New Jersey Resources NJR continues to benefit from its infrastructure upgrades that help serve its expanding customer base more efficiently. Given its earnings growth opportunities and strong return on equity (ROE), NJR makes for a solid investment option in the utility sector.

Let's focus on the factors that make this Zacks Rank #2 (Buy) company a strong investment pick at the moment.

Growth Projections & Surprise History

The Zacks Consensus Estimate for fiscal 2024 earnings per share has moved up 1.7% in the past 90 days to $2.94.

New Jersey Resources delivered an average earnings surprise of 107.4% in the last four quarters.

Return on Equity

ROE indicates how efficiently a company has been utilizing the funds to generate higher returns. Currently, New Jersey Resources' ROE is 12.16%, higher than the industry's average of 9.7%. This indicates that the company has been utilizing the funds more constructively than its peers in the utility gas distribution industry.

Dividend Growth

NJR has been increasing shareholders' value by paying dividends. Currently, its quarterly dividend is 42 cents per share, resulting in an annualized dividend of $1.68 per share, up 7.7% from the previous figure of $1.56. The company's current dividend yield is 3.99%, better than the Zacks S&P 500 composite's 1.29%.

Systematic Investments & Customer Growth

New Jersey Resources makes consistent investments to upgrade and maintain its existing infrastructure. The idea is to provide reliable services to its customers around the clock. The company expects capital investments to be in the range of $619-$754 million and $578-$742 million for fiscal 2024 and fiscal 2025, respectively.

The company added 4,058 new customers during the first six months of fiscal 2024, compared with 4,064 in the same period of fiscal 2023. It expects these new customers to contribute nearly $3.4 million of incremental utility gross margin on an annualized basis.

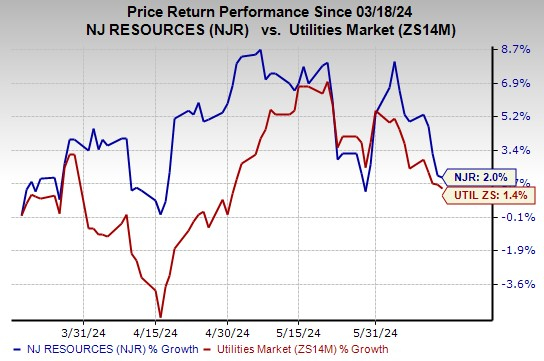

Price Performance

In the past three months, shares of the company have risen 2% compared with the sector's 1.4% growth.

Image Source: Zacks Investment Research

Other Stocks to Consider

A few other top-ranked stocks from the same industry are Atmos Energy ATO, MDU Resources MDU and UGI Corporation UGI, each holding a Zacks Rank #2 at present.

ATO's long-term (three to five years) earnings growth rate is 7%. The Zacks Consensus Estimate for ATO's fiscal 2024 EPS indicates year-over-year growth of 10.2%.

MDU's long-term earnings growth rate is 6%. The Zacks Consensus Estimate for MDU's 2024 EPS indicates a year-over-year increase of 3.3%.

The Zacks Consensus Estimate for UGI's fiscal 2024 EPS indicates a year-over-year improvement of 2.8%. The company delivered an average earnings surprise of 19.1% in the last four quarters.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.