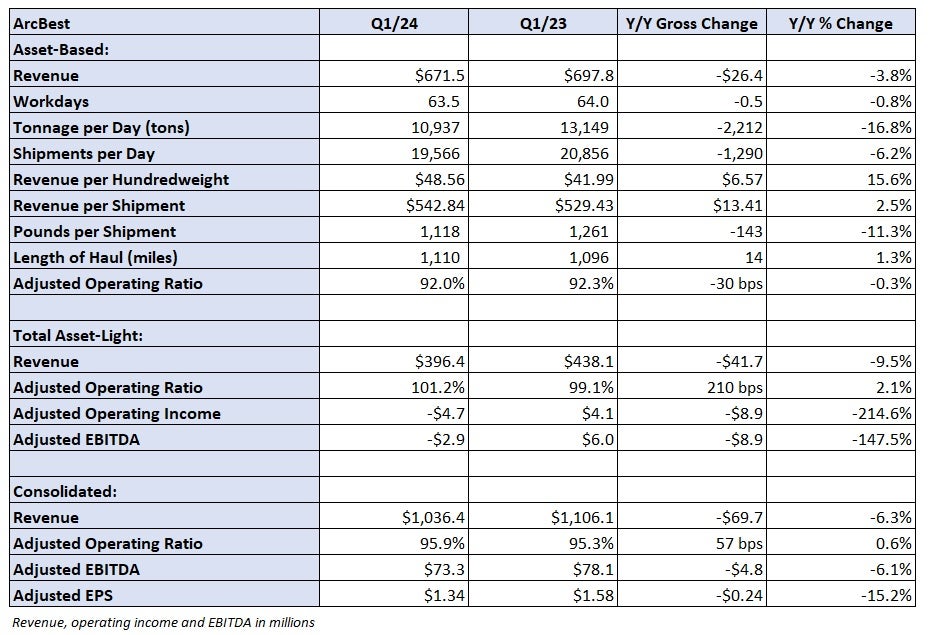

After adjusting for several items the company considers nonrecurring (various technology costs including a freight handling pilot, acquisition-related expenses and a write off of an equity investment) it reported adjusted earnings per share of $1.34, which was 19 cents worse than the consensus estimate and 24 cents lower year over year (y/y).

The write-off was related to ArcBest's $25 million investment in Phantom Auto, a software company enabling the remote operation of forklifts, robots and yard trucks, which shut down during the first quarter.

ArcBest's asset-based segment, which includes less-than-truckload operations, reported a 4% y/y decline in revenue to $672 million. Tonnage per day was down 17% y/y, which was mostly offset by a 16% increase in revenue per hundredweight, or yield.

The tonnage decline was the combination of a 6% decline in daily shipments and an 11% decline in weight per shipment.

The volume reduction was tied to the carrier's shift away from a dynamic pricing strategy, which captures more loads from transactional customers to keep the network full, to a mix favoring contractual freight from core customers. Rate increases on its spot business resulted in a volume decline among the company's noncore accounts. Also, severe storms in January resulted in 130 terminal closures compared to a 10-year average of 57, the company said on its fourth-quarter call in February.

The company said shipments from core accounts increased 12% y/y and tonnage was up 9% in the quarter.

A large decline in weight per shipment favorably impacted the yield metric but the metric includes fuel surcharges and diesel prices were down 9% y/y in the quarter. Pricing on contract renewals and deferred agreements was up 5.3% y/y in the quarter, following a 5.6% increase in the fourth quarter.

So far in April, revenue per day is down 4% y/y. Tonnage is down 22% but yield is up 24%. Shipments from core customers are up 13% and tonnage is 9% higher.

The LTL segment posted a 92% adjusted operating ratio, which was 30 basis points better y/y but 430 bps worse than the fourth quarter. Salaries, wages and benefits as a percentage of revenue increased 330 bps, mostly due to the new labor contract with its union workforce.

The asset-light unit, which includes truck brokerage, reported a $15.3 million operating loss (a $4.7 million loss when excluding acquisition-related items). Revenue was down 10% y/y to $396 million as managed transportation shipments per day increased 14%, offset by a 20% decline in revenue per shipment.

ArcBest will host a call on Tuesday at 9:30 a.m. EDT to discuss first-quarter results.

Table: ArcBest's key performance indicators

The post ArcBest misses mark in Q1 appeared first on FreightWaves.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.