Analysts' ratings for Voya Financial VOYA over the last quarter vary from bullish to bearish, as provided by 5 analysts.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 4 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 3 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

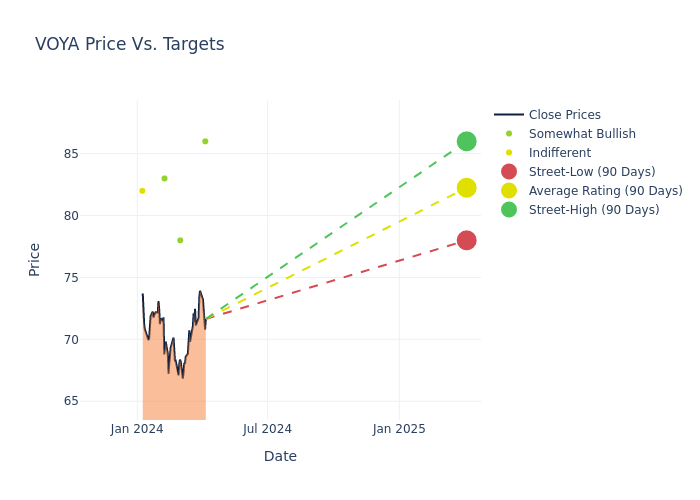

In the assessment of 12-month price targets, analysts unveil insights for Voya Financial, presenting an average target of $81.6, a high estimate of $86.00, and a low estimate of $78.00. Surpassing the previous average price target of $81.50, the current average has increased by 0.12%.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of Voya Financial among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| John Barnidge | Piper Sandler | Raises | Overweight | $86.00 | $78.00 |

| Nigel Dally | Morgan Stanley | Lowers | Overweight | $78.00 | $79.00 |

| Kenneth Lee | RBC Capital | Lowers | Outperform | $83.00 | $85.00 |

| Nigel Dally | Morgan Stanley | Lowers | Overweight | $79.00 | $84.00 |

| Alex Scott | Goldman Sachs | Announces | Neutral | $82.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Voya Financial. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Voya Financial compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Voya Financial's stock. This examination reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Voya Financial's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Voya Financial analyst ratings.

About Voya Financial

Voya Financial Inc is a financial services company, which, through its subsidiaries, provides various investment, insurance, and retirement solutions to individual and institutional clients in the United States. Its products and services include tax savings plans, individual retirement accounts, group life insurance plans, and employee benefits products, among others. The company tailors each of its products to the needs of its customer base. It operates its business through three principal lines: Wealth Solutions, Investment Management, and Health Solutions The Wealth segment generates roughly half of the company's revenue.

Voya Financial's Economic Impact: An Analysis

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Voya Financial displayed positive results in 3 months. As of 31 December, 2023, the company achieved a solid revenue growth rate of approximately 15.34%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Financials sector.

Net Margin: Voya Financial's net margin is impressive, surpassing industry averages. With a net margin of 6.59%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Voya Financial's ROE excels beyond industry benchmarks, reaching 3.22%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Voya Financial's ROA stands out, surpassing industry averages. With an impressive ROA of 0.08%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Voya Financial's debt-to-equity ratio is below the industry average. With a ratio of 0.82, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Basics of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.