SBA Communications' SBAC extensive and geographically diverse communication real estate portfolio is well-poised to benefit from wireless carriers' high capital spending for network expansion amid accelerated 5G network deployment efforts. Portfolio expansion moves, backed by a solid balance sheet position, augur well. However, notable customer concentration and high interest rates raise concerns.

What's Aiding SBAC?

The advancement in mobile technology, such as 4G and 5G networks, and the proliferation of bandwidth-intensive applications have driven the growth in mobile data usage globally.

This has resulted in wireless service providers and carriers expanding their networks and deploying additional equipment for existing networks to boost network coverage and capacity to meet the rising consumer demand, poising tower real estate investment trusts like SBA Communications well for growth.

The company has a resilient and stable site-leasing business model and generates most of its revenues from long-term (typically five to 10 years) tower leases that have built-in rent escalators. This assures steady revenues over the long term.

Moreover, with wireless service providers continuing to lease additional antenna space on the company's towers amid the increase in network use, data transfer, network expansion and network coverage requirements, its site-leasing revenue growth is likely to remain robust in the upcoming period.

SBA Communications' portfolio expansion efforts into select international markets with high growth characteristics position it well to take advantage of the secular trends in mobile data usage and wireless spending growth across the globe. In the first quarter of 2024, the company acquired 11 communication sites. In the first quarter of 2024, it also built 76 towers.

Subsequent to Mar 31, 2024, SBA Communications purchased or is under contract to buy 271 communication sites for a total cash consideration of $84.5 million. It expects to conclude these buyouts by the end of the third quarter of 2024.

On the balance sheet front, SBA Communications exited the first quarter of 2024 with $261.8 million in cash and cash equivalents, short-term restricted cash and short-term investments. As of Apr 29, 2024, the company had $195 million outstanding under its $2.0 billion revolving credit facility.

Further, SBAC's current cash flow growth is projected at 13.13 % compared with the negative 5.32% estimated for the industry. With ample financial flexibility, SBAC seems well-poised to capitalize on long-term growth opportunities.

What's Hurting SBAC?

The company has a high customer concentration, with T-Mobile TMUS, AT&T T and Verizon VZ accounting for the majority of its domestic site-leasing revenues. In the first quarter of 2024, T-Mobile, AT&T and Verizon accounted for 38.8%, 29.5% and 20%, respectively, of SBAC's domestic site-leasing revenues.

Therefore, the loss of any of these customers, consolidation among them or a reduction in network spending might hurt the company's top line significantly. Specifically, the churn arising from the Sprint-related decommissioning is likely to weigh on its performance in the near term.

SBA Communications has a substantially leveraged balance sheet, with $12.4 billion of total debt and net debt to the annualized adjusted EBITDA leverage of 6.5X as of the end of the first quarter of 2024. The high amount of debt is likely to keep SBA Communications' financial obligations elevated. Moreover, its debt-to-capital ratio is higher than the industry average. In addition, a high interest rate environment is likely to result in high borrowing costs for the company, affecting its ability to purchase or develop real estate.

Analysts seem a bit bearish on this Zacks Rank #3 (Hold) company, with the Zacks Consensus Estimate for SBAC's 2024 funds from operations per share moving marginally south in the past two months to $13.22.

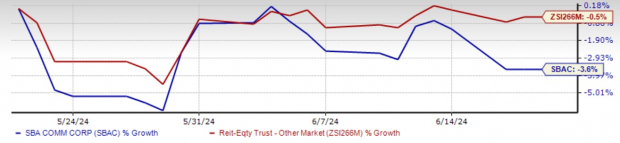

The company's shares have declined 3.6% in the past month compared with the industry's fall of 0.5%.

Image Source: Zacks Investment Research

Note: Anything related to earnings presented in this write-up represents funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.