Ratings for ITT ITT were provided by 4 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

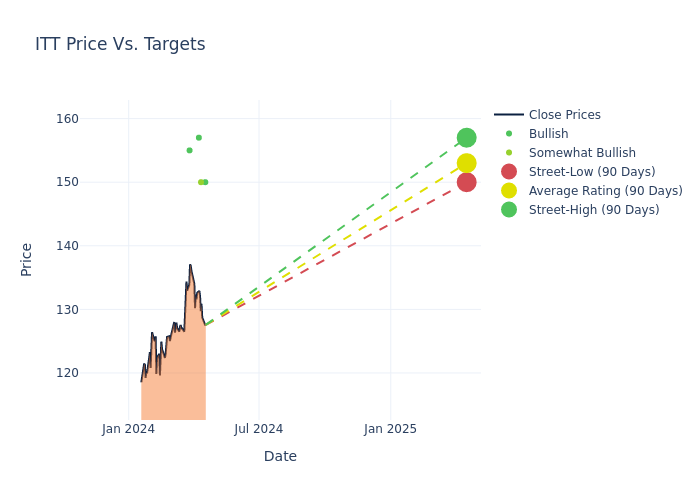

Analysts have set 12-month price targets for ITT, revealing an average target of $153.0, a high estimate of $157.00, and a low estimate of $150.00. Marking an increase of 10.07%, the current average surpasses the previous average price target of $139.00.

Analyzing Analyst Ratings: A Detailed Breakdown

A comprehensive examination of how financial experts perceive ITT is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Nathan Jones | Stifel | Raises | Buy | $150.00 | $141.00 |

| Jeffrey Hammond | Keybanc | Raises | Overweight | $150.00 | $136.00 |

| Vladimir Bystricky | Citigroup | Raises | Buy | $157.00 | $139.00 |

| Matt Summerville | DA Davidson | Raises | Buy | $155.00 | $140.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to ITT. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of ITT compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of ITT's stock. This analysis reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of ITT's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on ITT analyst ratings.

Get to Know ITT Better

ITT Inc is a diversified manufacturer of engineered critical components and customized technology solutions predominantly for the transportation, industrial and energy markets. The company's products include, brake pads, shock absorbers, pumps, valves, connectors, switches and others. Its operating segments are; Motion Technologies (MT), Industrial Process (IP), and Connect & Control Technologies (CCT). The majority of the revenue is generated from the Motion Technologies segment which is a manufacturer of brake pads, shims, shock absorbers, energy absorption components and sealing technologies. Geographically, the company generates majority of the revenue from North America, and also has its presence in South America, Europe, Asia, Middle East and Africa.

Financial Insights: ITT

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Positive Revenue Trend: Examining ITT's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 7.04% as of 31 December, 2023, showcasing a substantial increase in top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: ITT's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 11.04%, the company may face hurdles in effective cost management.

Return on Equity (ROE): ITT's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 3.71%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): ITT's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.37% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: ITT's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.11.

The Basics of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.