Zinger Key Points

- BofA analyst Justin Post reiterates Buy on Uber with a $91 target, citing strong bookings and EBITDA growth.

- Uber's new verticals like Shared Rides and Grocery projected to push Q1 bookings to $4.4 billion, up 58% Y/Y.

- Markets are swinging wildly, but for Matt Maley, it's just another opportunity to trade. His clear, simple trade alerts have helped members lock in gains as high as 100% and 450%. Now, you can get his next trade signal—completely free.

BofA analyst Justin Post reiterated a Buy rating on Uber Technologies, Inc UBER with a price target of $91.

Post remained constructive on Uber as his top travel and transportation stock, given bookings and EBTIDA growth well above peers. Data points for first-quarter Mobility spending suggest accelerating trends, while Restaurant spending may have decelerated, though Uber’s other verticals should drive above-industry trends.

Also Read: Uber Eats Embraces TikTok Wave with New Short-Form Video Discovery Tool

Overall, with Leap Year and Easter benefits, Post expects results in line with his estimates for core bookings to accelerate 1pt to 24% year-on year CC (23% Y/Y including FX and above Street at 22%). Scaling New Vertical products like Hailables, Shared Rides (now a $1 billion+ run rate product), and Grocery should continue to fuel overall new vertical growth, which he estimates to reach $4.4 billion in

first quarter (58% Y/Y) and contributed 3.4pts to core bookings growth.

Post noted Uber can continue delivering strong incremental EBITDA margins through advertising growth.

He projected first-quarter bookings, revenue and EBITDA of $38.3 billion, $10.09 billion and $1.33 billion, above Street at $38.0 billion, $10.09 billion and $1.32 billion.

Given a relatively constructive mobility data, mixed delivery data and sequential calendar related headwinds for Internet sector, Post expects second-quarter bookings guidance of $39.5 billion – $40.5 billion (midpoint in line with Street at $40.0 billion). For EBITDA, he expects a guidance range of $1.42 billon – $1.50 billion (with the midpoint slightly below Street at $1.47 billion).

Tesla Inc TSLA CEO Elon Musk recently reiterated that the company is focused on building a robotaxi capability for existing FSD vehicles, which could be viewed as a competitive threat to Uber.

However, Post noted Tesla’s focus is not so much on competing with Uber as it is unlocking use cases (and economics) for Tesla customers who want better asset utilization from their vehicles.

This would also make Tesla vehicles more affordable compared to other brands that don’t have this option to increase utilization. To that end, Post noted that (in the long term) Uber and Tesla could partner.

However, additional announcements around Tesla’s robotaxis will likely continue to act as an adverse headline risk for Uber stock.

Overall, Post noted that the industry is years away from total autonomous vehicles being a viable and reliable nationwide ride-sharing solution. According to the analyst, increasing competition in the AV industry could be a long-term positive for Uber.

Uber remains one of the best large cap growth stories in the sector and is attractively valued, as per the analyst.

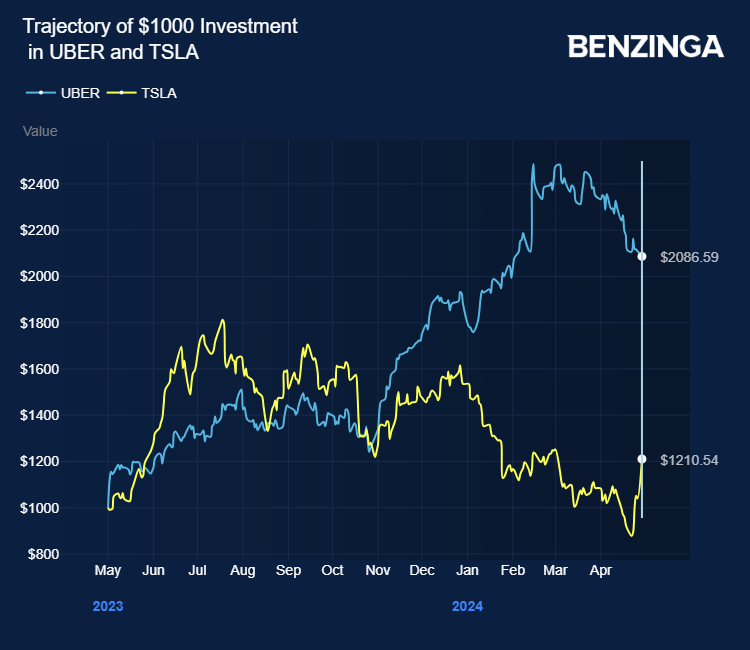

Price Action: UBER shares traded lower by 2% at $67.67 at the last check Monday.

Photo via Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.