Investors with a lot of money to spend have taken a bearish stance on Adobe ADBE.

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with ADBE, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 33 uncommon options trades for Adobe.

This isn't normal.

The overall sentiment of these big-money traders is split between 30% bullish and 69%, bearish.

Out of all of the special options we uncovered, 26 are puts, for a total amount of $2,383,102, and 7 are calls, for a total amount of $312,046.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $370.0 to $630.0 for Adobe during the past quarter.

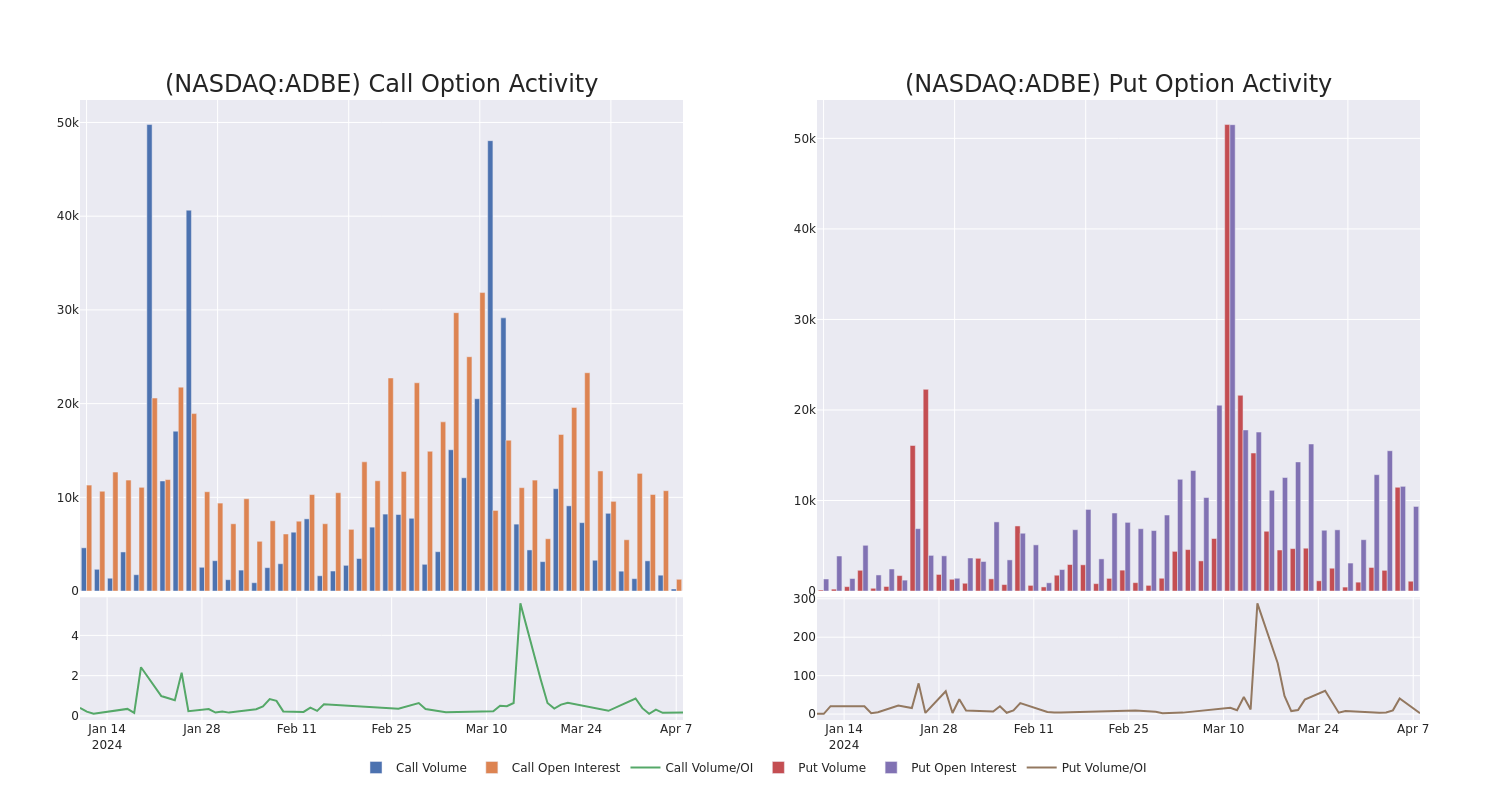

Volume & Open Interest Development

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Adobe's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Adobe's substantial trades, within a strike price spectrum from $370.0 to $630.0 over the preceding 30 days.

Adobe Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADBE | PUT | TRADE | BULLISH | 05/17/24 | $16.65 | $16.4 | $16.4 | $485.00 | $655.9K | 1.1K | 414 |

| ADBE | PUT | TRADE | BULLISH | 09/20/24 | $17.9 | $17.3 | $17.35 | $430.00 | $173.5K | 304 | 2 |

| ADBE | PUT | TRADE | BULLISH | 03/21/25 | $14.9 | $14.35 | $14.5 | $370.00 | $145.0K | 40 | 0 |

| ADBE | PUT | SWEEP | BEARISH | 01/17/25 | $33.85 | $33.6 | $33.85 | $450.00 | $118.4K | 1.0K | 65 |

| ADBE | PUT | TRADE | NEUTRAL | 04/19/24 | $35.55 | $34.1 | $34.88 | $520.00 | $87.2K | 1.3K | 6 |

About Adobe

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing and engaging with compelling content multiple operating systems, devices and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

In light of the recent options history for Adobe, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Where Is Adobe Standing Right Now?

- Currently trading with a volume of 2,024,731, the ADBE's price is down by -0.23%, now at $484.0.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 66 days.

What The Experts Say On Adobe

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $597.0.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Adobe with a target price of $650.

- An analyst from Mizuho downgraded its action to Buy with a price target of $680.

- Consistent in their evaluation, an analyst from TD Cowen keeps a Outperform rating on Adobe with a target price of $640.

- An analyst from Keybanc downgraded its action to Underweight with a price target of $445.

- Maintaining their stance, an analyst from JP Morgan continues to hold a Neutral rating for Adobe, targeting a price of $570.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Adobe with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.