Investors with significant funds have taken a bullish position in Canopy Gwth CGC, a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in CGC usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 10 options transactions for Canopy Gwth. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 80% being bullish and 20% bearish. Of all the options we discovered, 9 are puts, valued at $390,515, and there was a single call, worth $41,000.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $7.0 to $21.0 for Canopy Gwth over the last 3 months.

Insights into Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Canopy Gwth options trades today is 4392.67 with a total volume of 1,424.00.

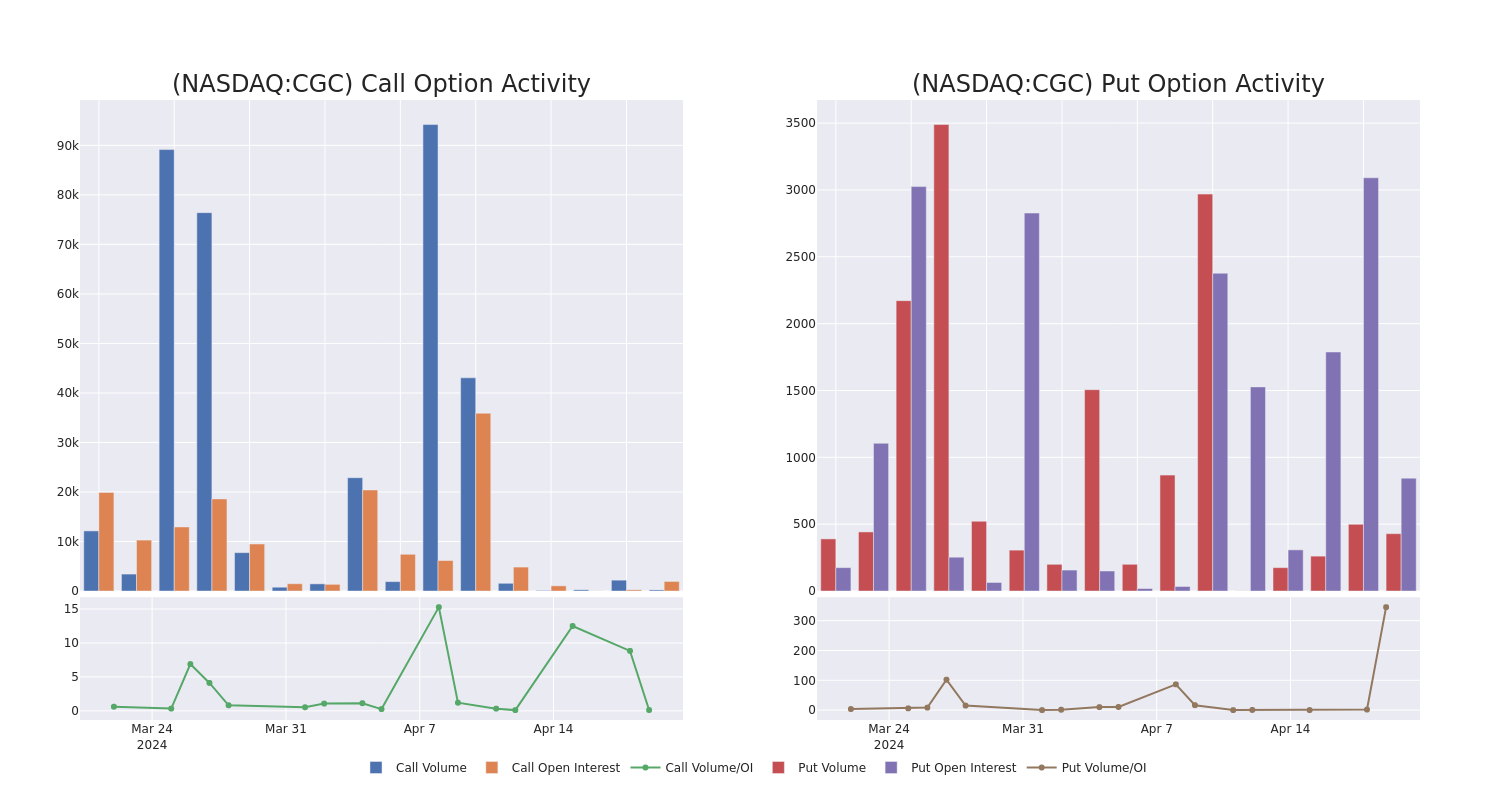

In the following chart, we are able to follow the development of volume and open interest of call and put options for Canopy Gwth's big money trades within a strike price range of $7.0 to $21.0 over the last 30 days.

Canopy Gwth 30-Day Option Volume & Interest Snapshot

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CGC | PUT | TRADE | BULLISH | 11/15/24 | $15.7 | $14.95 | $14.95 | $21.00 | $58.3K | 0 | 80 |

| CGC | PUT | TRADE | BEARISH | 04/26/24 | $11.4 | $11.2 | $11.4 | $20.00 | $47.8K | 0 | 42 |

| CGC | PUT | TRADE | BULLISH | 10/18/24 | $14.45 | $13.75 | $13.75 | $20.00 | $41.2K | 5 | 238 |

| CGC | PUT | TRADE | BULLISH | 10/18/24 | $14.45 | $13.6 | $13.75 | $20.00 | $41.2K | 5 | 208 |

| CGC | PUT | TRADE | BULLISH | 10/18/24 | $14.45 | $13.75 | $13.75 | $20.00 | $41.2K | 5 | 31 |

About Canopy Gwth

Canopy Growth, headquartered in Smiths Falls, Canada, cultivates and sells medicinal and recreational cannabis, and hemp, through a portfolio of brands that include Doja, 7ACRES, Tweed, and Deep Space. Its non-THC products include skincare products under Martha Stewart CBD and Storz & Bickel vaporizers. Canopy growth is attempting to merge its U.S. assets into a separately operated holding company, Canopy USA, which will not be consolidated into the Canadian company's financials.

Following our analysis of the options activities associated with Canopy Gwth, we pivot to a closer look at the company's own performance.

Present Market Standing of Canopy Gwth

- With a volume of 9,470,636, the price of CGC is up 13.55% at $8.91.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 58 days.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Canopy Gwth, Benzinga Pro gives you real-time options trades alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.