Earlier this month, we talked about how bull markets tend to last much longer and generate much stronger returns than the one we continue to experience.

But prices don’t go up for the sake of going up.

They go up because earnings are going up.

Sure, oftentimes prices may decouple from fundamentals (i.e., a company’s ability to make money) over short-term periods — which is why market-timing is so difficult.

But many analysts argue that’s not what’s going on right now. They’ll argue that prices are up because the fundamentals are favorable.

Here’s a sampling of what Wall Street’s top stock market pros of pointed out in recent weeks:

Cash Flow Generation Is Strong

One of the more repeated concerns in the stock market is that valuations are elevated above their long-term averages.

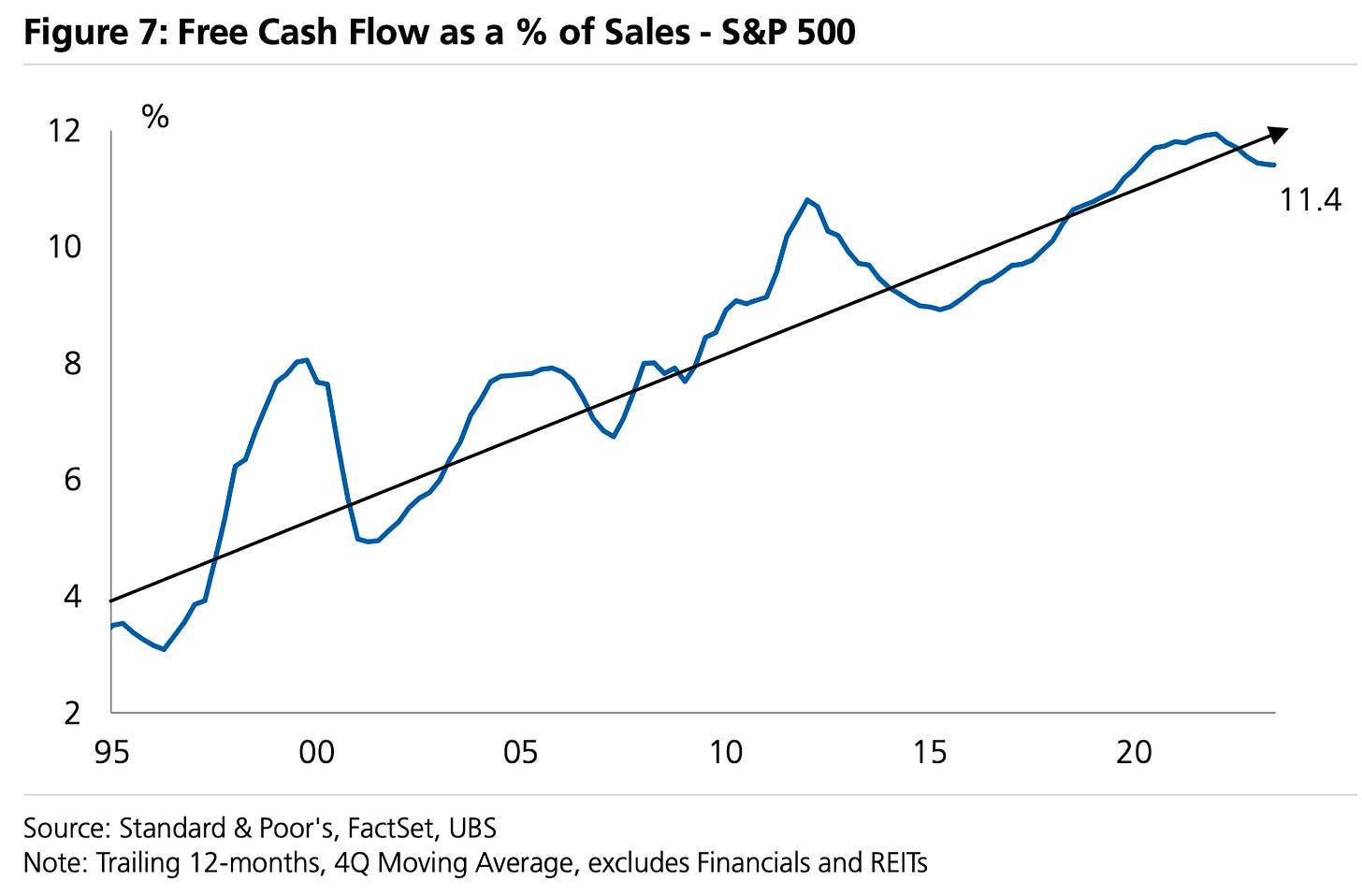

UBS’s Jonathan Golub argues today’s historically high valuations are justified.

“S&P 500 companies have been generating more cash flow over the past 3 decades, justifying higher valuations,“ Golub wrote on Monday.

Free cash flow levels have been rising relative to sales for years. UBS

Resilient Profit Margins Are Amplifying Earnings Growth

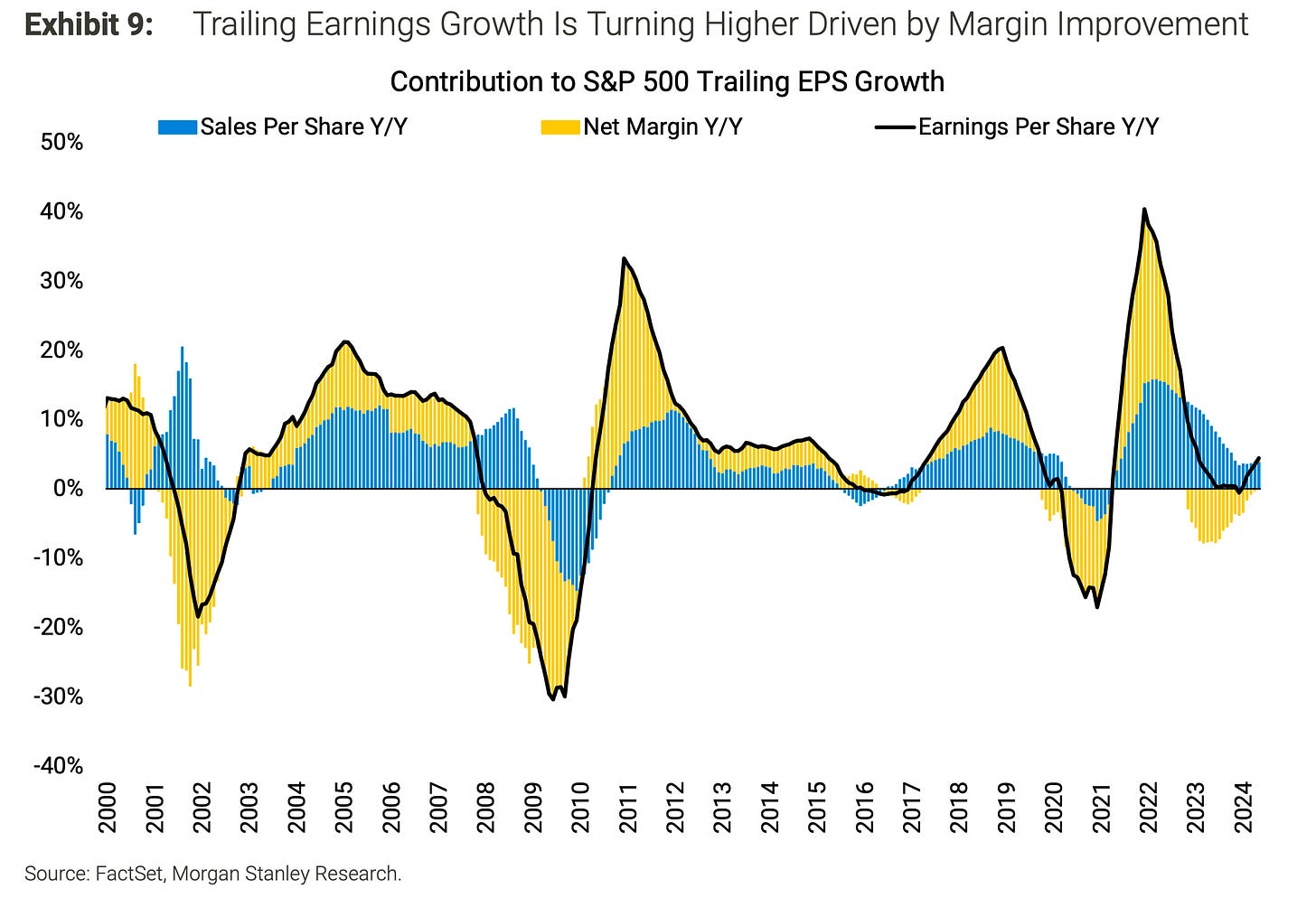

With the economy cooling, sales growth isn’t as hot as it used to be. But that hasn’t had too much of an impact on earnings growth.

“[W]e think it's important to point out that S&P 500 trailing earnings growth is turning higher (now 4% Y/Y up from -1% to start the year),” Morgan Stanley’s Michael Wilson observed on Monday. “Margin improvement is fueling this rise in earnings growth as top line growth has remained steady throughout the year.”

Improving profit margins are helping earnings growth to heat up. (Source: Morgan Stanley)

Earnings Are Driving Stock Prices

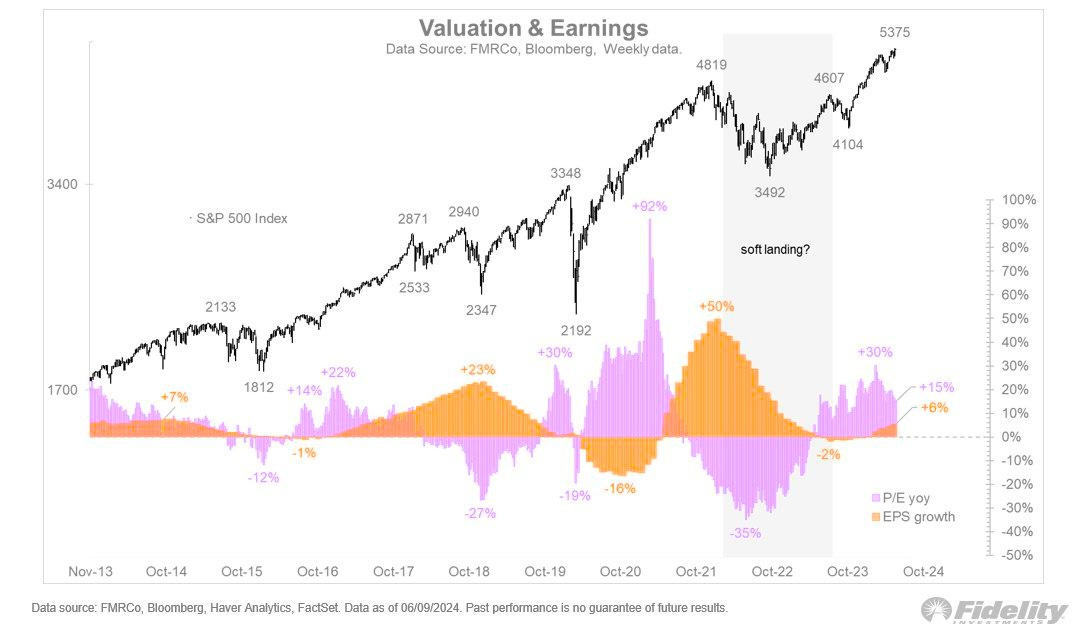

Expanding valuations were a large driver of stock market returns over the past year.

More recent gains appear to be driven by earnings.

“Good news - the baton seems to be being passed from valuation to earnings,” Fidelity’s Jurrien Timmer wrote on Wednesday. “This is exactly what is needed to sustain the cyclical bull market. Per the weekly chart below, the year-over-year change in the trailing P/E ratio has slowed from +30% to +15%, while the year-over-year change in trailing earnings has accelerated from -2% to +6%.“

Returns are increasingly being driven by earnings growth. (Source: @TimmerFidelity)

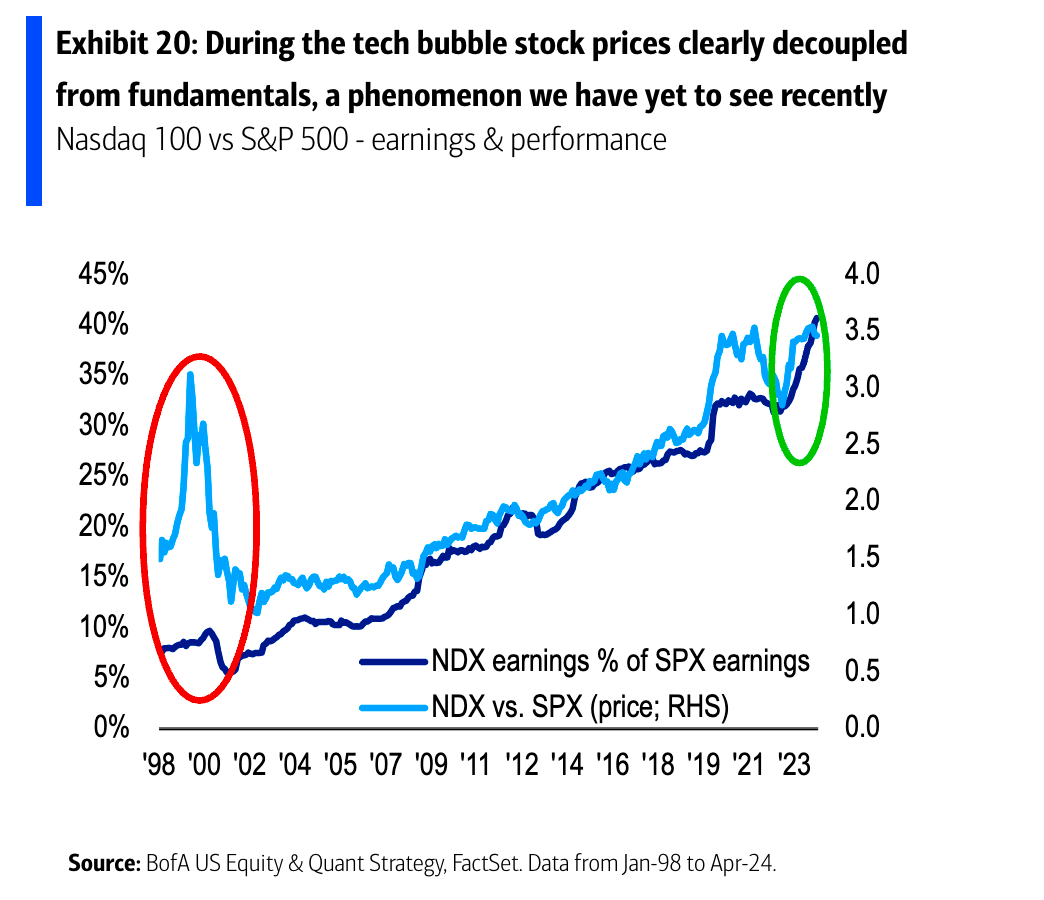

Fundamentals Suggest It’s Not A Tech Bubble

The megacap tech names have drawn a lot of attention as they’ve been responsible for much of the stock market’s gains in recent years. But their outperformance is supported by outsized earnings growth, which makes the current run up in prices very different from the dotcom bubble.

“As asset bubbles form, a key reason volatility rises is that stocks start trading purely on momentum, decoupling from their fundamental tether (where fundamentals exist),” BofA’s Benjamin Bowler wrote. “Exhibit 20 shows how this tether was broken in the Nasdaq in 1998-2000 (vs the S&P), in contrast to how closely linked fundamentals & tech stock prices appear today.”

The outperformance of big tech stocks is supported by earnings. (Source: BofA)

Increased Market Concentration Isn’t A Sign Of Trouble

As we’ve discussed, market concentration in itself is not a reason to be too concerned about the market.

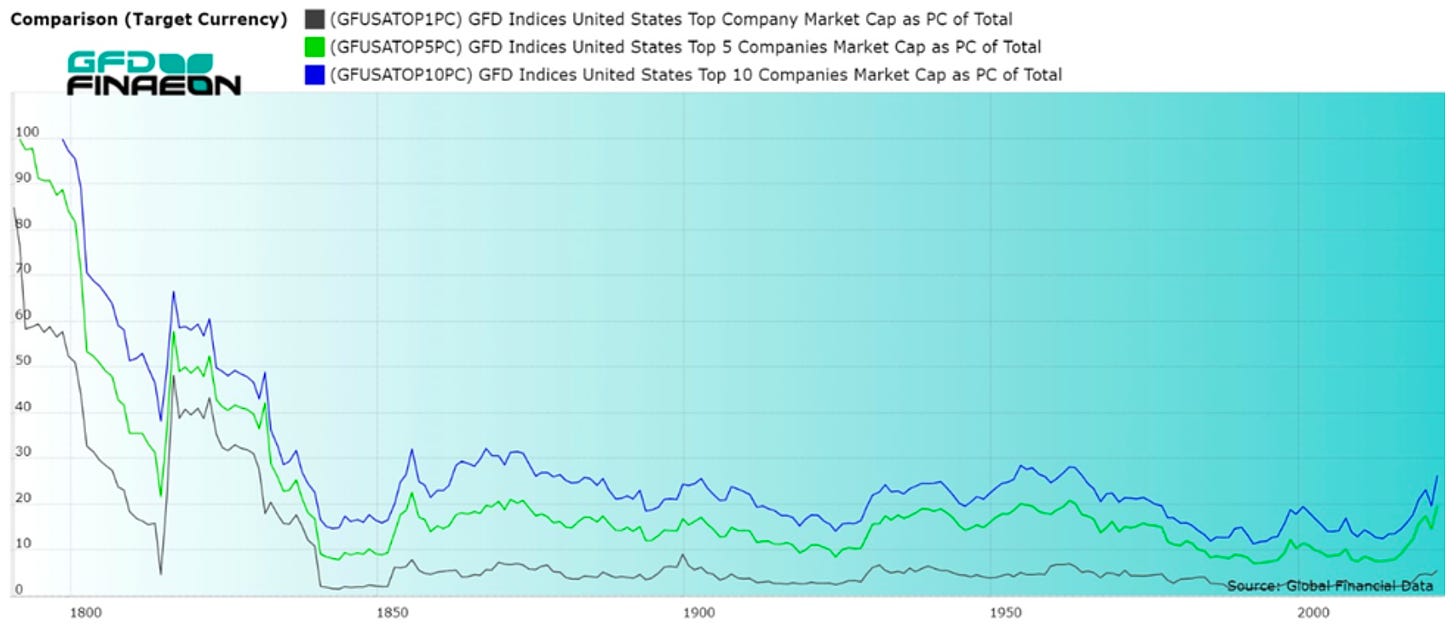

Global Financial Data (GFD) has a great post exploring market concentration going all the way back to 1790. High market concentration is not a new phenomenon.

“Based upon our analysis of the past 150 years, there seems no reason to believe that the increased concentration of the past ten years is the harbinger of a major bear market,” GFD’s Bryan Taylor wrote. “Increased concentration is the sign of a bull market and bear markets reduce concentration.“

There are many periods throughout history when the market was concentrated like it is today. (Source: Global Financial Data)

Earnings Growth Is Broadening Out

Yes, it is the case that the megacap tech names have been responsible for much of the earnings growth in the market. But that narrative is shifting.

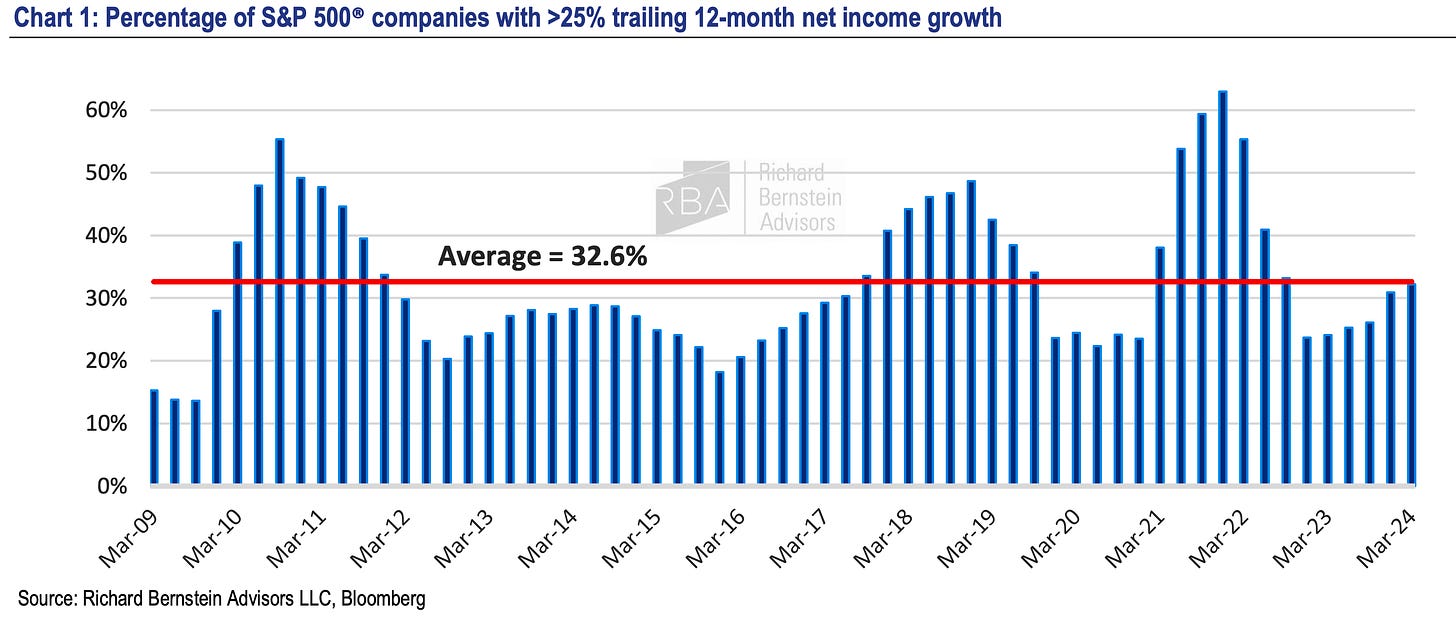

“Perhaps the most important near-term support for the stock market is the ongoing acceleration of corporate earnings,” Richard Bernstein Advisors’ Dan Suzuki wrote on Wednesday. “Earnings growth has been accelerating since the end of 2022, and we forecast further acceleration over the next several quarters. Not only is growth accelerating, but critically, it’s also broadening out.”

A growing share of the market is reporting impressive earnings growth. RBA

The Bottom Line

The “bottom line” is an idiom that’s often used as a metaphor to characterize “the essential or salient point.“

The term actually comes from accounting. On an income statement, the top line is revenue. As you move down the income statement, you see costs, expenses, interest, taxes, and other items, all of which you subtract from revenue. And what you’re left with is the bottom line: earnings.

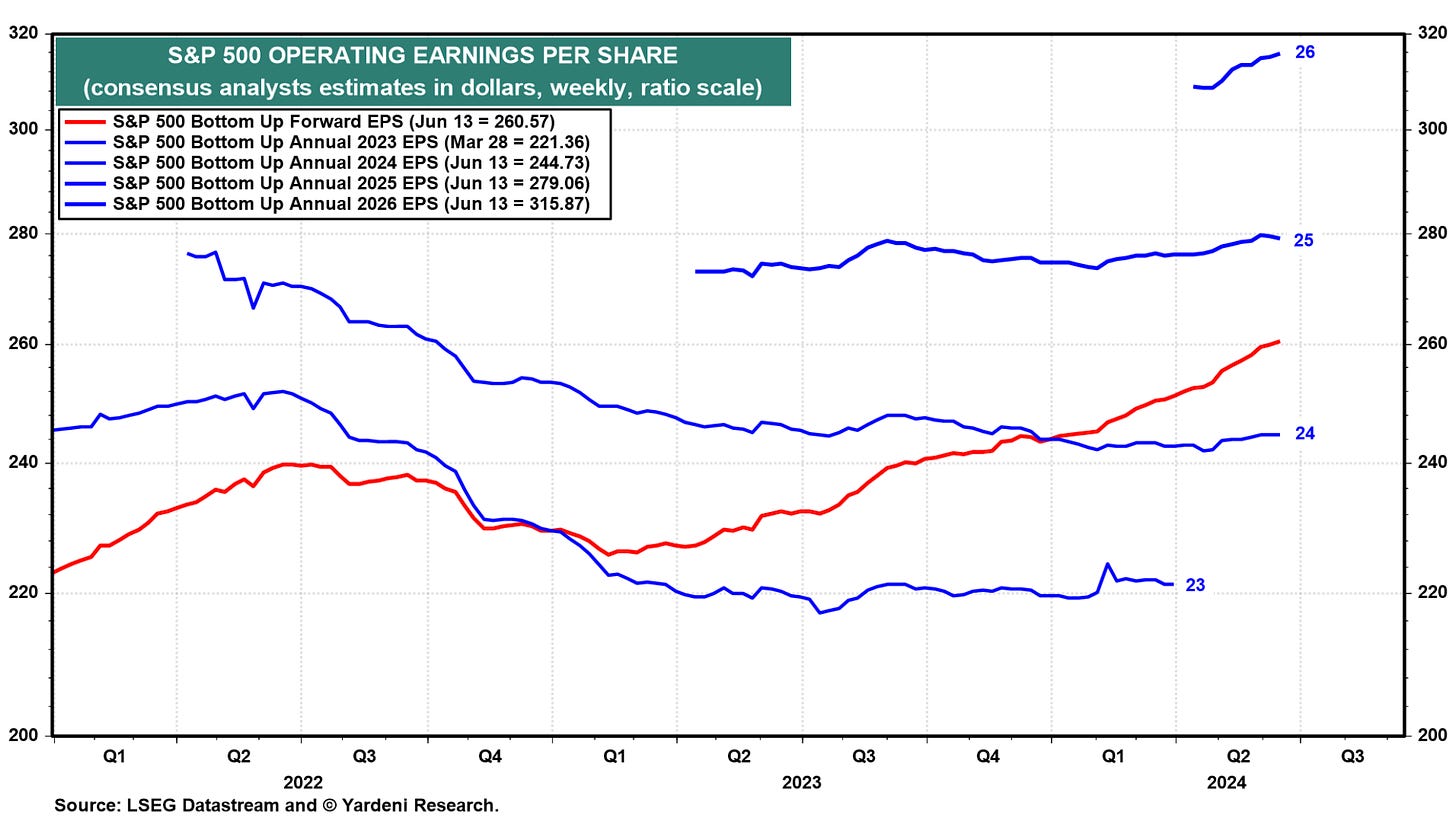

As we’ve seen in the charts above, analysts agree the prospects for earnings are looking favorable for stocks.

Analysts expect healthy earnings growth through at least 2026. (Source: Yardeni Research)

And in the stock market, earnings are the most important driver of prices in the long run.

That is to say: The bottom line is the bottom line.

A version of this post was originally published on Tker.co.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.