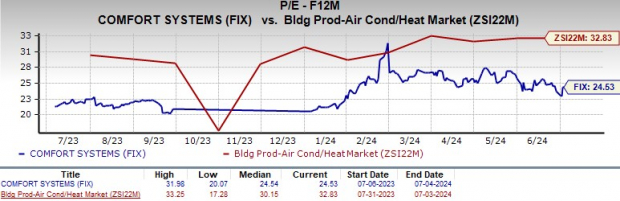

Comfort Systems USA, Inc. FIX shares soared 51.6% year to date (YTD), outperforming the Zacks Building Products - Air Conditioner and Heating industry's 18.2% growth. The stock even fared better than the broader Construction sector's 3% rise. This leading provider of commercial, industrial, and institutional heating, ventilation, air conditioning, and electrical contracting services has been benefiting from sustained demand for its offerings and a solid backlog. Innovation remains at the forefront of its operations. Strong market conditions in the technology and manufacturing sectors, combined with FIX's robust project pipeline, provide a solid foundation for future performance.

The first quarter of 2024 brought impressive financial performance for Comfort Systems USA, marking it as a strong contender in the HVAC and mechanical services market. Earnings per share increased from the first quarter of 2023 by over a dollar. Its backlog saw a notable increase and generated more than $140 million in cash flow. The Mechanical business experienced significant improvement, and profitability in the Electrical segment reached unprecedented levels. Construction and service sectors continued to flourish, with sustained demand bolstering growth.

EBITDA nearly doubled to $170 million in the first quarter, a substantial increase from $90 million a year ago, with same-store EBITDA growing more than 70%. The company anticipates maintaining strong EBITDA margins throughout 2024, potentially matching or exceeding 2023 levels. Operating income also saw a significant boost in the quarter, with the operating margin increasing to 8.8% from 6.0% in the prior year, driven by improved gross profit margins and favorable SG&A leverage.

Stock Performance

Image Source: Zacks Investment Research

Factors Supporting Growth

Sustained Demand From Technology & Manufacturing Sectors

Having historically grown through organic means as well as acquisitions of numerous peers and competitors, Comfort Systems USA provides mechanical and electrical contracting services. The company's first-quarter revenues reported 31% year-over-year growth, attributable to a 23% rise in same-store revenues and an additional $96 million from acquisitions. Mechanical segment revenues (which accounted for 77.2% of its quarterly total revenues) soared 29%, while the Electrical segment (22.9% of its total revenues) witnessed a remarkable 37% increase. The company attributed part of this growth to less seasonality, with more projects in warmer climates.

Notably, the solid same-store activity reflects strong market conditions and robust demand across key sectors. Notably, the technology and manufacturing sectors, including data centers, chip plants, food, and pharmaceuticals, have been pivotal in driving this growth.

Inorganic Efforts

Acquisitions have been instrumental in propelling Comfort Systems USA's growth over the years. These strategic moves have not only broadened FIX's operational scope but have also integrated seamlessly to enhance revenue streams. For the past 16 years, the company has devoted an average of 75% of its capital to acquisitions.

On Feb 1, 2024, FIX acquired Summit Industrial Construction, LLC, and J & S Mechanical Contractors, Inc. within its mechanical segment. These recent acquisitions, along with those in 2023, including DECCO and Eldeco, collectively contributed approximately 8.1% to Comfort Systems USA's revenue growth in the first quarter of 2024.

Solid Backlog Level

A critical factor supporting FIX's sustained growth is its solid backlog, which reached a record $5.9 billion at the end of the first quarter. This represents a significant increase of $1.5 billion, or 33%, compared to last year. The backlog growth is balanced between same-store growth and contributions from acquisitions, underscoring the company's robust pipeline. The sequential backlog increased $754 million, with $612 million from acquisitions and $142 million from same-store activity. This indicates a consistent and strong pipeline of projects, ensuring future revenue streams. The backlog's composition aligns with high-demand areas such as data centers, chip fabrication, battery plants, life sciences, and food. This strategic focus positions FIX well to capitalize on sector-specific growth trends.

Solid Liquidity & Dividend

Comfort Systems USA is a financially robust company, holding $100.8 million in cash and carrying $89.9 million in debt as of Mar 31, 2024. This positions the company to potentially repay all its debt immediately, leaving $10.9 million in cash on hand. With this strong net cash position, Comfort Systems USA has the flexibility to pursue additional debt, distribute capital to shareholders, or pursue growth opportunities.

The company has effectively managed its cash flow, benefiting from advanced payments for future work. Operating cash flow has exceeded earnings by approximately $300 million on a trailing 12-month basis, allowing the company to invest in growth and acquisitions while reducing interest costs. Despite large cash payments for recent acquisitions, total debt stood at $90 million, with no funded debt from banks as of Mar 31, 2024.

Over the past 16 years, Comfort Systems USA has consistently allocated an average of 11% of its capital toward dividend payments to shareholders. Supported by steady free cash flow and a resilient balance sheet, the company has increased its dividend payout for the past 12 consecutive years, underscoring its commitment to shareholder rewards.

FIX is currently paying an annual cash dividend of $1.20 per share, which translates to a payout ratio of around 10%.

Stock Valuation

FIX's stock is currently undervalued compared to its industry, as shown in the chart below. Despite the company's shares' outperformance compared to its industry, FIX's current valuation is still considered undervalued. This might imply that the market has not yet fully recognized or priced in the company's potential growth prospects or earnings potential. The company is also trading currently at a discount compared to other industry players like Watsco, Inc. WSO and AAON, Inc. AAON but premium to EMCOR Group, Inc. EME.

Again, FIX's trailing 12-month return on equity (ROE) of 28.6% is better than its peer group average of 22.1%.

Image Source: Zacks Investment Research

What's Hindering the Stock?

Tough Comparisons

While the company's performance remains promising, FIX faces tougher prior-year comparable results for the remainder of 2024. Gross margin is expected to remain strong, although it may fluctuate due to amortization and purchase-related adjustments.

Cash Flow Headwind

FIX has experienced some positive momentum in the first quarter, especially with advanced payments for upcoming work. However, the normalization of pre-bookings and equipment advances could pose cash flow challenges in the future. Keeping an eye on how the company manages these transitions will be crucial.

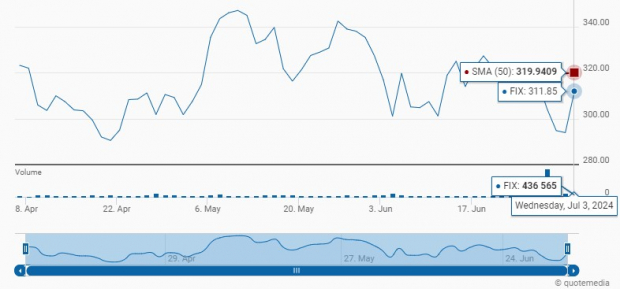

FIX Trading Below 50-Day Moving Average

Comfort Systems USA's shares are currently trading well below the 50-day moving average from June-end. As of Jul 3, 2024, the stock closed at $311.85, which is below its 52-week high of $352.45 but significantly above its 52-week low of $151.89.

FIX Price Movement vs 50-Day Moving Average

Image Source: Zacks Investment Research

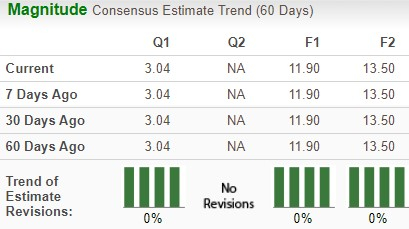

FIX Estimate Movement

The Zacks Consensus Estimate for 2024 EPS has remained unchanged over the past 60 days. This depicts that there is limited upside potential for the stock as of now. Yet, the estimated figure indicates 36.2% year-over-year growth for 2024. FIX delivered a trailing four-quarter earnings surprise of 20%, on average.

Image Source: Zacks Investment Research

Investment Thoughts

The company's resilient same-store activity, strategic acquisitions, record backlog, strategic cash management, impressive valuation and solid returns provide a solid foundation.

However, caution is warranted due to the challenges ahead, including tougher year-over-year comparisons and potential cash flow headwinds as pre-bookings normalize. Existing stakeholders should maintain their position in this Zacks Rank #3 (Hold) stock, while potential new investors may wait for more clarity on how FIX manages these pressures and navigates the broader economic environment before making new investment decisions.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.