Deep-pocketed investors have adopted a bearish approach towards NextEra Energy NEE, and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NEE usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 20 extraordinary options activities for NextEra Energy. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 40% leaning bullish and 50% bearish. Among these notable options, 5 are puts, totaling $600,588, and 15 are calls, amounting to $1,305,200.

Predicted Price Range

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $60.0 to $75.0 for NextEra Energy over the last 3 months.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for NextEra Energy options trades today is 2251.15 with a total volume of 16,171.00.

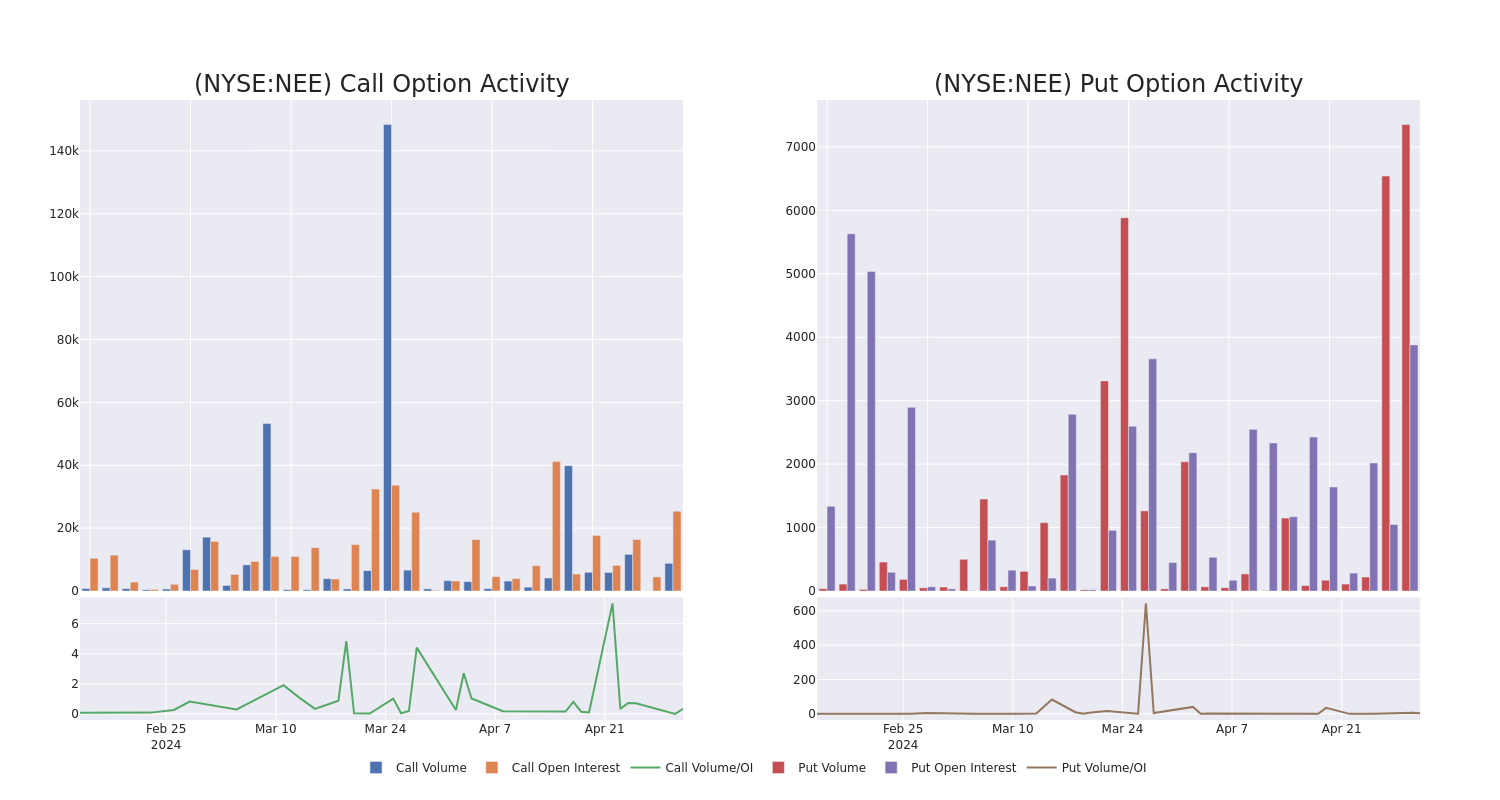

In the following chart, we are able to follow the development of volume and open interest of call and put options for NextEra Energy's big money trades within a strike price range of $60.0 to $75.0 over the last 30 days.

NextEra Energy Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEE | CALL | SWEEP | BULLISH | 09/20/24 | $2.73 | $2.73 | $2.73 | $72.50 | $239.6K | 832 | 71 |

| NEE | CALL | SWEEP | BULLISH | 10/18/24 | $2.45 | $2.18 | $2.45 | $75.00 | $234.2K | 1.1K | 43 |

| NEE | PUT | SWEEP | BEARISH | 09/20/24 | $2.6 | $2.52 | $2.6 | $65.00 | $218.6K | 1.7K | 2.7K |

| NEE | CALL | SWEEP | BEARISH | 05/17/24 | $2.08 | $2.03 | $2.04 | $67.50 | $204.7K | 8.9K | 1.1K |

| NEE | PUT | SWEEP | BEARISH | 09/20/24 | $2.5 | $2.45 | $2.5 | $65.00 | $202.2K | 1.7K | 1.3K |

About NextEra Energy

NextEra Energy's regulated utility, Florida Power & Light, is the largest rate-regulated utility in Florida. The utility distributes power to nearly 6 million customer accounts in Florida and owns 34 gigawatts of generation. FP&L contributes roughly 70% of NextEra's consolidated operating earnings. NextEra Energy Resources, the renewable energy segment, generates and sells power throughout the United States and Canada with more than 30 GW of generation capacity, including natural gas, nuclear, wind, and solar.

In light of the recent options history for NextEra Energy, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Current Position of NextEra Energy

- With a volume of 13,388,008, the price of NEE is up 2.42% at $68.59.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 83 days.

Expert Opinions on NextEra Energy

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $71.8.

- An analyst from BMO Capital persists with their Outperform rating on NextEra Energy, maintaining a target price of $72.

- Consistent in their evaluation, an analyst from B of A Securities keeps a Neutral rating on NextEra Energy with a target price of $67.

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Overweight rating on NextEra Energy with a target price of $79.

- Maintaining their stance, an analyst from BMO Capital continues to hold a Outperform rating for NextEra Energy, targeting a price of $68.

- An analyst from Scotiabank persists with their Sector Outperform rating on NextEra Energy, maintaining a target price of $73.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest NextEra Energy options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.