Whales with a lot of money to spend have taken a noticeably bearish stance on Amgen.

Looking at options history for Amgen AMGN we detected 17 trades.

If we consider the specifics of each trade, it is accurate to state that 23% of the investors opened trades with bullish expectations and 58% with bearish.

From the overall spotted trades, 9 are puts, for a total amount of $557,464 and 8, calls, for a total amount of $303,400.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $240.0 to $310.0 for Amgen over the last 3 months.

Volume & Open Interest Trends

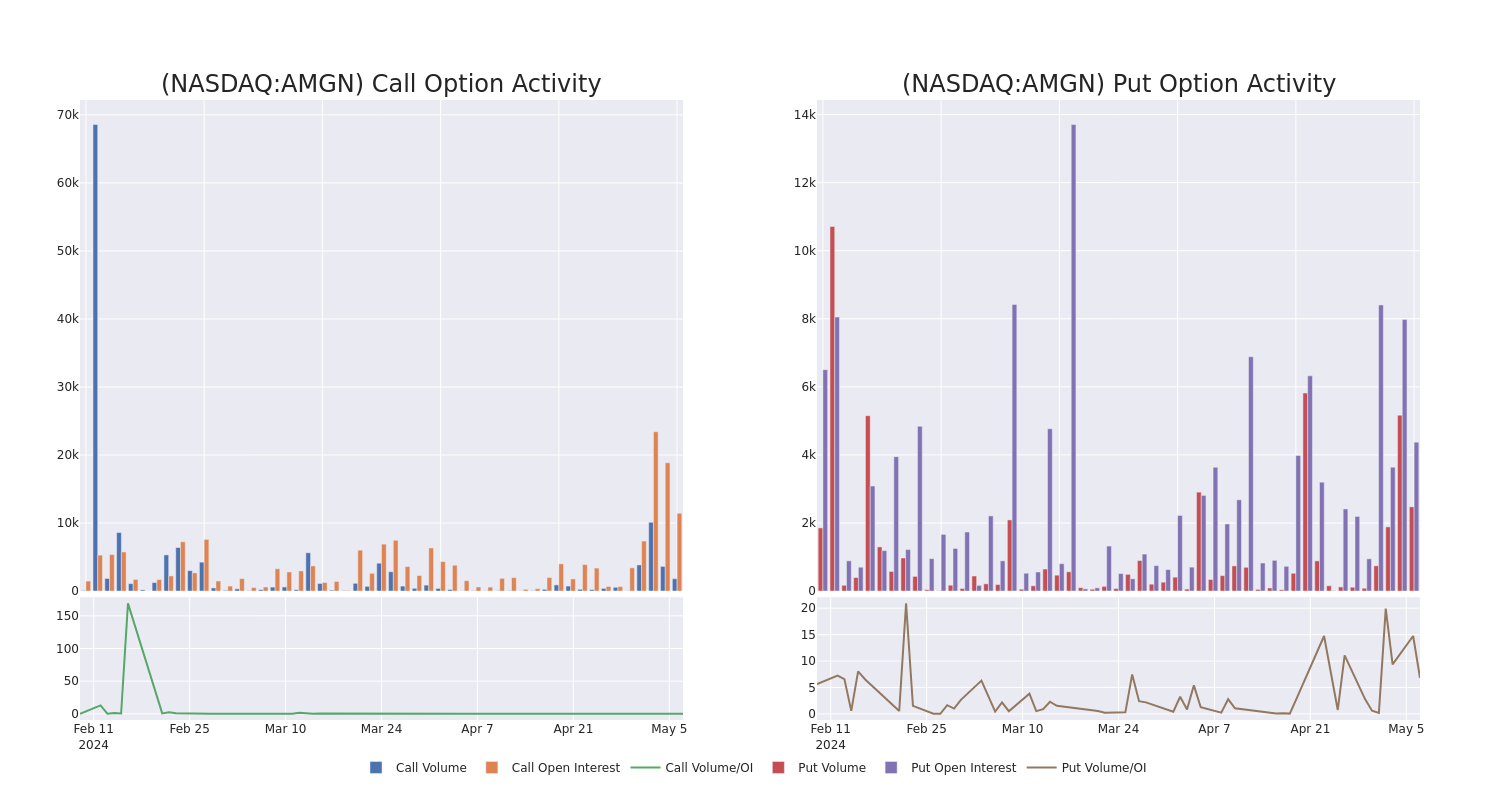

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Amgen's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Amgen's whale activity within a strike price range from $240.0 to $310.0 in the last 30 days.

Amgen Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | PUT | SWEEP | BEARISH | 09/20/24 | $15.55 | $14.8 | $15.6 | $300.00 | $173.1K | 247 | 40 |

| AMGN | PUT | TRADE | BEARISH | 06/21/24 | $6.25 | $6.05 | $6.2 | $300.00 | $62.0K | 2.0K | 10 |

| AMGN | PUT | TRADE | BEARISH | 05/17/24 | $2.53 | $2.31 | $2.45 | $300.00 | $61.2K | 818 | 767 |

| AMGN | PUT | SWEEP | BULLISH | 05/24/24 | $6.45 | $5.5 | $5.58 | $302.50 | $55.9K | 0 | 204 |

| AMGN | CALL | TRADE | BEARISH | 06/20/25 | $35.7 | $34.2 | $34.25 | $310.00 | $51.3K | 97 | 0 |

About Amgen

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm's therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brings several rare-disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

Following our analysis of the options activities associated with Amgen, we pivot to a closer look at the company's own performance.

Current Position of Amgen

- Currently trading with a volume of 852,384, the AMGN's price is up by 0.92%, now at $303.07.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 85 days.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Amgen with Benzinga Pro for real-time alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.