Zinger Key Points

- For FemBloc in the U.S. alone, Femasys looks to address the needs of the over 13 million women who no longer intend to have children.

- Femasys CEO faced challenges, particularly in securing funding and navigating evolving regulatory requirements.

- Today's manic market swings are creating the perfect setup for Matt’s next volatility trade. Get his next trade alert for free, right here.

Femasys Inc FEMY is a biomedical company focused on women’s healthcare.

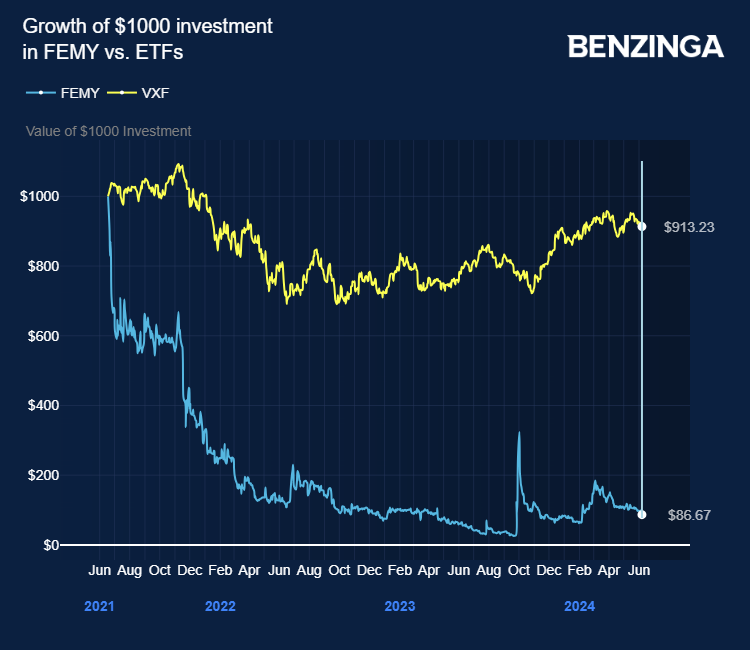

The company, with a market capitalization of $22.50 million as of data from Benzinga Pro on 17 June, went public in June 2021.

In an emailed interview with Benzinga, Kathy Lee-Sepsick, the founder & CEO of Femasys, said, “I considered permanent birth control but found the available options too risky.”

Femasys’ commercially available products are:

- FemaSeed: A form of artificial insemination where sperm is delivered directly and safely into the fallopian tube

- FemVue: A contrast-generating device for ultrasound evaluation.

- FemCath: A delivery catheter for fallopian tube and uterine cavity evaluation

- FemCerv: An endocervical tissue sampler for diagnosis of cervical cancer.

The company is also developing FemBloc, a non-surgical permanent birth control, which is in late-stage clinical development.

Here’s a summary of the Q&A:

- Benzinga: How does Femasys place itself in the crowded contraceptive and fertility market?

- Kathy Lee-Sepsick: “Despite advancements in the fertility space, there has been no new affordable option for first-line care in decades.”

- “FemaSeed has been developed as a low-cost infertility treatment that is safe and effective. In the contraceptive market, there remains one option for permanent birth control, which requires women to undergo surgery with its associated risks.”

- “FemBloc is a permanent, in-office procedure that requires no anesthesia, no permanent implant, no surgery, and no hormones.”

- Benzinga: What is the revenue goal over the next 1-2 years, and what steps do you plan to take to accomplish those goals?

- Kathy Lee-Sepsick: “We are in the early stages of our market launch and haven’t set revenue targets yet.” She adds that the company is at an inflection point, and revenue is expected to begin in the coming quarters.

- Benzinga: What are the upcoming catalysts for FemBloc, including commercialization, and what is the expected total addressable market size for the product?

- Kathy Lee-Sepsick: FemBloc is a phase 3 trial that started in October 2023. Primary completion is expected by December 2029.

- “Over 100 years of stagnant innovation could lead to a $20 billion market expansion opportunity for FemBloc in the U.S. alone as we look to address the needs of the over 13 million women who no longer intend to have children.”

- “Additionally, Roe v. Wade being overturned two years ago has caused more women to seek permanent birth control options. We expect a large portion of the market to be interested in our product.”

- Benzinga: How does Femasys plan to expand its pipeline and product offering? Is there any plan to enter the men’s health segment?

- Kathy Lee-Sepsick: “We intend to keep our focus on women…”

- Benzinga: What are the challenges and opportunities Femasys has faced related to the women’s health market?

- Kathy Lee-Sepsick: “I’ve faced numerous challenges, particularly in securing funding and navigating evolving regulatory requirements.”

- She adds that Femasys has significant opportunities targeting multi-billion-dollar global markets with its products.

- Benzinga: What is your message for your investors?

- Kathy Lee-Sepsick: “Femasys is at an inflection point as we bring our infertility portfolio products to market through our direct commercial team in the U.S.” “We continue to believe that the company is undervalued…”

Price Action: FEMY stock closed at $1.04 on Friday.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.