Investors with a lot of money to spend have taken a bearish stance on HubSpot HUBS.

And retail traders should know.

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with HUBS, it often means somebody knows something is about to happen.

Today, Benzinga's options scanner spotted 11 options trades for HubSpot.

This isn't normal.

The overall sentiment of these big-money traders is split between 36% bullish and 63%, bearish.

Out of all of the options we uncovered, there was 1 put, for a total amount of $51,000, and 10, calls, for a total amount of $387,368.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $600.0 to $680.0 for HubSpot during the past quarter.

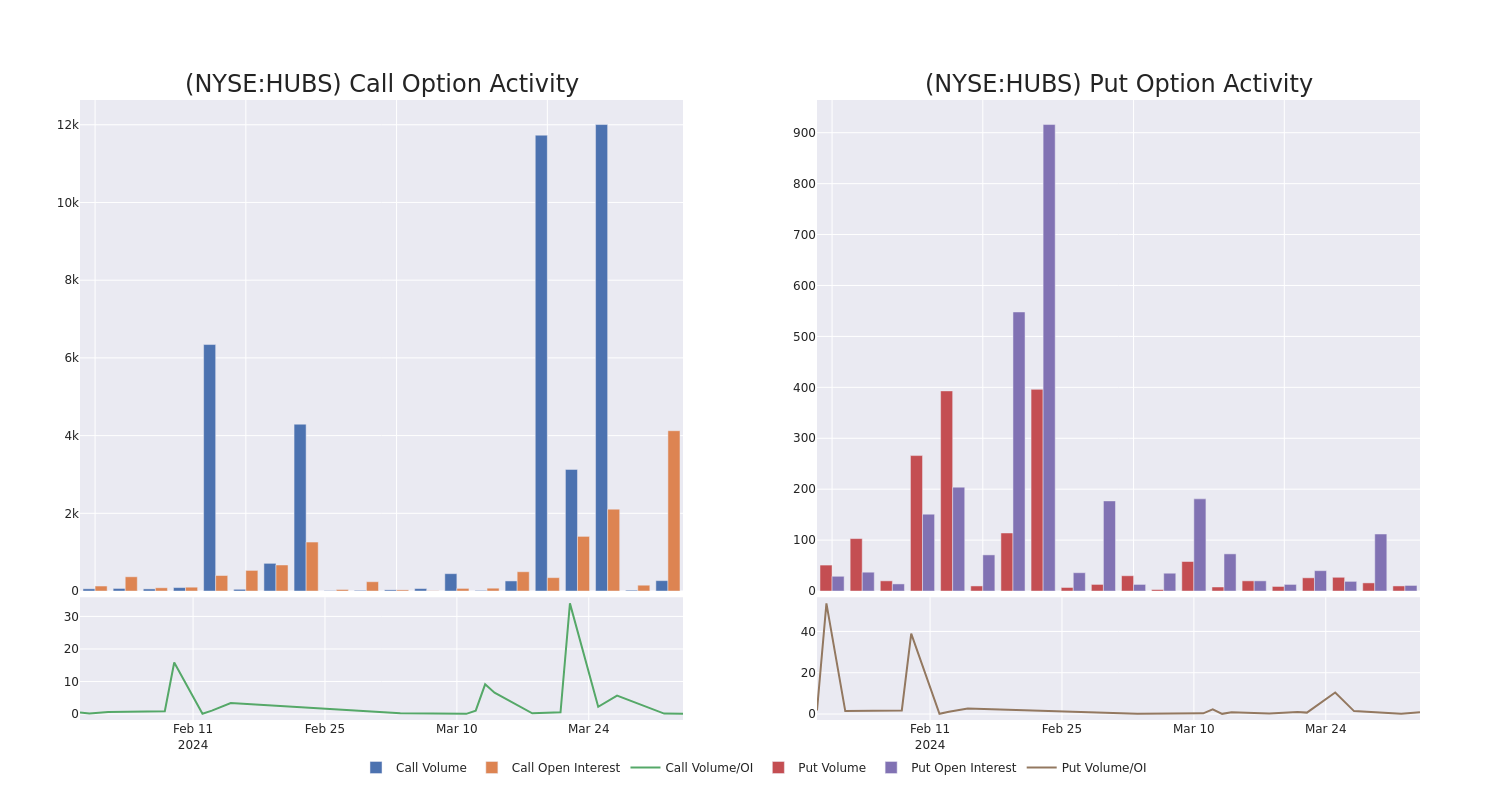

Volume & Open Interest Development

In today's trading context, the average open interest for options of HubSpot stands at 517.12, with a total volume reaching 268.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in HubSpot, situated within the strike price corridor from $600.0 to $680.0, throughout the last 30 days.

HubSpot 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HUBS | CALL | TRADE | BEARISH | 09/20/24 | $96.6 | $93.0 | $93.9 | $610.00 | $93.9K | 13 | 10 |

| HUBS | PUT | TRADE | BEARISH | 04/19/24 | $51.6 | $45.0 | $51.0 | $670.00 | $51.0K | 11 | 10 |

| HUBS | CALL | SWEEP | BULLISH | 04/19/24 | $12.6 | $12.6 | $12.6 | $670.00 | $46.5K | 177 | 49 |

| HUBS | CALL | TRADE | BEARISH | 05/17/24 | $26.7 | $26.5 | $26.5 | $680.00 | $39.7K | 59 | 15 |

| HUBS | CALL | SWEEP | BULLISH | 05/17/24 | $63.0 | $61.2 | $62.2 | $600.00 | $37.3K | 38 | 2 |

About HubSpot

HubSpot provides a cloud-based marketing, sales, and customer service software platform referred to as the growth platform. The applications are available ala carte or packaged together. HubSpot's mission is to help companies grow better and has expanded from its initial focus on inbound marketing to embrace marketing, sales, and service more broadly. The company was founded in 2006, completed its initial public offering in 2014, and is headquartered in Cambridge, Massachusetts.

Current Position of HubSpot

- With a volume of 352,347, the price of HUBS is down 0.0% at $609.97.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 28 days.

Expert Opinions on HubSpot

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $520.0.

- Reflecting concerns, an analyst from Keybanc lowers its rating to Underweight with a new price target of $520.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for HubSpot with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.