Vertex Pharmaceuticals VRTX underwent analysis by 16 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 8 | 2 | 0 | 2 |

| Last 30D | 0 | 0 | 0 | 0 | 1 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 3 | 6 | 2 | 0 | 1 |

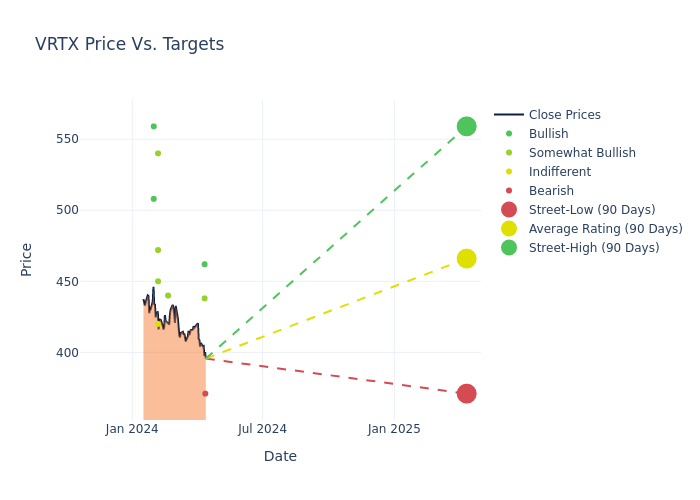

Analysts have set 12-month price targets for Vertex Pharmaceuticals, revealing an average target of $453.25, a high estimate of $559.00, and a low estimate of $371.00. This current average has increased by 7.58% from the previous average price target of $421.31.

Deciphering Analyst Ratings: An In-Depth Analysis

The analysis of recent analyst actions sheds light on the perception of Vertex Pharmaceuticals by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Whitney Ijem | Canaccord Genuity | Maintains | Sell | $371.00 | $371.00 |

| Andrew Fein | HC Wainwright & Co. | Raises | Buy | $462.00 | $457.00 |

| Liisa Bayko | Evercore ISI Group | Announces | Outperform | $438.00 | - |

| Olivia Brayer | Cantor Fitzgerald | Maintains | Overweight | $440.00 | - |

| Olivia Brayer | Cantor Fitzgerald | Maintains | Overweight | $440.00 | - |

| Jessica Fye | JP Morgan | Raises | Overweight | $450.00 | $438.00 |

| Mohit Bansal | Wells Fargo | Raises | Overweight | $540.00 | $500.00 |

| Brian Abrahams | RBC Capital | Raises | Sector Perform | $420.00 | $397.00 |

| Gena Wang | Barclays | Raises | Overweight | $472.00 | $446.00 |

| Liisa Bayko | Evercore ISI Group | Raises | In-Line | $438.00 | $436.00 |

| Andrew Fein | HC Wainwright & Co. | Raises | Buy | $457.00 | $397.00 |

| Jessica Fye | JP Morgan | Raises | Overweight | $438.00 | $390.00 |

| Robyn Karnauskas | Truist Securities | Raises | Buy | $508.00 | $456.00 |

| Salveen Richter | Goldman Sachs | Raises | Buy | $559.00 | $442.00 |

| Olivia Brayer | Cantor Fitzgerald | Raises | Overweight | $440.00 | $415.00 |

| Whitney Ijem | Canaccord Genuity | Raises | Sell | $379.00 | $332.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Vertex Pharmaceuticals. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Vertex Pharmaceuticals compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Vertex Pharmaceuticals's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Vertex Pharmaceuticals's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Vertex Pharmaceuticals analyst ratings.

Delving into Vertex Pharmaceuticals's Background

Vertex Pharmaceuticals is a global biotechnology company that discovers and develops small-molecule drugs for the treatment of serious diseases. Its key drugs are Kalydeco, Orkambi, Symdeko, and Trikafta/Kaftrio for cystic fibrosis, where Vertex therapies remain the standard of care globally. Vertex has diversified its portfolio through Casgevy, a gene-editing therapy for beta thalassemia and sickle-cell disease. Additionally, Vertex is evaluating small-molecule inhibitors targeting acute and chronic pain using nonopioid treatments, and small-molecule inhibitors of APOL1-mediated kidney diseases. Vertex is also investigating cell therapies to deliver a potential functional cure for type 1 diabetes.

Financial Milestones: Vertex Pharmaceuticals's Journey

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Vertex Pharmaceuticals's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 9.34%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Vertex Pharmaceuticals's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 38.48%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Vertex Pharmaceuticals's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 5.68%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Vertex Pharmaceuticals's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 4.36%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Vertex Pharmaceuticals's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.05.

Analyst Ratings: What Are They?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.