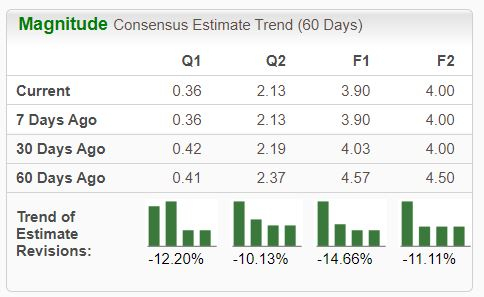

Nutrien NTR, a current Rank #5 (Strong Sell), is a leading integrated provider of crop inputs and services through its leading global retail network. Analysts have taken a bearish stance on the company's outlook across the board.

Image Source: Zacks Investment Research

In addition, the company is in the Zacks Fertilizers industry, which is currently ranked in the bottom 14% of all Zacks industries. Let's take a closer look at how the company currently stacks up.

Nutrien

Nutrien shares have faced a rocky road over the last year, down more than 20% and widely underperforming relative to the S&P 500. Quarterly results have consistently come in below expectations as of late, with NTR falling short of the Zacks Consensus EPS estimate by an average of 35% across its last four releases.

The less-than-ideal performance from shares has boosted its yield considerably, paying 4.2% on an annual basis.

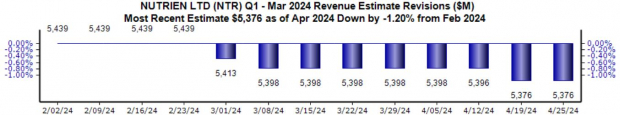

Keep an eye out for the company's upcoming quarterly release expected on May 8th, as current consensus expectations suggest a 67% pullback in earnings on 12% lower sales. Revenue expectations have been similarly taken lower, with the $5.4 billion expected down 1% since the beginning of February.

Image Source: Zacks Investment Research

Bottom Line

Analysts' negative earnings estimate revisions paint a challenging picture for the company's shares in the near term.

Nutrien NTR is a Zacks Rank #5 (Strong Sell), indicating that analysts have taken a bearish stance on the company's earnings outlook.

For those seeking strong stocks, a great idea would be to focus on stocks carrying a Zacks Rank #1 (Strong Buy) or a Zacks Rank #2 (Buy). These stocks sport a notably stronger earnings outlook and the potential to deliver explosive gains in the near term.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.