In the latest quarter, 8 analysts provided ratings for AbbVie ABBV, showcasing a mix of bullish and bearish perspectives.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 6 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 1 | 4 | 0 | 0 | 0 |

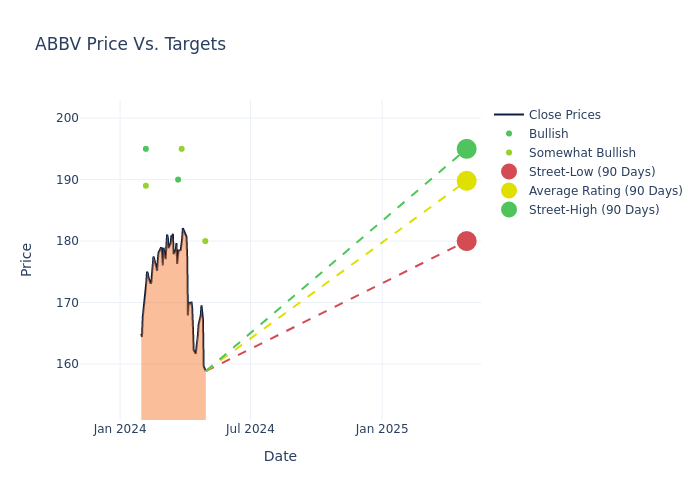

Analysts have set 12-month price targets for AbbVie, revealing an average target of $189.75, a high estimate of $195.00, and a low estimate of $180.00. Witnessing a positive shift, the current average has risen by 3.12% from the previous average price target of $184.00.

Interpreting Analyst Ratings: A Closer Look

An in-depth analysis of recent analyst actions unveils how financial experts perceive AbbVie. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Evan David Seigerman | BMO Capital | Lowers | Outperform | $180.00 | $195.00 |

| Carter Gould | Barclays | Raises | Overweight | $195.00 | $185.00 |

| Vamil Divan | Guggenheim | Raises | Buy | $190.00 | $188.00 |

| Gary Nachman | Raymond James | Raises | Outperform | $189.00 | $181.00 |

| Robyn Karnauskas | Truist Securities | Raises | Buy | $195.00 | $180.00 |

| Gary Nachman | Raymond James | Raises | Outperform | $189.00 | $181.00 |

| Evan David Seigerman | BMO Capital | Raises | Outperform | $195.00 | $187.00 |

| Carter Gould | Barclays | Raises | Overweight | $185.00 | $175.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to AbbVie. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of AbbVie compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of AbbVie's stock. This analysis reveals shifts in analysts' expectations over time.

To gain a panoramic view of AbbVie's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on AbbVie analyst ratings.

About AbbVie

AbbVie is a pharmaceutical firm with a strong exposure to immunology (with Humira, Skyrizi, and Rinvoq) and oncology (with Imbruvica and Venclexta). The company was spun off from Abbott in early 2013. The 2020 acquisition of Allergan added several new products and drugs in aesthetics (including Botox).

Understanding the Numbers: AbbVie's Finances

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Negative Revenue Trend: Examining AbbVie's financials over 3 months reveals challenges. As of 31 December, 2023, the company experienced a decline of approximately -5.42% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: AbbVie's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 5.45%, the company may face hurdles in effective cost management.

Return on Equity (ROE): AbbVie's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 6.94%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): AbbVie's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.58%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: With a high debt-to-equity ratio of 5.73, AbbVie faces challenges in effectively managing its debt levels, indicating potential financial strain.

Understanding the Relevance of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.