Financial giants have made a conspicuous bullish move on Dell Technologies. Our analysis of options history for Dell Technologies DELL revealed 23 unusual trades.

Delving into the details, we found 47% of traders were bullish, while 43% showed bearish tendencies. Out of all the trades we spotted, 10 were puts, with a value of $540,300, and 13 were calls, valued at $1,301,083.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $105.0 to $140.0 for Dell Technologies during the past quarter.

Insights into Volume & Open Interest

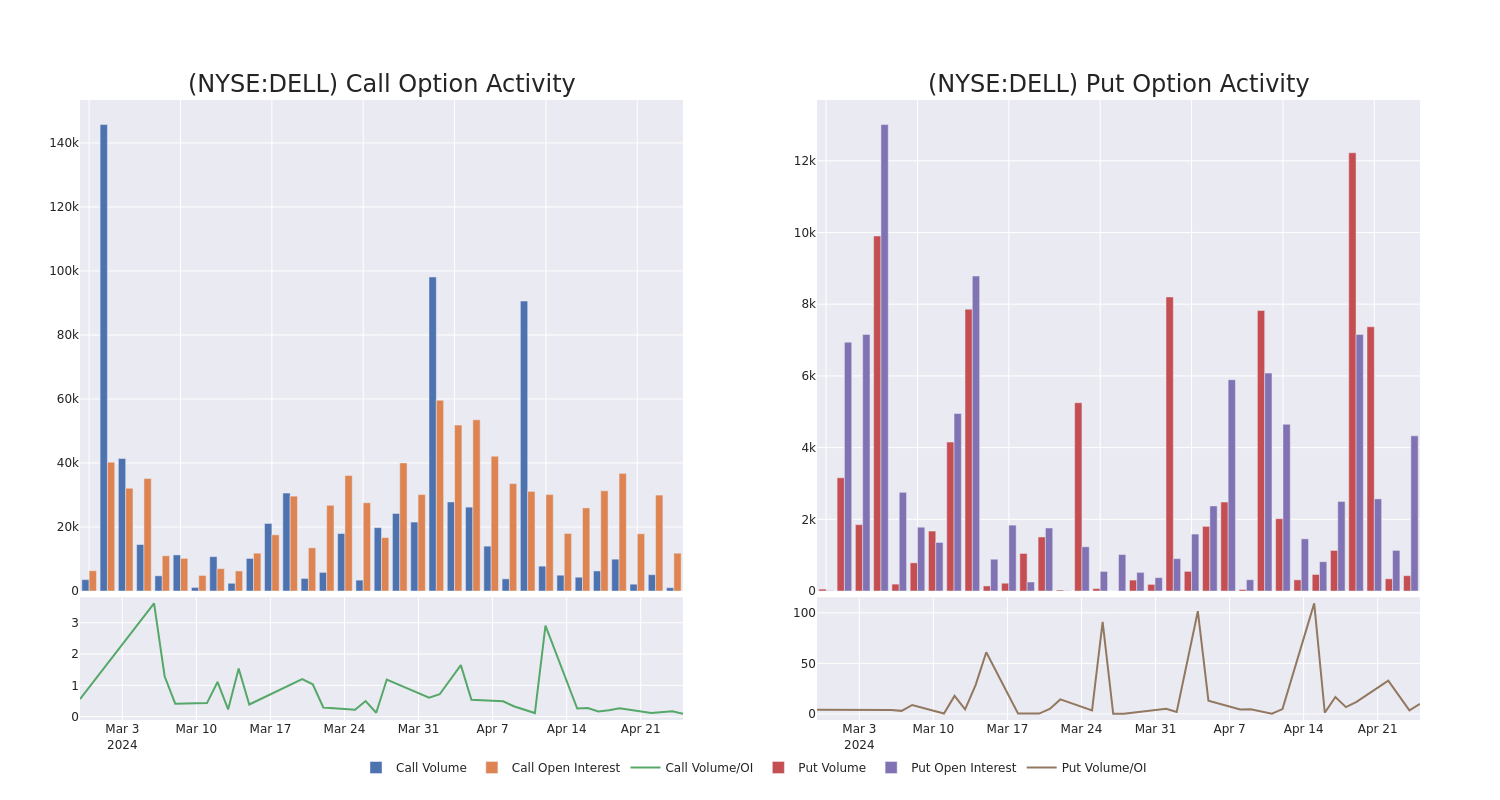

In terms of liquidity and interest, the mean open interest for Dell Technologies options trades today is 807.65 with a total volume of 1,473.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Dell Technologies's big money trades within a strike price range of $105.0 to $140.0 over the last 30 days.

Dell Technologies 30-Day Option Volume & Interest Snapshot

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DELL | CALL | TRADE | BEARISH | 06/21/24 | $13.3 | $13.1 | $13.1 | $120.00 | $327.5K | 3.2K | 54 |

| DELL | CALL | SWEEP | BULLISH | 06/20/25 | $25.2 | $24.8 | $25.2 | $125.00 | $216.7K | 37 | 86 |

| DELL | PUT | SWEEP | BEARISH | 01/17/25 | $28.3 | $25.5 | $26.9 | $135.00 | $172.1K | 150 | 0 |

| DELL | CALL | TRADE | BULLISH | 01/17/25 | $11.9 | $11.3 | $11.9 | $140.00 | $119.0K | 433 | 0 |

| DELL | CALL | TRADE | BULLISH | 06/20/25 | $21.0 | $19.6 | $20.55 | $130.00 | $113.0K | 118 | 0 |

About Dell Technologies

Dell Technologies is a broad information technology vendor, primarily supplying hardware to enterprises. It is focused on premium personal computers and enterprise on-premises data center hardware. It holds top-three shares in its core markets of personal computers, peripheral displays, mainstream servers, and external storage. Dell is vertically integrated but has a robust ecosystem of component and assembly partners, and also relies heavily on channel partners to fulfill its sales.

Following our analysis of the options activities associated with Dell Technologies, we pivot to a closer look at the company's own performance.

Where Is Dell Technologies Standing Right Now?

- With a trading volume of 3,309,816, the price of DELL is up by 3.24%, reaching $124.1.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 35 days from now.

Expert Opinions on Dell Technologies

1 market experts have recently issued ratings for this stock, with a consensus target price of $141.0.

- An analyst from UBS has decided to maintain their Buy rating on Dell Technologies, which currently sits at a price target of $141.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Dell Technologies, Benzinga Pro gives you real-time options trades alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.