High-rolling investors have positioned themselves bearish on PayPal Holdings PYPL, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in PYPL often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 12 options trades for PayPal Holdings. This is not a typical pattern.

The sentiment among these major traders is split, with 16% bullish and 66% bearish. Among all the options we identified, there was one put, amounting to $46,470, and 11 calls, totaling $1,007,460.

Predicted Price Range

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $60.0 to $75.0 for PayPal Holdings over the recent three months.

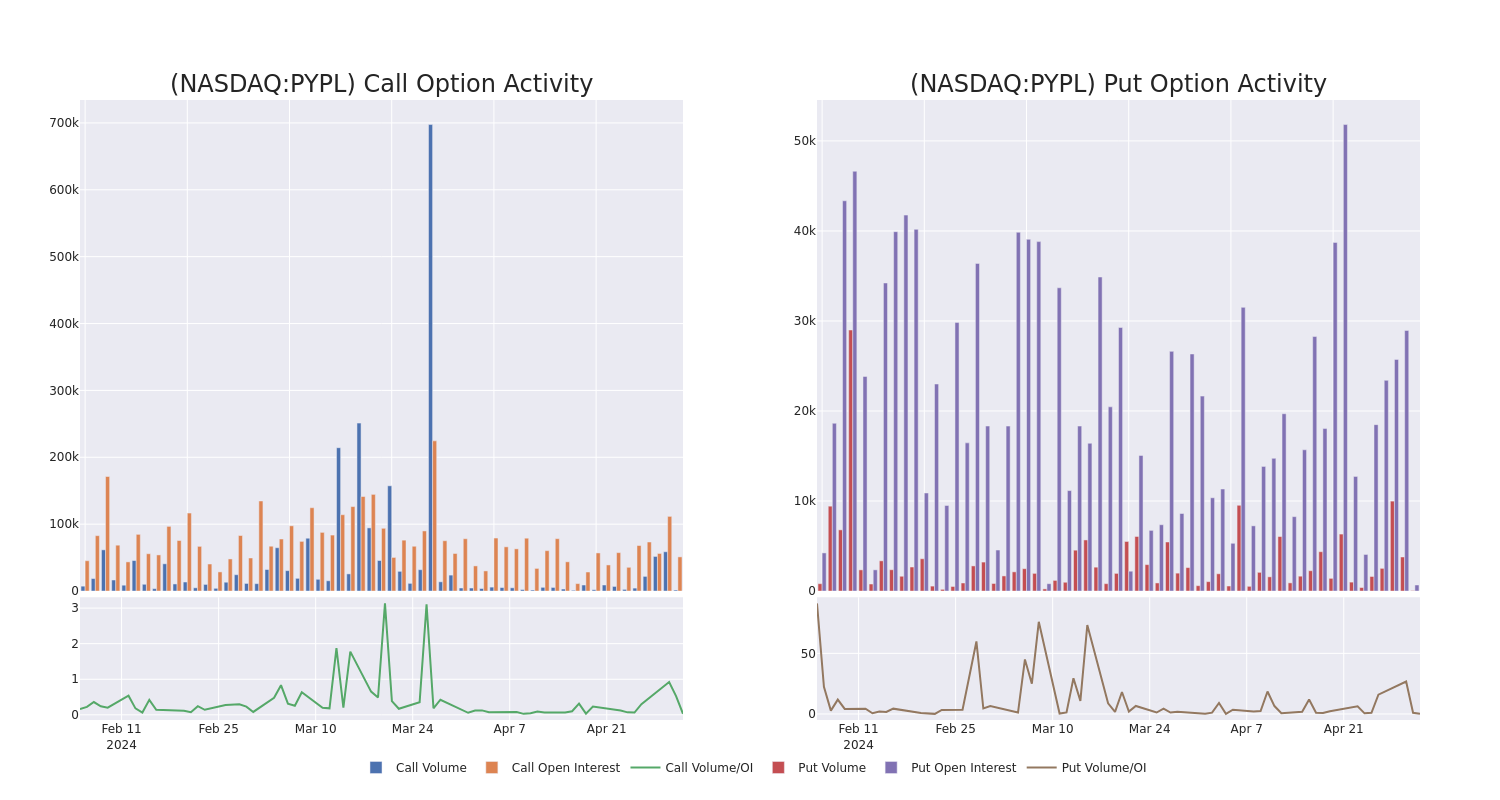

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for PayPal Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of PayPal Holdings's whale trades within a strike price range from $60.0 to $75.0 in the last 30 days.

PayPal Holdings Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PYPL | CALL | SWEEP | BEARISH | 05/17/24 | $2.57 | $2.56 | $2.56 | $65.00 | $192.6K | 17.1K | 85 |

| PYPL | CALL | SWEEP | BEARISH | 08/16/24 | $9.8 | $9.75 | $9.8 | $60.00 | $134.2K | 307 | 104 |

| PYPL | CALL | SWEEP | BEARISH | 06/20/25 | $10.05 | $10.0 | $10.05 | $72.50 | $117.5K | 933 | 1 |

| PYPL | CALL | SWEEP | BEARISH | 05/10/24 | $3.05 | $3.0 | $3.0 | $64.00 | $106.8K | 508 | 501 |

| PYPL | CALL | SWEEP | BEARISH | 06/20/25 | $9.15 | $9.05 | $9.05 | $75.00 | $85.9K | 1.2K | 1 |

About PayPal Holdings

PayPal was spun off from eBay in 2015 and provides electronic payment solutions to merchants and consumers, with a focus on online transactions. The company had 426 million active accounts at the end of 2023. The company also owns Venmo, a person-to-person payment platform.

PayPal Holdings's Current Market Status

- With a volume of 2,305,417, the price of PYPL is up 0.28% at $66.33.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 90 days.

What The Experts Say On PayPal Holdings

In the last month, 5 experts released ratings on this stock with an average target price of $69.2.

- An analyst from Wells Fargo has decided to maintain their Equal-Weight rating on PayPal Holdings, which currently sits at a price target of $65.

- An analyst from BMO Capital has decided to maintain their Market Perform rating on PayPal Holdings, which currently sits at a price target of $65.

- Maintaining their stance, an analyst from UBS continues to hold a Neutral rating for PayPal Holdings, targeting a price of $71.

- An analyst from Stephens & Co. persists with their Equal-Weight rating on PayPal Holdings, maintaining a target price of $75.

- Maintaining their stance, an analyst from JMP Securities continues to hold a Market Outperform rating for PayPal Holdings, targeting a price of $70.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest PayPal Holdings options trades with real-time alerts from Benzinga Pro.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.