Whales with a lot of money to spend have taken a noticeably bullish stance on Zscaler.

Looking at options history for Zscaler ZS we detected 13 trades.

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 46% with bearish.

From the overall spotted trades, 3 are puts, for a total amount of $84,316 and 10, calls, for a total amount of $338,060.

What's The Price Target?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $150.0 to $185.0 for Zscaler over the recent three months.

Analyzing Volume & Open Interest

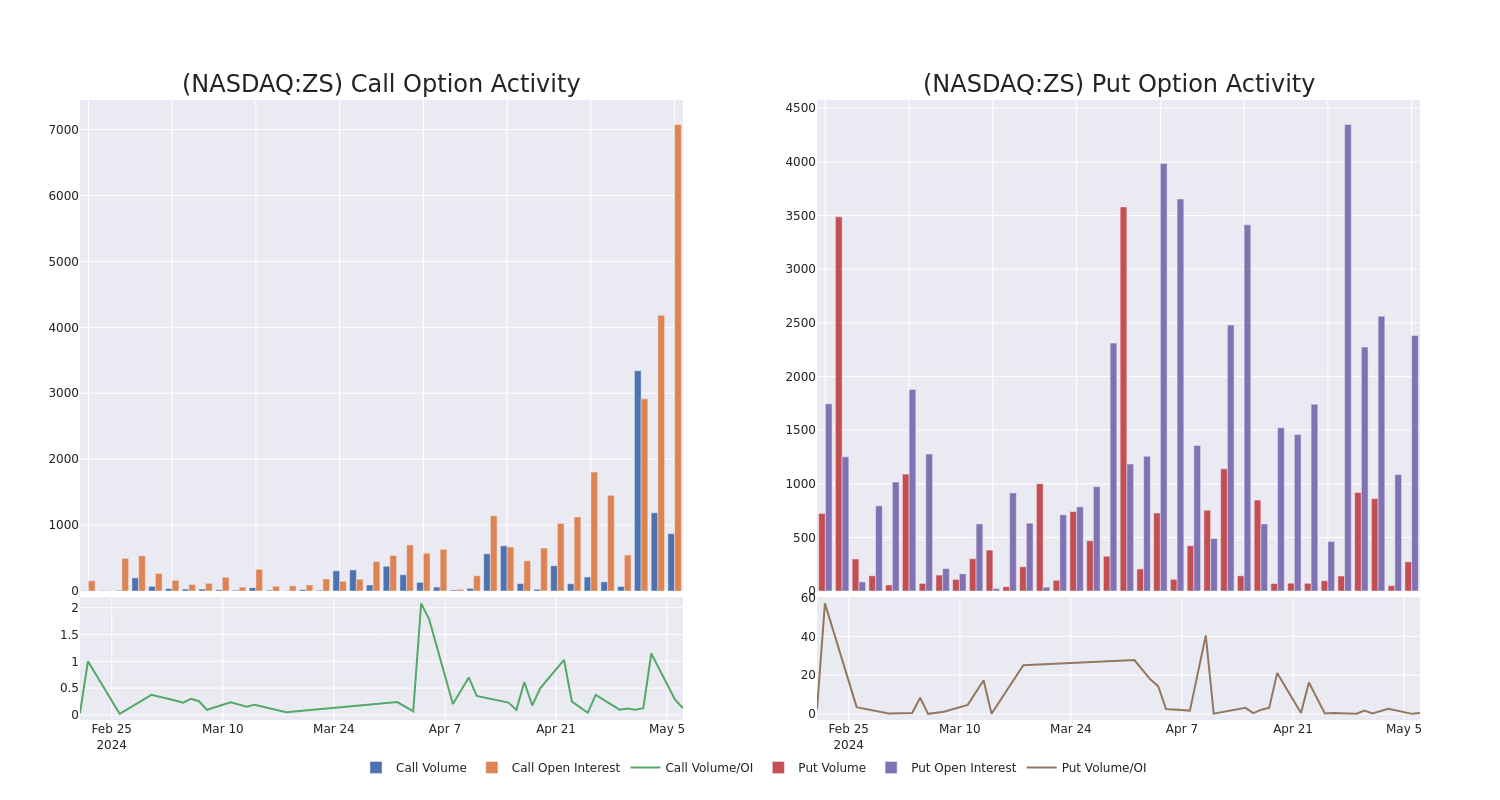

In today's trading context, the average open interest for options of Zscaler stands at 945.8, with a total volume reaching 998.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Zscaler, situated within the strike price corridor from $150.0 to $185.0, throughout the last 30 days.

Zscaler Call and Put Volume: 30-Day Overview

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ZS | CALL | SWEEP | BEARISH | 05/17/24 | $8.65 | $8.35 | $8.35 | $172.50 | $59.2K | 445 | 109 |

| ZS | CALL | TRADE | BULLISH | 05/17/24 | $7.05 | $6.0 | $6.85 | $175.00 | $41.1K | 1.0K | 1 |

| ZS | CALL | TRADE | BULLISH | 01/16/26 | $61.0 | $59.5 | $61.0 | $150.00 | $36.6K | 100 | 6 |

| ZS | CALL | SWEEP | BULLISH | 07/19/24 | $13.85 | $13.55 | $13.85 | $180.00 | $34.6K | 579 | 25 |

| ZS | CALL | SWEEP | BEARISH | 05/17/24 | $9.15 | $8.85 | $8.85 | $172.50 | $33.6K | 445 | 38 |

About Zscaler

Zscaler is a software-as-a-service, or SaaS, firm focusing on providing cloud-native cybersecurity solutions to primarily enterprise customers. Zscaler's offerings can be broadly partitioned into Zscaler Internet Access, which provides secure access to external applications, and Zscaler Private Access, which provides secure access to internal applications. The firm is headquartered in San Jose, California, and went public in 2018.

Current Position of Zscaler

- With a trading volume of 1,351,355, the price of ZS is down by -0.56%, reaching $177.14.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 23 days from now.

Professional Analyst Ratings for Zscaler

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $225.0.

- An analyst from Cantor Fitzgerald has revised its rating downward to Neutral, adjusting the price target to $230.

- Showing optimism, an analyst from Keybanc upgrades its rating to Overweight with a revised price target of $220.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Zscaler with Benzinga Pro for real-time alerts.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.