Ratings for Glacier Bancorp GBCI were provided by 4 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 0 | 4 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

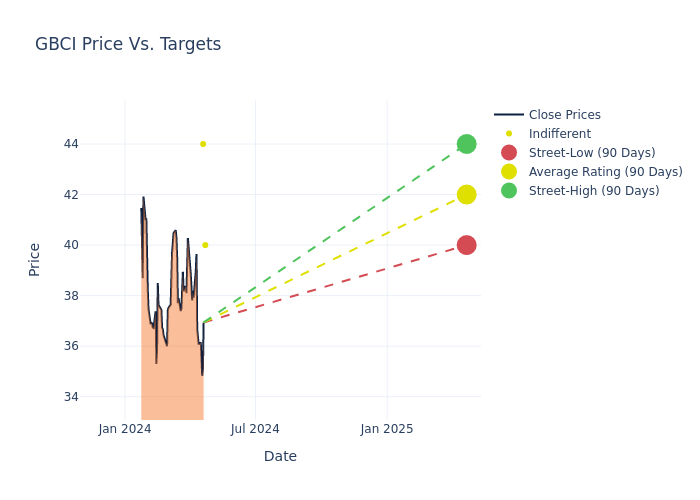

Analysts have set 12-month price targets for Glacier Bancorp, revealing an average target of $42.75, a high estimate of $45.00, and a low estimate of $40.00. This current average represents a 1.34% decrease from the previous average price target of $43.33.

Investigating Analyst Ratings: An Elaborate Study

The standing of Glacier Bancorp among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brandon King | Truist Securities | Lowers | Hold | $40.00 | $42.00 |

| Andrew Terrell | Stephens & Co. | Maintains | Equal-Weight | $44.00 | - |

| Brandon King | Truist Securities | Lowers | Hold | $42.00 | $45.00 |

| Brandon King | Truist Securities | Raises | Hold | $45.00 | $43.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Glacier Bancorp. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Glacier Bancorp compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Capture valuable insights into Glacier Bancorp's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Glacier Bancorp analyst ratings.

Delving into Glacier Bancorp's Background

Glacier Bancorp Inc is a regional bank holding company providing commercial banking services to scores of communities through its wholly-owned bank subsidiary, Glacier Bank. The bank operates a multitude of banking offices in Montana, Idaho, Colorado, Utah, Washington, and Wyoming. The bank's wide range of products and services include deposit, loans, and mortgage origination services, among others. The bank primarily serves individuals, small- to medium-sized businesses, community organizations, and public entities. Glacier's strategy emphasizes both internal growth and growth through selective acquisitions. A majority of the bank's loan portfolio is in commercial real estate, while a majority of its net revenue is net interest income.

Glacier Bancorp: Financial Performance Dissected

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Glacier Bancorp's revenue growth over a period of 3 months has faced challenges. As of 31 December, 2023, the company experienced a revenue decline of approximately -16.06%. This indicates a decrease in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 28.41%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Glacier Bancorp's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 1.84%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Glacier Bancorp's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.19%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Glacier Bancorp's debt-to-equity ratio surpasses industry norms, standing at 0.98. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Core of Analyst Ratings: What Every Investor Should Know

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.