Zinger Key Points

- Salesforce halts Informatica acquisition talks, unable to finalize terms.

- Informatica's stock value assessed at ~$11.2 billion; Salesforce's previous big buys include Slack and Tableau.

- Get two weeks of free access to pro-level trading tools, including news alerts, scanners, and real-time market insights.

Salesforce Inc CRM ended its acquisition discussions with data-management software company Informatica Inc INFA after failing to agree on terms.

The negotiations, which were in advanced stages earlier in April, could have resulted in one of Salesforce’s largest acquisitions if successful, Reuters cites familiar sources.

Informatica’s stock price declined after the report, while Salesforce’s stock price went upwards.

Based on a report from the Wall Street Journal, Salesforce was considering purchasing Informatica at a mid-$30s per share price.

Informatica’s stock, which was at $38.48 when the acquisition talks were first revealed on April 12, closed at $35.19 on Friday.

The price puts the value of Informatica, based in Redwood City, California, at approximately $11.2 billion, debt included.

Informatica, founded in 1993, provides cloud-based, subscription data management services and automation solutions to over 5,000 active customers, including Unilever and Deloitte.

Salesforce faced criticism for its acquisition strategy from activist investors such as ValueAct Capital and Elliott Management in early 2023, leading to cost reductions, increased share repurchases, and the dissolution of its mergers and acquisitions board committee.

Salesforce has acquired numerous companies over the years, including Tableau Software for $15.7 billion in 2019 and Slack Technologies for nearly $28 billion in 2020, marking its most significant acquisition.

Earlier, Nvidia Corp’s NVDA plan to SNAP British chip designer Arm Holdings Plc ARM succumbed to regulatory opposition. Multiple Big Tech acquisition deals drew global regulatory attention over antitrust concerns.

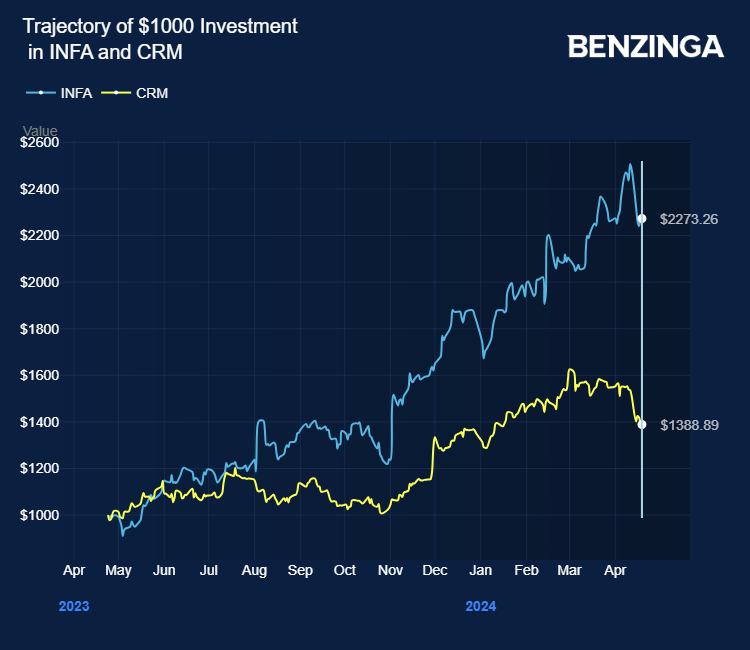

Informatica stock gained over 127% in the last 12 months. Salesforce stock gained 39%.

Price Actions: INFA shares traded lower by 5.94% at $33.10 premarket on the last check Monday. CRM shares traded higher by 3.11% at $278.78.

Also Read: Salesforce’s Q4 Earnings Potential Bolstered by Generative AI and Market Optimism, Analysts Forecast

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy of Salesforce

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.