West Pharmaceutical Services, Inc. WST reported first-quarter 2024 adjusted earnings per share EPS of $1.56, which beat the Zacks Consensus Estimate by 20.9%. The bottom line, however, was down 21.2% year over year.

The adjustments include expenses related to the amortization of acquisition-related intangible assets.

GAAP EPS for the quarter was $1.55, down 16.2% year over year.

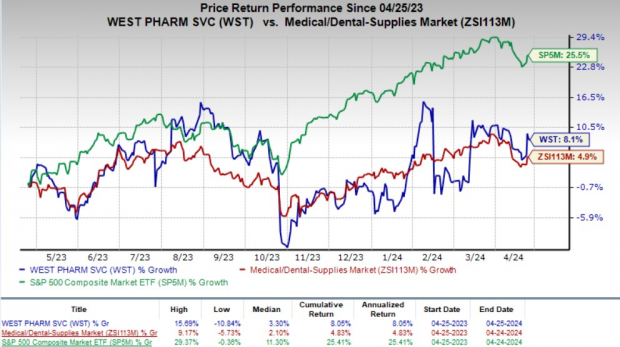

The company's shares have risen 8.1% in the past year compared with the industry's growth of 4.9%. The broader S&P 500 Index has increased 25.5% in the same time frame.

Image Source: Zacks Investment Research

Revenues in Detail

West Pharmaceutical registered net sales of $695.4 million in the first quarter, down 3% year over year. The figure, however, beat the Zacks Consensus Estimate by 3.3%.

The company recorded an organic net sales decline of 3% in the reported quarter.

Per management, the top-line decline was driven by Proprietary Products' lower high-value product (HVP) sales and weak Generic product sales. However, higher Contract Manufacturing component sales and continued demand for NovaPure and self-injection device platforms partially offset the decline.

Segmental Details

West Pharmaceutical operates under two segments — Proprietary Products and Contract-Manufactured Products.

Net sales in the Proprietary Products segment were $559.5 million, indicating a decline of 4% year over year as well as on an organic basis. HVP net sales, which accounted for approximately 72% of the segment's net sales, registered an organic decline of low-single-digit percentage points.

The Pharma market units of the Proprietary Products segment reflected a high-single-digit percentage point organic decline in the first-quarter sales. The Generic market unit registered a double-digit percentage point decline in sales. However, low-single-digit organic sales growth for the Biologics market unit partially offset the decline in the Pharma and Generic market units.

Product-wise, the company witnessed continued growth for its NovaPure and self-injection device platforms, along with higher sales for Daikyo Crystal Zenith components, which were more than offset by declines in FluroTec, Westar and standard components.

Net sales in the Contract-Manufactured Products segment increased 1.8% year over year to $135.9 million. Currency translation was a tailwind, boosting sales growth by 50 basis points. The segment saw a 1.3% improvement in organic net sales.

Margins

In the quarter under review, West Pharmaceutical's gross profit decreased 15.1% to $230.2 million. The gross margin contracted nearly 480 basis points (bps) to 33.1%.

Selling, general and administrative expenses rose 0.8% to $86.7 million. Research and development expenses went up 2.9% year over year to $17.6 million.

Adjusted operating profit totaled $123 million, indicating a decrease of 25.4% from the prior-year quarter's level. The adjusted operating margin contracted 530 bps to 17.7%.

Financial Position

West Pharmaceutical exited first-quarter 2024 with cash and cash equivalents of $601.8 million compared with $853.9 million at the end of the fourth quarter. Total debt at the end of the reported quarter was $206.2 million compared with $206.8 million at the end of the previous quarter.

Cumulative net cash flow from operating activities totaled $118.2 million compared with $138.1 million in the year-ago period.

2024 Guidance

WST raised its 2024 outlook for earnings but maintained the same for revenues.

It projects adjusted EPS in the range of $7.63-$7.88 for full-year 2024, compared with the previous guidance of $7.50-$7.75. The Zacks Consensus Estimate for the same is pegged at $7.62.

Net sales are projected between $3 billion and $3.025 billion. The Zacks Consensus Estimate for the same is pegged at $3.01 billion. The company expects currency translation to have a positive impact of $8 million on revenues. The organic sales growth estimate is 2-3%.

Our Take

West Pharmaceutical exited the first quarter of 2024 with better-than-expected results. The recovery in organic growth is encouraging. However, lower COVID-related sales continue to hurt the top line. The company's lower-than-market revenue outlook reflects the same. Moreover, contractions in the operating margin do not bode well.

On a positive note, demand for West Pharmaceutical's HVP products continued to be strong. Robust organic net sales growth in the Pharma, Biologics and Generic market units, excluding COVID-related sales, is another quarterly highlight.

Zacks Rank and Stocks to Consider

Currently, West Pharmaceutical carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space are IDEXX Laboratories, Inc. IDXX, Becton, Dickinson and Company BDX, popularly known as BD, and Ecolab Inc. ECL.

IDEXX, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 11.6%. IDXX's earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 8.3%.

IDEXX's shares have risen 2.9% compared with the industry's 3.9% growth in the past year.

BD, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 9.4%. BDX's earnings surpassed estimates in three of the trailing four quarters and met once, delivering an average surprise of 4.6%.

BD's shares have lost 11.1% against the industry's 4.9% growth in the past year.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. ECL's earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 1.7%.

Ecolab's shares have rallied 33.8% against the industry's 9.3% decline in the past year.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.