PepsiCo, Inc. PEP has reported robust second-quarter 2024 results, wherein earnings surpassed the Zacks Consensus Estimate, while revenues lagged. However, the top and bottom lines improved year over year. The company's results have mainly been aided by improvements in its international business, which delivered significant volume growth and organic revenue growth of 5.5% year over year. The international business also reported 10% core operating profit growth and strong core operating margin expansion.

The results also reflect gains from strength and resilience in its categories, diversified portfolio, modernized supply chain, improved digital capabilities, flexible go-to-market distribution systems and robust consumer demand trends.

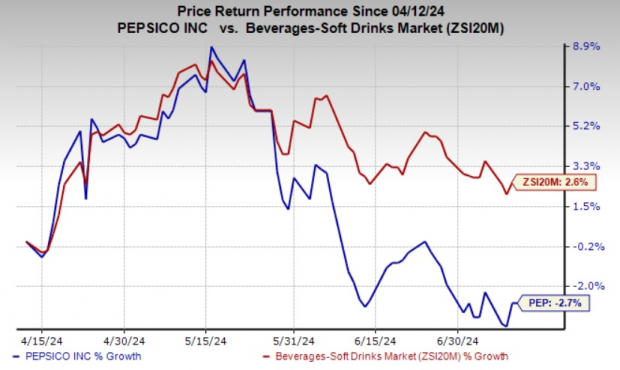

Shares of PepsiCo declined 1.9% in the pre-market session on Jul 11, as results have continued to be impacted by QFNA's recall-related headwinds and soft performance at the North America convenient foods businesses. Shares of the Zacks Rank #3 (Hold) company have declined 2.7% in the past three months against the industry's 2.6% growth.

Image Source: Zacks Investment Research

Quarter in Detail

PepsiCo's second-quarter core EPS of $2.28 beat the Zacks Consensus Estimate of $2.15 and increased 9% year over year. In constant currency, core earnings improved 10% from the year-ago period. The company's reported EPS of $2.23 rose 13% year over year in the quarter. Foreign currency impacted EPS by 1%.

Net revenues of $22.5 million rose 0.8% year over year but missed the Zacks Consensus Estimate of $22.6 billion. Revenues were negatively impacted by subdued category demand within its North America convenient foods businesses. Unit volume was down 2% for the convenient food business and was flat for the beverage business. Foreign currency impacted revenues by 1%.

On an organic basis, revenues grew 1.9% year over year, significantly below organic revenue growth of 13% in second-quarter 2023. The variance mainly resulted from a soft QFNA performance, which was impacted by certain product recalls. The QFNA segment revenues reduced organic revenue growth by 60 basis points (bps) in second-quarter 2024.

Segmental Details

The company witnessed revenue growth on a reported basis across most of the operating segments, except for QFNA, FLNA and APAC. Revenues in the QFNA segment were impacted by certain product recalls and tough revenue growth comparisons with the prior year. FLNA revenues were partly marred by subdued category demand in the convenient foods business.

Revenues on a reported basis improved 1% year over year in PBNA, 7% in Latin America, 2.5% in Europe, and 2% in the AMESA segment. However, reported revenues declined 0.5% at FLNA, 18% at QFNA and 2% at the APAC segment.

PEP's organic revenues improved across all operating segments, except for QFNA. Organic revenues were flat for FLNA, and rose 1% for PBNA, 2% for Latin America, 7% for Europe, 12% for AMESA and 1% for the APAC segment. However, organic revenues declined 18% for the QFNA segment.

Financials

The company ended second-quarter 2024 with cash and cash equivalents of $6.4 billion, long-term debt of $36.6 billion, and shareholders' equity (excluding non-controlling interest) of $19.4 billion.

Net cash used in operating activities was $1.3 billion as of Jun 15, 2024, compared with $2 billion as of Jun 17, 2023.

Outlook

PepsiCo has revised its view for 2024. The company expects year-over-year organic revenue growth of 4% for 2024, compared with the prior view of at least 4%. It anticipates core constant-currency EPS growth of at least 8% from the year-ago period's reported figure.

Based on the current rates, PEP expects currency headwinds to hurt revenues and the core EPS by 1 percentage point in 2024. The company expects a core effective tax rate of 20% for 2024.

Given the above assumption, PepsiCo expects a core EPS of at least $8.15 for 2024. This suggests a 7% increase from the core EPS of $7.62 reported in 2023.

PepsiCo has been committed to rewarding shareholders through dividends and share buybacks. It expects to return a value worth $8.2 billion in 2024, including $7.2 billion of dividends. Additionally, the company plans to repurchase shares worth $1 billion in 2024.

Don't Miss These Better-Ranked Stocks

We have highlighted three better-ranked stocks from the Consumer Staple sector, namely Vita Coco Company COCO, Coca-Cola FEMSA KOF and J & J Snack Foods JJSF.

Vita Coco currently flaunts a Zacks Rank #1 (Strong Buy). COCO shares have rallied 20.4% in the past three months. The company has a trailing four-quarter earnings surprise of 25.3%, on average.

The Zacks Consensus Estimate for Vita Coco's current financial-year sales and earnings suggests growth of 3.5% and 40.5%, respectively, from the year-ago period's reported figures.

Coca-Cola FEMSA currently has a Zacks Rank #2 (Buy). KOF shares have declined 12.3% in the past three months.

The Zacks Consensus Estimate for Coca-Cola FEMSA's current financial-year sales and EPS suggests growth of 11.9% and 26.7%, respectively, from the year-ago period's reported figures. KOF has a trailing four-quarter negative earnings surprise of 1.3%, on average.

J & J Snack currently carries a Zacks Rank #2. JJSF shares have gained 24.2% in the past three months. JJSF has a trailing four-quarter earnings surprise of 5.7%, on average.

The Zacks Consensus Estimate for J & J Snack's current financial-year sales and earnings suggests growth of 1.6% and 17.6%, respectively, from the year-ago period's reported figures.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.