Ameresco AMRC underwent analysis by 4 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

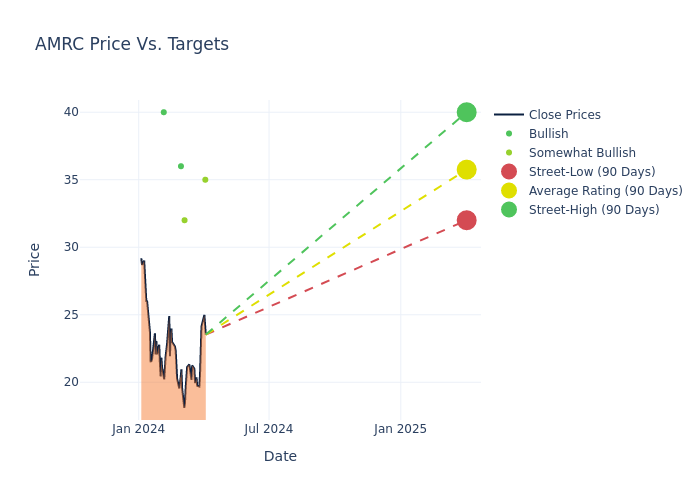

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $35.75, along with a high estimate of $40.00 and a low estimate of $32.00. Experiencing a 19.66% decline, the current average is now lower than the previous average price target of $44.50.

Diving into Analyst Ratings: An In-Depth Exploration

A comprehensive examination of how financial experts perceive Ameresco is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Pavel Molchanov | Raymond James | Lowers | Outperform | $35.00 | $40.00 |

| Kashy Harrison | Piper Sandler | Lowers | Overweight | $32.00 | $42.00 |

| George Gianarikas | Canaccord Genuity | Lowers | Buy | $36.00 | $50.00 |

| Christopher Souther | B. Riley Securities | Lowers | Buy | $40.00 | $46.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Ameresco. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Ameresco compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Ameresco's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Ameresco's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Ameresco analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About Ameresco

Ameresco Inc provides energy efficiency solutions for facilities in North America and Europe. It focuses on projects that reduce energy, also focuses on the operations and maintenance costs of governmental, educational, utility, healthcare, and other institutional, commercial, and industrial entities facilities. Ameresco distributes solar energy products and systems, such as PV panels, solar regulators, solar charge controllers, inverters, solar-powered lighting systems, solar-powered water pumps, solar panel mounting hardware, and other system components. The company's segment includes U.S. Regions; U.S. Federal; Canada; Alternative Fuels; Non-Solar DG and All Other. It derives a majority of revenue from the U.S. Regions segment.

Ameresco: Delving into Financials

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Over the 3 months period, Ameresco showcased positive performance, achieving a revenue growth rate of 33.05% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Industrials sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Ameresco's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 7.66% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 3.82%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Ameresco's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.94%, the company may face hurdles in achieving optimal financial performance.

Debt Management: Ameresco's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.72, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.