Credit Acceptance Corporation CACC is well-poised for top-line growth, supported by decent demand for auto loans, along with increases in dealer enrollments and active dealers. The company's share buyback policy also seems impressive.

However, elevated expenses will likely hurt the company's profitability to some extent. Weak credit quality and high debt levels are other concerns.

The Zacks Consensus Estimate for CACC's 2024 earnings has been unchanged over the past 30 days. Hence, the company currently carries a Zacks Rank #3 (Hold).

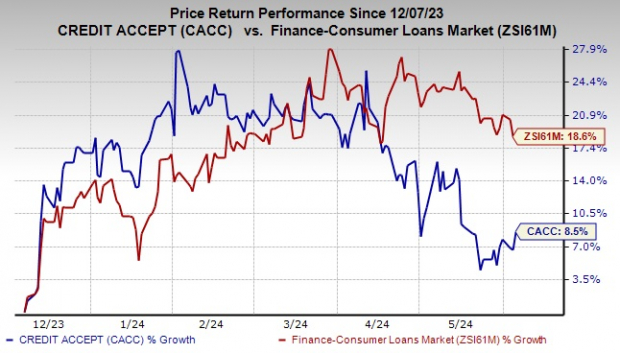

Over the past six months, shares of Credit Acceptance have gained 8.5% compared with the 18.6% growth of the industry.

Image Source: Zacks Investment Research

Looking at its fundamentals, supported by an increase in finance charges, Credit Acceptance's revenues witnessed a seven-year (2016-2023) compound annual growth rate (CAGR) of 10.1%, with the uptrend continuing in the first quarter of 2024.

In first-quarter 2024, finance charges accounted for 92.4% of total revenues. While finance charges are likely to witness headwinds from macroeconomic factors in the near term, the same will rebound once the operating backdrop improves completely. We anticipate the company's total GAAP revenues to rise 9.5% this year, 6.3% in 2025 and 3.7% in 2026.

As of Mar 31, 2024, CACC had total debt of $5.60 billion, significantly higher than cash and cash equivalents (including restricted cash and restricted securities) of $667.5 million. Nevertheless, the company has a revolving secured line of credit facility and some Warehouse facilities, which reflect that its current liquidity position is sufficient to meet near-term debt obligations, even if the economic situation worsens.

Further, Credit Acceptance believes in returning capital to shareholders through stock repurchases instead of paying dividends. In August 2023, it authorized an additional 2 million shares to be repurchased. As of Mar 31, 2024, the company had 1.5 million shares left to be repurchased. Despite having a substantial debt burden, its high cash flow generating business model and low capital expenditure are likely to help sustain share buybacks.

However, the company's operating expenses witnessed a CAGR of 10.4% over the last six years (2017-2023), with the uptrend continuing in the first quarter of 2024. The increase has been mainly due to a rise in salaries and wages, and sales and marketing expenses. Owing to the company's continued efforts to hire additional team members and sales force, expenses are expected to be elevated. We project total expenses to witness a CAGR of 5.2% over the next three years.

Also, Credit Acceptance's asset quality has been a cause of concern. While provision for credit losses declined in 2018, the same witnessed a substantial rise in 2020 on account of the coronavirus-related concerns. The upward trend persisted in 2022, 2023 and the first three months of 2024. Given the rise in loan balances and tough macroeconomic outlook, provisions are expected to be elevated in the near term.

Stocks to Consider

A couple of better-ranked stocks from the finance space are T. Rowe Price Group, Inc. TROW and Artisan Partners Asset Management Inc. APAM.

Earnings estimates for TROW have been revised 13% upward for the current year over the past 60 days. The company's share price has increased 16.9% over the past six months. TROW currently flaunts a Zacks Rank #1 (Strong Buy).

Artisan Partners presently carries a Zacks Rank #2 (Buy). Its earnings estimates have been revised upward by 3% for the current year over the past 60 days. In the last six months, APAM's share price increased 12.1%.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.