Danaher DHR has been analyzed by 7 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 3 | 1 | 0 | 0 |

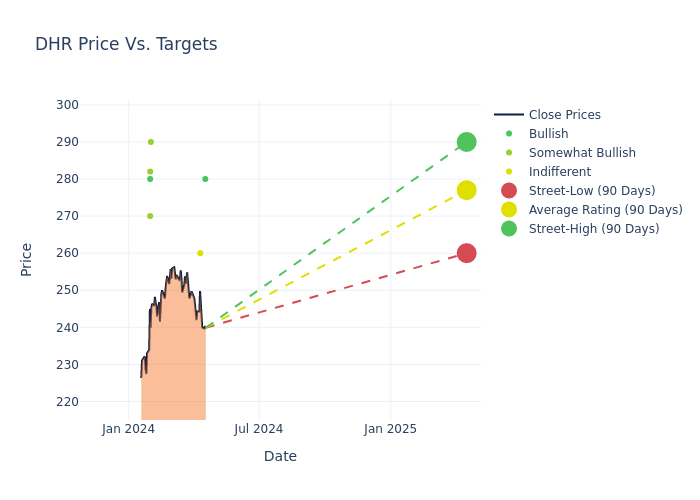

Analysts have recently evaluated Danaher and provided 12-month price targets. The average target is $271.71, accompanied by a high estimate of $290.00 and a low estimate of $240.00. Witnessing a positive shift, the current average has risen by 8.76% from the previous average price target of $249.83.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Danaher among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Rajesh Kumar | HSBC | Raises | Buy | $280.00 | $250.00 |

| Luke Sergott | Barclays | Raises | Equal-Weight | $260.00 | $240.00 |

| Paul Knight | Keybanc | Raises | Overweight | $290.00 | $260.00 |

| Andrew Cooper | Raymond James | Raises | Outperform | $270.00 | $240.00 |

| Conor McNamara | RBC Capital | Raises | Outperform | $282.00 | $254.00 |

| Patrick Donnelly | Citigroup | Raises | Buy | $280.00 | $255.00 |

| Luke Sergott | Barclays | Announces | Equal-Weight | $240.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Danaher. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Danaher compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Danaher's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Danaher's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Danaher analyst ratings.

Unveiling the Story Behind Danaher

In 1984, Danaher's founders transformed a real estate organization into an industrial-focused manufacturing company. Through a series of mergers, acquisitions, and divestitures, Danaher now focuses primarily on manufacturing scientific instruments and consumables in two segments--life sciences and diagnostics--after the late 2023 divesititure of its environmental and applied solutions group, Veralto.

A Deep Dive into Danaher's Financials

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Danaher's revenue growth over a period of 3 months has faced challenges. As of 31 December, 2023, the company experienced a revenue decline of approximately -23.95%. This indicates a decrease in the company's top-line earnings. When compared to others in the Health Care sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 40.07%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Danaher's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 2.04%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Danaher's ROA stands out, surpassing industry averages. With an impressive ROA of 1.25%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Danaher's debt-to-equity ratio is below the industry average at 0.37, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.