Zinger Key Points

- Negative Coinbase Premium Index indicates decreasing demand from US investors for Bitcoin.

- "2009 is to Millennials what 1982 was to Boomers," highlighting Bitcoin's evolving investment status.

- Get real-time earnings alerts before the market moves and access expert analysis that uncovers hidden opportunities in the post-earnings chaos.

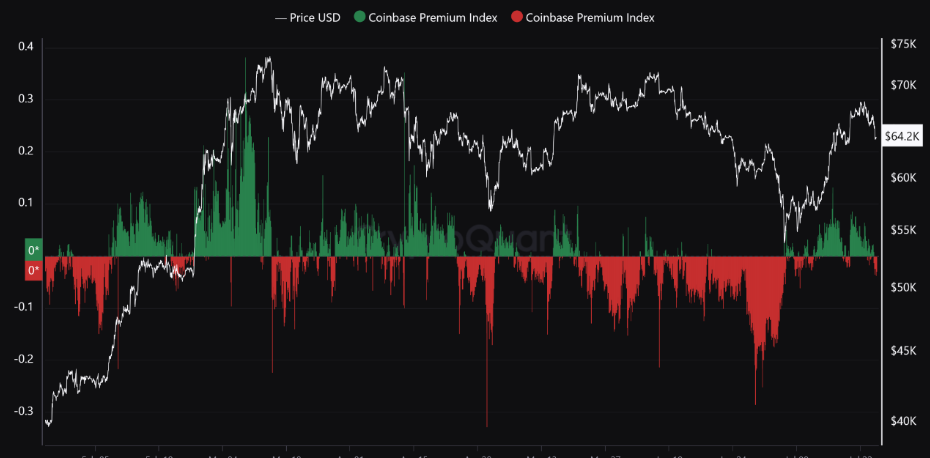

The Bitcoin BTC/USD Coinbase Premium Index has turned negative, signaling a decrease in demand from U.S. investors.

What Happened: Crypto analytics firm CryptoQuant reported the negative turn in the Coinbase Premium Index.

This index measures the percentage difference between Bitcoin prices on Coinbase Pro (USD pair) and Binance (USDT pair).

A positive premium typically indicates strong buying pressure from U.S. investors on Coinbase, while a negative value suggests waning interest.

The shift in U.S. investor sentiment coincides with a broader market downturn. Bitcoin, the world’s largest cryptocurrency by market capitalization, experienced a nearly 3.5% drop since midnight UTC, trading around $64,000.

Ethereum ETH/USD saw an even steeper decline of over 8%, pulling the wider altcoin market down with it.

This cryptocurrency market downturn is occurring against a backdrop of global economic concerns.

China’s second interest rate cut in a week has sparked worries about instability in the world’s second-largest economy.

As a result, major European stock indices, including Germany’s DAX, France’s CAC and the eurozone’s Euro Stoxx 50, all fell by over 1.5%. In the U.S., futures tied to the tech-heavy Nasdaq 100 were slightly lower following the index’s 3% slide on Wednesday.

Why It Matters: Despite the current market volatility, some analysts maintain a long-term bullish outlook on Bitcoin and the broader cryptocurrency market.

Jamie Coutts, Chief Crypto Analyst at Real Vision, drew parallels between Bitcoin’s current trajectory and the early days of the NASDAQ:

“2009 is to Millennials what 1982 was to Boomers,” Coutts stated. “The NASDAQ launched in the 1970s but wasn’t considered a serious investment venue until the mid-1980s or early ’90s. Since then, it has outperformed all other markets.”

Coutts argues that Bitcoin, launched in 2009, is entering its “mainstream moment” after a decade of skepticism.

He views investing in Bitcoin as a “low-risk way to hedge against accelerating debasement,” while considering the broader blockchain asset class as “a bet on the secular trend of technological adoption.”

However, Coutts also emphasized the distinction between Bitcoin and other cryptocurrencies, noting they are “two very different assets with distinct risk profiles.”

He advises investors to “size accordingly” but also to “zoom out,” suggesting that the current market conditions are part of a larger, ongoing secular bull market in the crypto space.

What’s Next: For those interested in further exploring the evolving landscape of digital assets and their integration into mainstream finance, Benzinga’s Future of Digital Assets event on Nov. 19 offers a timely platform for discussion and insight.

Read Next:

Image: Shutterstock

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.