Source: Clive Maund 04/30/2024

Technical Analyst Clive Maund reviews Atlas Lithium to explain why he believes it is a good time to buy.

Right after we looked at Atlas Lithium Corp. ATLX on March 26, it surged on very heavy volume for several days, but then interest waned, and it reacted back on much lighter volume, as we can see on its latest 6-month chart below, which action is very bullish.

The reaction back has been quite deep, and technically, the reason for it was the still unfavorable alignment of moving averages.

Basically, the stock wanted to spend more time basing before embarking on a sustainable major uptrend, and looking at the chart now, we can see that the pattern that has formed since mid-February approximates to a Head-and-Shoulders bottom.

With the price having reacted back to a support level and volume easing back to a relatively low level, the Accumulation line holding up well on the reaction, and momentum (MACD) now trending higher, everything is in place for the stock to advance anew, and it is now starting higher again.

The following interesting slides from the company's investor deck were not included in the original article for reasons of space.

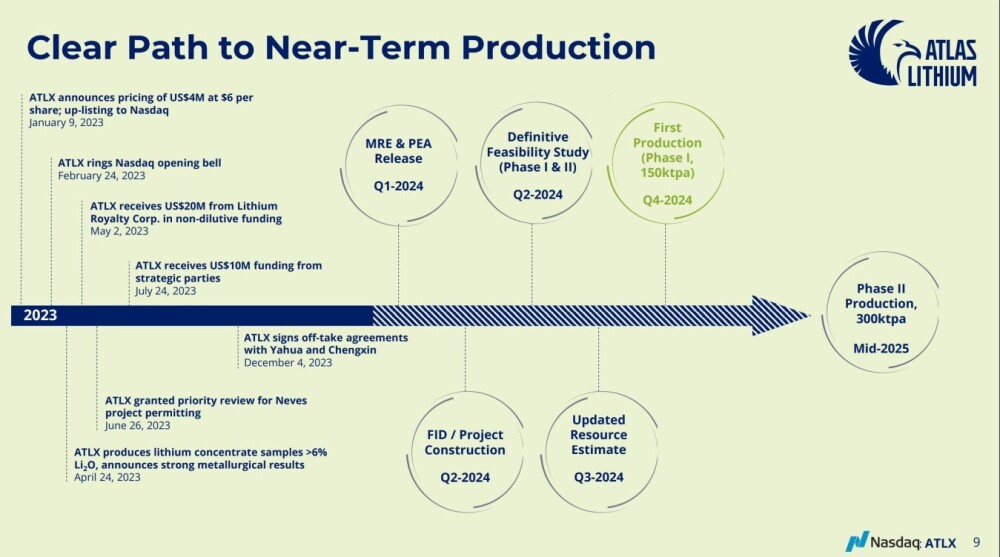

The first slide shows the path to near-term production.

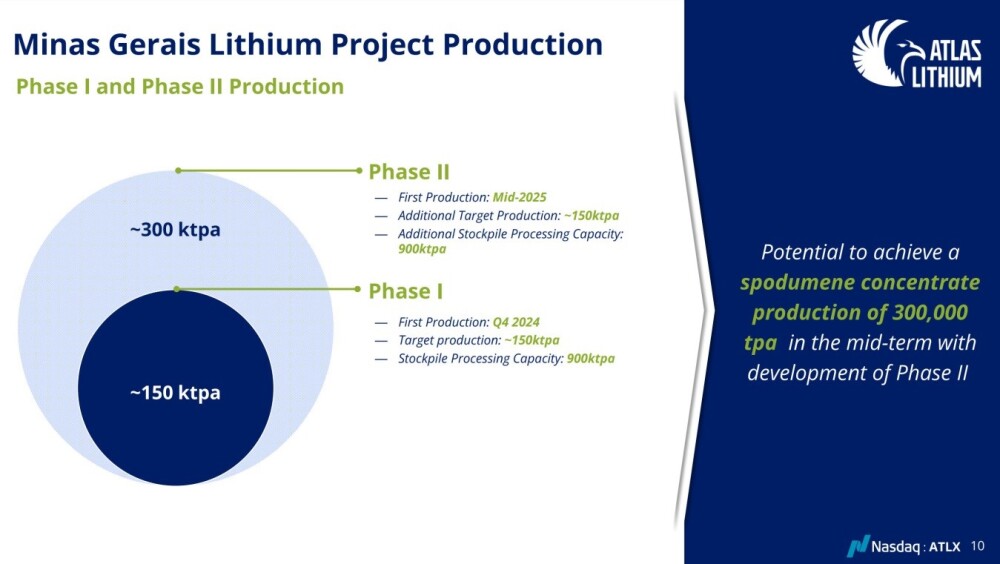

On the next slide, we can see that production is set to ramp up rapidly by mid-late 2025.

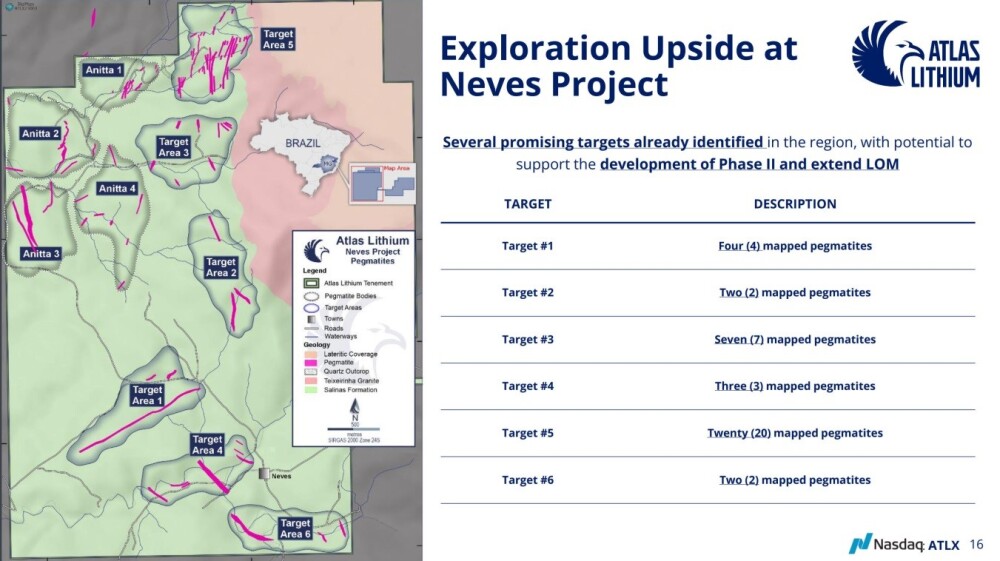

On this slide, it is evident that there is plenty of upside to exploration for the company's Neves Project.

You are referred back to the original article, in which there are other important slides that are not reproduced here in order to avoid repetition and save space.

I would also like to mention that Atlas Lithium has Buy recommendations from three analysts with the below price targets:

- Joe Reagor with Roth MKM - US$36

- Heiko F. Ihle with H.C. Wainwright & Co. - US$40

- Jake Sekelsky with Alliance Global Partners - US$55

It is thus clear that there is a lot to go for with Atlas Lithium, so we stay long the stock, and this is considered to be a very good time to buy or add to positions.

Atlas Lithium Corp. closed for trading at US$14.86 on April 29, 2024.

Important Disclosures:

- Atlas Lithium Corp. is a billboard sponsor of Streetwise Reports and pays SWR a monthly sponsorship fee between US$4,000 and US$5,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Atlas Lithium Corp.

- Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing this article. Maund received his UK Technical Analysts' Diploma in 1989. The recommendations and opinions expressed in this content accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressed

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

Clivemaund.com Disclosures

The above represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.