NOV NOV has been analyzed by 6 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 2 | 0 | 0 |

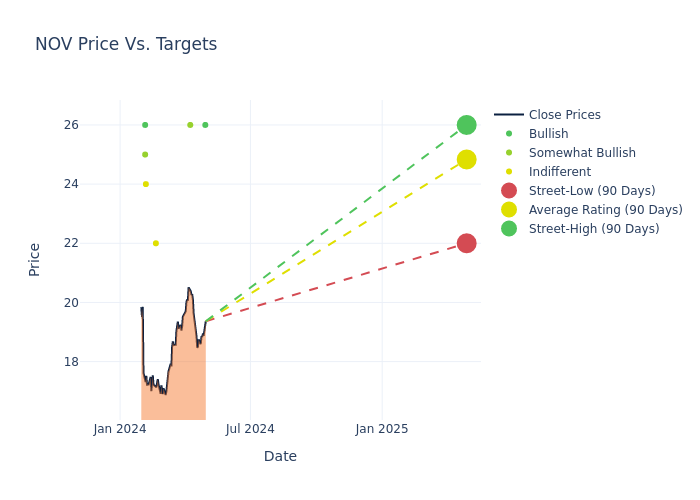

Insights from analysts' 12-month price targets are revealed, presenting an average target of $24.83, a high estimate of $26.00, and a low estimate of $22.00. This current average has decreased by 8.04% from the previous average price target of $27.00.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of NOV among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Marc Bianchi | TD Cowen | Lowers | Buy | $26.00 | $27.00 |

| Charles Minervino | Susquehanna | Maintains | Positive | $26.00 | - |

| Luke Lemoine | Piper Sandler | Lowers | Neutral | $22.00 | $25.00 |

| Keith Mackey | RBC Capital | Maintains | Sector Perform | $24.00 | - |

| Stephen Gengaro | Stifel | Lowers | Buy | $26.00 | $28.00 |

| James Rollyson | Raymond James | Lowers | Outperform | $25.00 | $28.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to NOV. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of NOV compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of NOV's stock. This examination reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of NOV's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on NOV analyst ratings.

All You Need to Know About NOV

NOV (formerly National Oilwell Varco) is a leading supplier of oil and gas drilling rig equipment and products, such as downhole tools, drill pipe, and well casing. The company operates on a global scale, with international markets contributing more than 60% of its annual revenue.

Key Indicators: NOV's Financial Health

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: NOV displayed positive results in 3 months. As of 31 December, 2023, the company achieved a solid revenue growth rate of approximately 13.02%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Energy sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: NOV's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of 25.52%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): NOV's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 10.23% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 5.49%, the company showcases effective utilization of assets.

Debt Management: NOV's debt-to-equity ratio is below the industry average. With a ratio of 0.39, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.