High-rolling investors have positioned themselves bullish on Abercrombie & Fitch ANF, and it's important for retail traders to take note. \This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in ANF often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 8 options trades for Abercrombie & Fitch. This is not a typical pattern.

The sentiment among these major traders is split, with 37% bullish and 12% bearish. Among all the options we identified, there was one put, amounting to $68,680, and 7 calls, totaling $653,019.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $105.0 to $125.0 for Abercrombie & Fitch during the past quarter.

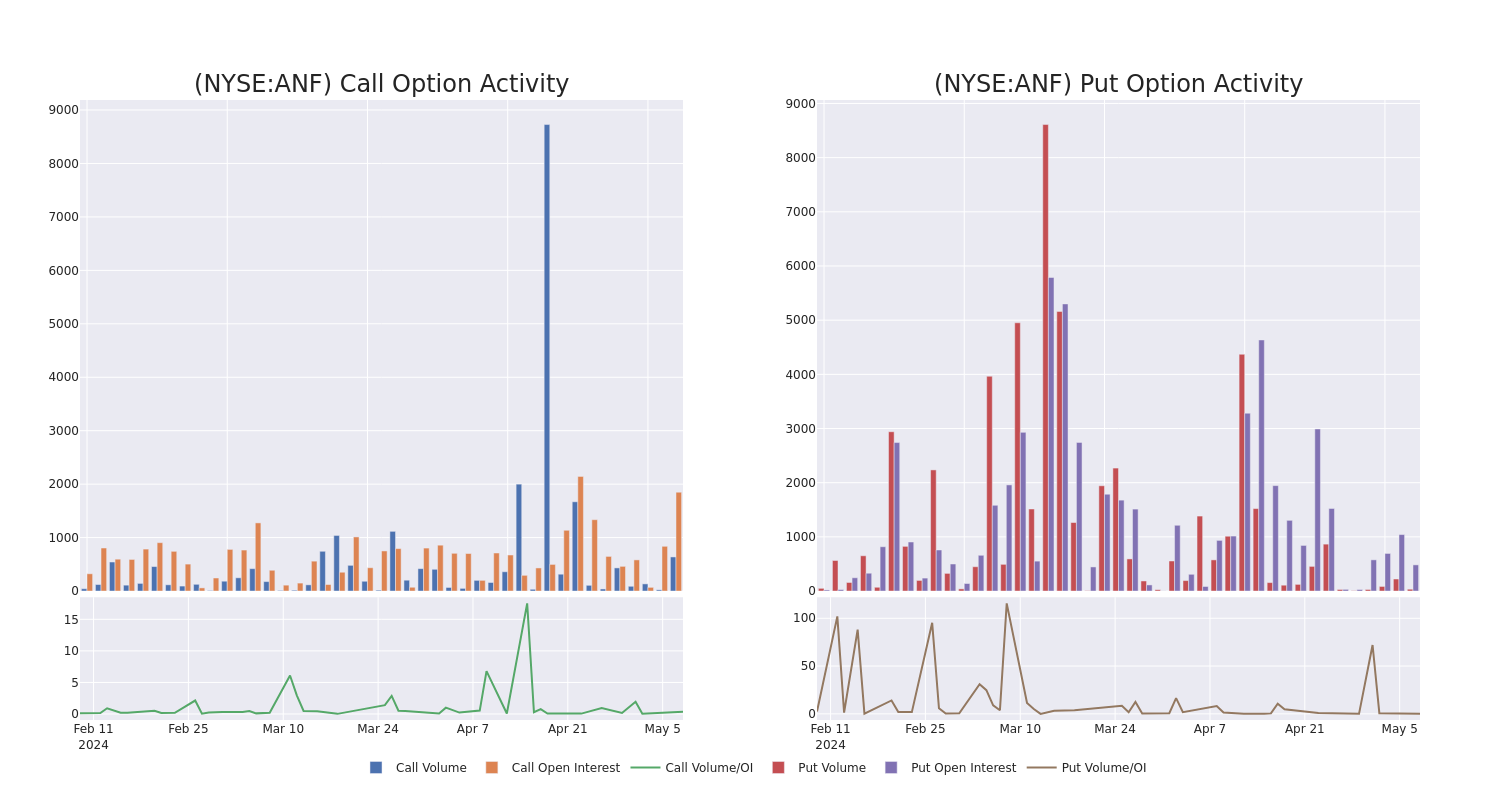

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Abercrombie & Fitch options trades today is 583.0 with a total volume of 672.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Abercrombie & Fitch's big money trades within a strike price range of $105.0 to $125.0 over the last 30 days.

Abercrombie & Fitch Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ANF | CALL | SWEEP | BEARISH | 06/21/24 | $27.1 | $26.9 | $26.9 | $105.00 | $161.4K | 198 | 63 |

| ANF | CALL | SWEEP | NEUTRAL | 05/24/24 | $11.1 | $10.7 | $10.86 | $120.00 | $105.4K | 1.4K | 147 |

| ANF | CALL | SWEEP | NEUTRAL | 05/24/24 | $11.1 | $10.7 | $10.9 | $120.00 | $98.1K | 1.4K | 150 |

| ANF | CALL | SWEEP | NEUTRAL | 05/10/24 | $9.1 | $8.5 | $8.82 | $120.00 | $85.7K | 205 | 97 |

| ANF | CALL | SWEEP | BULLISH | 06/21/24 | $27.6 | $27.3 | $27.3 | $105.00 | $81.9K | 198 | 33 |

About Abercrombie & Fitch

Abercrombie & Fitch Co is a specialty retailer that sells casual clothing, personal-care products, and accessories for men, women, and children. It sells direct to consumers through its stores and websites, which include the Abercrombie & Fitch, Abercrombie kids, and Hollister brands. Most stores are in the United States, but the company does have many stores in Canada, Europe, and Asia. All stores are leased. Abercrombie ships to well over 100 countries via its websites. The company sources its merchandise from dozens of vendors that are primarily located in Asia and Central America. Abercrombie has two distribution centers in Ohio to support its North American operations. It uses third-party distributors for sales in Europe and Asia.

In light of the recent options history for Abercrombie & Fitch, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Abercrombie & Fitch

- With a volume of 505,723, the price of ANF is up 0.43% at $128.97.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 21 days.

Professional Analyst Ratings for Abercrombie & Fitch

In the last month, 2 experts released ratings on this stock with an average target price of $121.0.

- An analyst from Argus Research has decided to maintain their Buy rating on Abercrombie & Fitch, which currently sits at a price target of $130.

- An analyst from Morgan Stanley persists with their Equal-Weight rating on Abercrombie & Fitch, maintaining a target price of $112.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Abercrombie & Fitch, Benzinga Pro gives you real-time options trades alerts.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.