Humana HUM has been analyzed by 15 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 4 | 7 | 0 | 0 |

| Last 30D | 0 | 2 | 2 | 0 | 0 |

| 1M Ago | 3 | 1 | 4 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

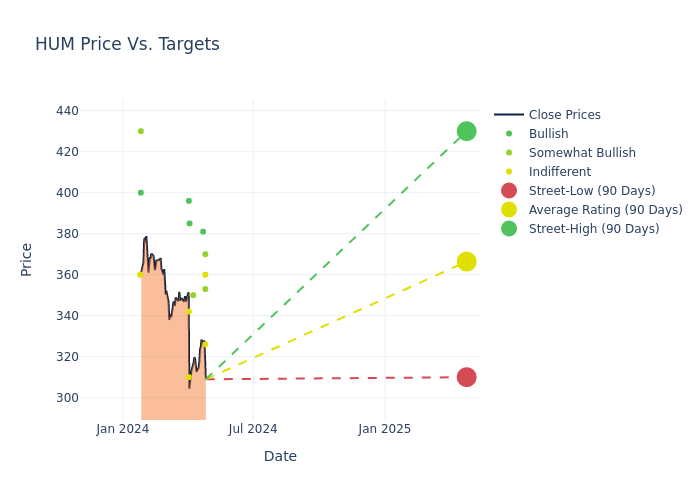

Analysts have recently evaluated Humana and provided 12-month price targets. The average target is $371.6, accompanied by a high estimate of $450.00 and a low estimate of $310.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 11.91%.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Humana among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Frank Morgan | RBC Capital | Lowers | Outperform | $353.00 | $415.00 |

| Kevin Caliendo | UBS | Lowers | Neutral | $326.00 | $334.00 |

| Sarah James | Cantor Fitzgerald | Lowers | Neutral | $360.00 | $391.00 |

| Michael Wiederhorn | Oppenheimer | Lowers | Outperform | $370.00 | $415.00 |

| David Windley | Jefferies | Lowers | Buy | $381.00 | $411.00 |

| Sarah James | Cantor Fitzgerald | Maintains | Neutral | $391.00 | - |

| Stephen Baxter | Wells Fargo | Lowers | Overweight | $350.00 | $413.00 |

| Sarah James | Cantor Fitzgerald | Maintains | Neutral | $391.00 | - |

| Nathan Rich | Goldman Sachs | Lowers | Buy | $385.00 | $450.00 |

| Andrew Mok | Barclays | Lowers | Equal-Weight | $310.00 | $356.00 |

| Gary Taylor | TD Cowen | Lowers | Buy | $396.00 | $427.00 |

| Kevin Fischbeck | B of A Securities | Lowers | Neutral | $342.00 | $470.00 |

| Andrew Mok | Barclays | Announces | Equal-Weight | $356.00 | - |

| Stephen Baxter | Wells Fargo | Lowers | Overweight | $413.00 | $465.00 |

| Nathan Rich | Goldman Sachs | Lowers | Buy | $450.00 | $515.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Humana. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Humana compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Humana's stock. This comparison reveals trends in analysts' expectations over time.

To gain a panoramic view of Humana's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Humana analyst ratings.

Delving into Humana's Background

Humana is one of the largest private health insurers in the U.S. with a focus on administering Medicare Advantage plans. The firm has built a niche specializing in government-sponsored programs, with nearly all its medical membership stemming from individual and group Medicare Advantage, Medicaid, and the military's Tricare program. The firm is also a leader in stand-alone prescription drug plans for seniors enrolled in traditional fee-for-service Medicare. Beyond medical insurance, the company provides other healthcare services, including primary-care services, at-home services, and pharmacy benefit management.

Humana: Delving into Financials

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Humana displayed positive results in 3 months. As of 31 December, 2023, the company achieved a solid revenue growth rate of approximately 17.93%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: Humana's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of -2.04%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Humana's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of -3.26%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Humana's ROA stands out, surpassing industry averages. With an impressive ROA of -1.05%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Humana's debt-to-equity ratio stands notably higher than the industry average, reaching 0.74. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Basics of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.