 | $655.00 |

| Toshiya Hari | Goldman Sachs | Raises | Buy | $912.00 | $700.00 |

| Atif Malik | Citigroup | Raises | Buy | $975.00 | $800.00 |

| Vijay Rakesh | Mizuho | Raises | Buy | $935.00 | $900.00 |

| Brian Chin | Stifel | Raises | Buy | $950.00 | $850.00 |

| Toshiya Hari | Goldman Sachs | Raises | Buy | $912.00 | $700.00 |

| Srini Pajjuri | Raymond James | Raises | Outperform | $950.00 | $850.00 |

| Raimo Lenschow | Barclays | Raises | Equal-Weight | $825.00 | $750.00 |

| Charles Shi | Needham | Raises | Buy | $900.00 | $800.00 |

| C J Muse | Cantor Fitzgerald | Announces | Neutral | $830.00 | - |

| Srini Pajjuri | Raymond James | Raises | Outperform | $850.00 | $725.00 |

| Brian Chin | Stifel | Raises | Buy | $850.00 | $750.00 |

| Raimo Lenschow | Barclays | Raises | Equal-Weight | $750.00 | $600.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Lam Research. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Lam Research compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Lam Research's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Lam Research's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Lam Research analyst ratings.

All You Need to Know About Lam Research

Lam Research is one of the largest semiconductor wafer fabrication equipment, or WFE, manufacturers in the world. It specializes in the market segments of deposition and etch, which entail the buildup of layers on a semiconductor and the subsequent selective removal of patterns from each layer. Lam holds the top market share in etch and holds the clear cut second share in deposition. It is more exposed to memory chipmakers for DRAM and NAND chips. It counts as top customers the largest chipmakers in the world, including TSMC, Samsung, Intel, and Micron.

Lam Research's Economic Impact: An Analysis

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Lam Research's revenue growth over a period of 3 months has faced challenges. As of 31 December, 2023, the company experienced a revenue decline of approximately -28.79%. This indicates a decrease in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: Lam Research's net margin excels beyond industry benchmarks, reaching 25.39%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Lam Research's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 11.73% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 5.11%, the company showcases effective utilization of assets.

Debt Management: With a high debt-to-equity ratio of 0.61, Lam Research faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Core of Analyst Ratings: What Every Investor Should Know

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.