AdaptHealth AHCO has been analyzed by 4 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 1 | 0 | 0 | 0 |

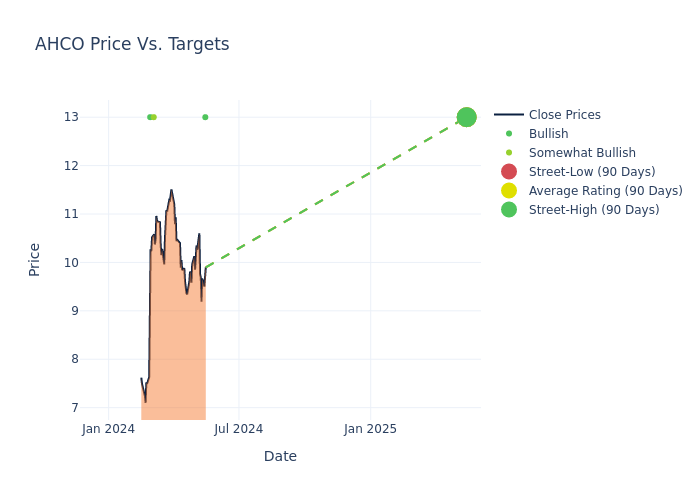

Analysts have recently evaluated AdaptHealth and provided 12-month price targets. The average target is $13.0, accompanied by a high estimate of $13.00 and a low estimate of $13.00. Surpassing the previous average price target of $11.00, the current average has increased by 18.18%.

Decoding Analyst Ratings: A Detailed Look

The standing of AdaptHealth among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| David Macdonald | Truist Securities | Maintains | Buy | $13.00 | $13.00 |

| Ben Hendrix | RBC Capital | Maintains | Outperform | $13.00 | - |

| Whit Mayo | UBS | Raises | Buy | $13.00 | $9.00 |

| David Macdonald | Truist Securities | Raises | Buy | $13.00 | $11.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to AdaptHealth. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of AdaptHealth compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

To gain a panoramic view of AdaptHealth's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on AdaptHealth analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About AdaptHealth

AdaptHealth Corp is engaged in providing patient-centered, healthcare-at-home solutions including home medical equipment (HME), medical supplies, and related services. It focuses on providing; sleep therapy equipment, supplies, and related services (including CPAP and bi-PAP services) to individuals suffering from obstructive sleep apnea (OSA), medical devices and supplies to patients for the treatment of diabetes (including continuous glucose monitors (CGM and insulin pumps), home medical equipment to patients discharged from acute care and other facilities, oxygen and related chronic therapy services in the home, and other HME devices and supplies on behalf of chronically ill patients with wound care, urological, incontinence, ostomy and nutritional supply needs.

Understanding the Numbers: AdaptHealth's Finances

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: AdaptHealth displayed positive results in 3 months. As of 31 March, 2024, the company achieved a solid revenue growth rate of approximately 6.89%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: AdaptHealth's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -0.36%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of -0.15%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of -0.05%, the company showcases effective utilization of assets.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.6, caution is advised due to increased financial risk.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.