Financial giants have made a conspicuous bearish move on CrowdStrike Holdings. Our analysis of options history for CrowdStrike Holdings CRWD revealed 20 unusual trades.

Delving into the details, we found 40% of traders were bullish, while 60% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $503,767, and 11 were calls, valued at $716,672.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $400.0 for CrowdStrike Holdings over the last 3 months.

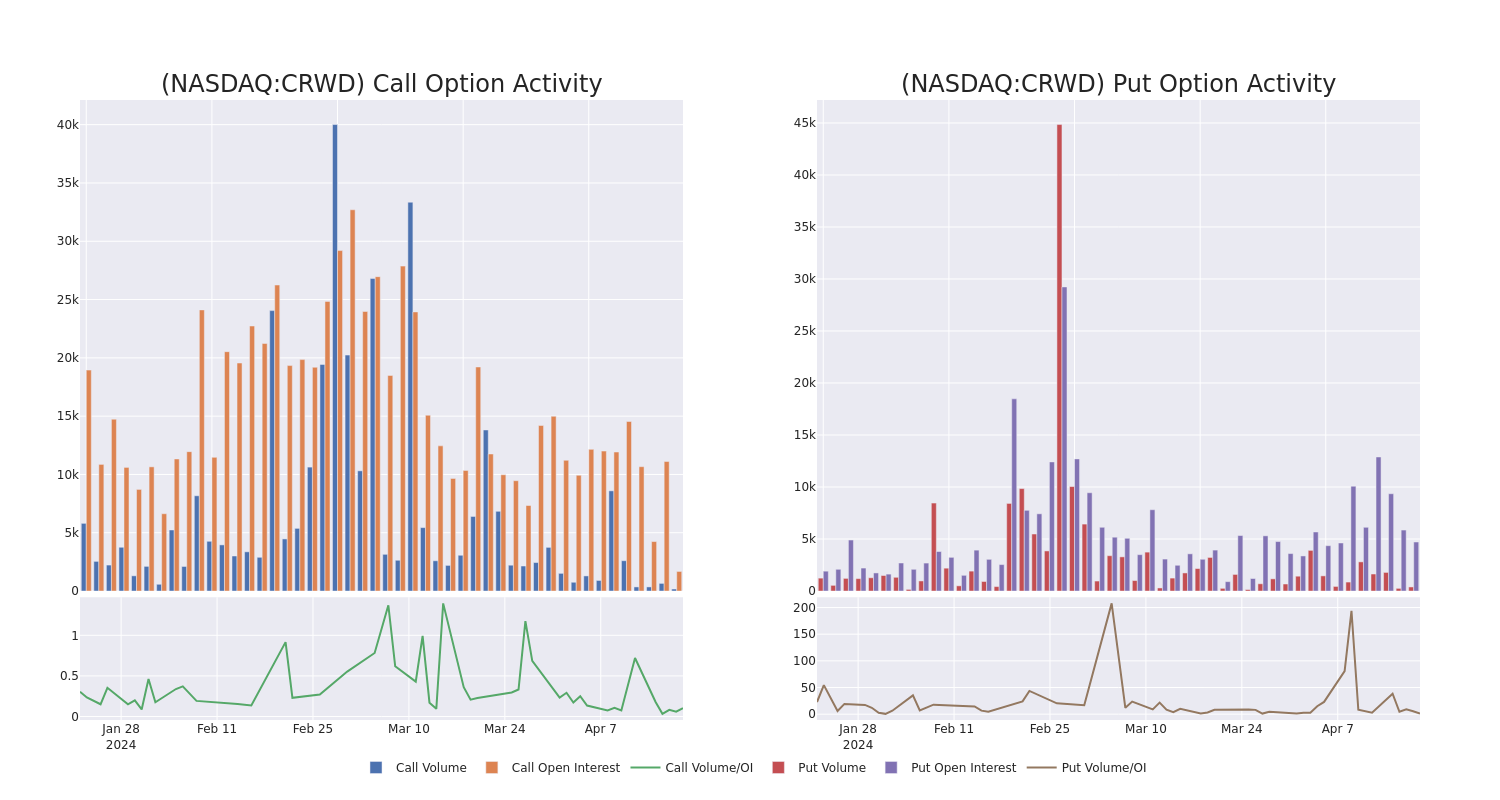

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for CrowdStrike Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of CrowdStrike Holdings's whale trades within a strike price range from $100.0 to $400.0 in the last 30 days.

CrowdStrike Holdings Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | CALL | TRADE | BULLISH | 01/16/26 | $197.0 | $195.85 | $197.0 | $100.00 | $197.0K | 32 | 10 |

| CRWD | CALL | TRADE | NEUTRAL | 01/16/26 | $72.8 | $70.55 | $71.67 | $300.00 | $143.3K | 439 | 0 |

| CRWD | PUT | TRADE | BULLISH | 09/20/24 | $23.55 | $23.2 | $23.2 | $270.00 | $125.2K | 497 | 75 |

| CRWD | PUT | SWEEP | BEARISH | 04/17/25 | $58.8 | $57.75 | $58.65 | $310.00 | $76.3K | 56 | 29 |

| CRWD | PUT | SWEEP | BEARISH | 06/20/25 | $50.85 | $48.0 | $50.85 | $290.00 | $61.0K | 283 | 37 |

About CrowdStrike Holdings

CrowdStrike is a cloud-based cybersecurity company specializing in next-generation security verticals such as endpoint, cloud workload, identity, and security operations. CrowdStrike's primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

Where Is CrowdStrike Holdings Standing Right Now?

- Currently trading with a volume of 621,698, the CRWD's price is down by -2.53%, now at $286.66.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 40 days.

What Analysts Are Saying About CrowdStrike Holdings

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $392.0.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $400.

- Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for CrowdStrike Holdings, targeting a price of $376.

- Maintaining their stance, an analyst from Rosenblatt continues to hold a Buy rating for CrowdStrike Holdings, targeting a price of $400.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for CrowdStrike Holdings, Benzinga Pro gives you real-time options trades alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.