Tempur Sealy Intl TPX has been analyzed by 6 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 4 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

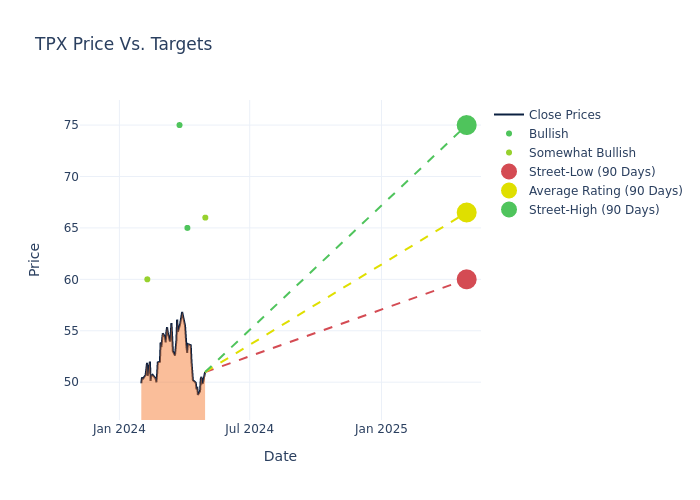

Analysts have recently evaluated Tempur Sealy Intl and provided 12-month price targets. The average target is $66.33, accompanied by a high estimate of $75.00 and a low estimate of $60.00. This current average has increased by 17.4% from the previous average price target of $56.50.

Interpreting Analyst Ratings: A Closer Look

The standing of Tempur Sealy Intl among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Seth Basham | Wedbush | Maintains | Outperform | $66.00 | - |

| Seth Basham | Wedbush | Maintains | Outperform | $66.00 | - |

| Keith Hughes | Truist Securities | Raises | Buy | $65.00 | $60.00 |

| Laura Champine | Loop Capital | Raises | Buy | $75.00 | $50.00 |

| Seth Basham | Wedbush | Raises | Outperform | $66.00 | $60.00 |

| Bradley Thomas | Keybanc | Raises | Overweight | $60.00 | $56.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Tempur Sealy Intl. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Tempur Sealy Intl compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Tempur Sealy Intl's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Tempur Sealy Intl's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Tempur Sealy Intl analyst ratings.

Get to Know Tempur Sealy Intl Better

Tempur Sealy International Inc is a bedding provider. The firm develops and distributes bedding products globally through its North America and international segments (Europe, Asia Pacific, and Latin America). Tempur Sealy's products are divided into the bedding and other product categories. The bedding category comprises the majority of net sales. The primary distribution channels of the company within each segment are retail (including furniture and bedding retailers, department stores, and warehouse clubs) and other (including e-commerce platforms, company-owned stores, and third-party distributors). Some brands of the firm include Tempur, Tempur-Pedic, Sealy, and Stearns and Foster. The cany generates revenue from sales from North America.

Key Indicators: Tempur Sealy Intl's Financial Health

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Challenges: Tempur Sealy Intl's revenue growth over 3 months faced difficulties. As of 31 December, 2023, the company experienced a decline of approximately -1.42%. This indicates a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 6.59%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Tempur Sealy Intl's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 28.69% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Tempur Sealy Intl's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.69% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Tempur Sealy Intl's debt-to-equity ratio surpasses industry norms, standing at 10.1. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

How Are Analyst Ratings Determined?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.