We hit earnings season and with the Magnificent 7 priced for perfection, it was going to take “perfect” earnings reports to keep the market from falling. $GOOG GOOG and $TSLA TSLA showed some weakness and for the second straight week, tech leads the stock market lower. Coursera COUR beats earnings and positions itself as an AI play causing the stock to rise almost 45% on Friday. Las Vegas Sands $LVS LVS slides on a temporary non-problem. We explain the situation. We get a strong GDP print and a higher-than-expected PCE. Many are saying the Fed will absolutely 100% cut rates in September. I think that’s possible, but not nearly the certain outcome the market expects. Finally, Alex attends the Bitcoin BTC/USD conference and receives a warm welcome.

This week, we’ll address the following topics:

-

Coursera $COUR earnings better than expected. Stock up huge. New AI play?

-

Las Vegas Sands $LVS reports earnings and I disagree with the market reaction.

-

The Magnificent Seven – not again!

-

GDP comes in strong. Does that affect the probability of rate cuts?

-

PCE comes in slightly high. Does that affect the probability of rate cuts?

-

DKI Intern, Alex Petrou, attends the Bitcoin Conference and meets friendly and knowledgeable Bitcoin celebrities.

Ready for another week of better earnings and higher inflation? Let’s dive in:

-

Coursera Enrolls 2MM in AI Courses – Market Thrilled:

Coursera has been a frustrating stock at DKI. Initial skepticism centered around the expected loss of the Covid-lockdown business when many people took courses after they had watched everything available on Netflix NFLX. Instead, the company kept that huge new base and continued to grow rapidly. Later, a slowing growth rate and poor results from competitor 2U TWOU and non-competitor Chegg CHGG crushed the stock. Last week, Coursera announced revenue and earnings that beat expectations and enrolled 2MM new students into a variety of generative AI courses. 2U declared bankruptcy highlighting the difference between their poor business model and Coursera’s more learner-friendly one.

Many thought AI was a threat to Coursera’s business. Teaching others how to use it is a source of growth. Slide from company presentation.

DKI Takeaway: Last quarter, $COUR warned about weaker growth due to delays some tech companies had in completing new certificate courses. With new AI-related courses from the mega-cap tech firms, these late arrivals are now a source of new growth. Revenue of $170MM beat prior guidance of $164MM at the midpoint and beat analyst estimates of $164MM. EPS of $.09 was above analyst estimates of $.01. The company completed a $95MM stock buyback retiring almost 3MM shares in the quarter. In order to keep full-year guidance unchanged, 3Q revenue guidance was $6MM below expectations. Given that’s the identical amount of the 2Q beat, I think it’s likely management took advantage of the opportunity to issue conservative guidance. The market liked what it saw, and as I write this, the stock is up 45% from yesterday’s close. More details on the company and industry for subscribers here and here.

-

I Disagree with the Market on Las Vegas Sands Earnings:

Las Vegas Sands $LVS has been trading down on concerns regarding the Chinese economy as well as expectations of lower property level EBITDA in Macau. While China is facing its share of economic difficulties, mass and premium mass visitation in Macau are at/above pre-Covid levels. Similar to when the US relaxed its stay-at-home regulations, the Chinese gambler has a lot of pent-up bankroll and a desire to travel and return to prior fun activities. Two Macau properties had sequential declines in revenue. Part of that is explained by normal seasonality. Most of it is explained by a large number of rooms temporarily out of service due to renovations. Gaming resorts take a lot of hard use and also need to appear luxurious. Regular renovations are a normal and important part of the business. The rooms currently out of service will come back in better shape and with higher-than-average room rates.

Continued recovery in Macau. Record results in Singapore. Slide from Sands presentation.

DKI Takeaway: I think actual results support my view on the company. Despite around 1,500 rooms out of service for renovations, Macau EBITDA was up from $541MM a year ago to $561MM this year. That’s only going to improve when the newly renovated rooms are complete in the next six months. Singapore continues to post record results with $512MM in EBITDA. That’s the best 2Q I’ve seen in my quarterly model going back to 2016. $LVS restarted the dividend a couple of quarters ago and has been buying back huge amounts of stock. Between dividends and stock buybacks, the company has returned almost $1.2B of capital to shareholders so far this year. With Macau recovering, Singapore at record highs, and the current disruption being both temporary and planned, I think the market is too pessimistic on Sands.

-

The Magnificent Seven’s Magnificent Tumble:

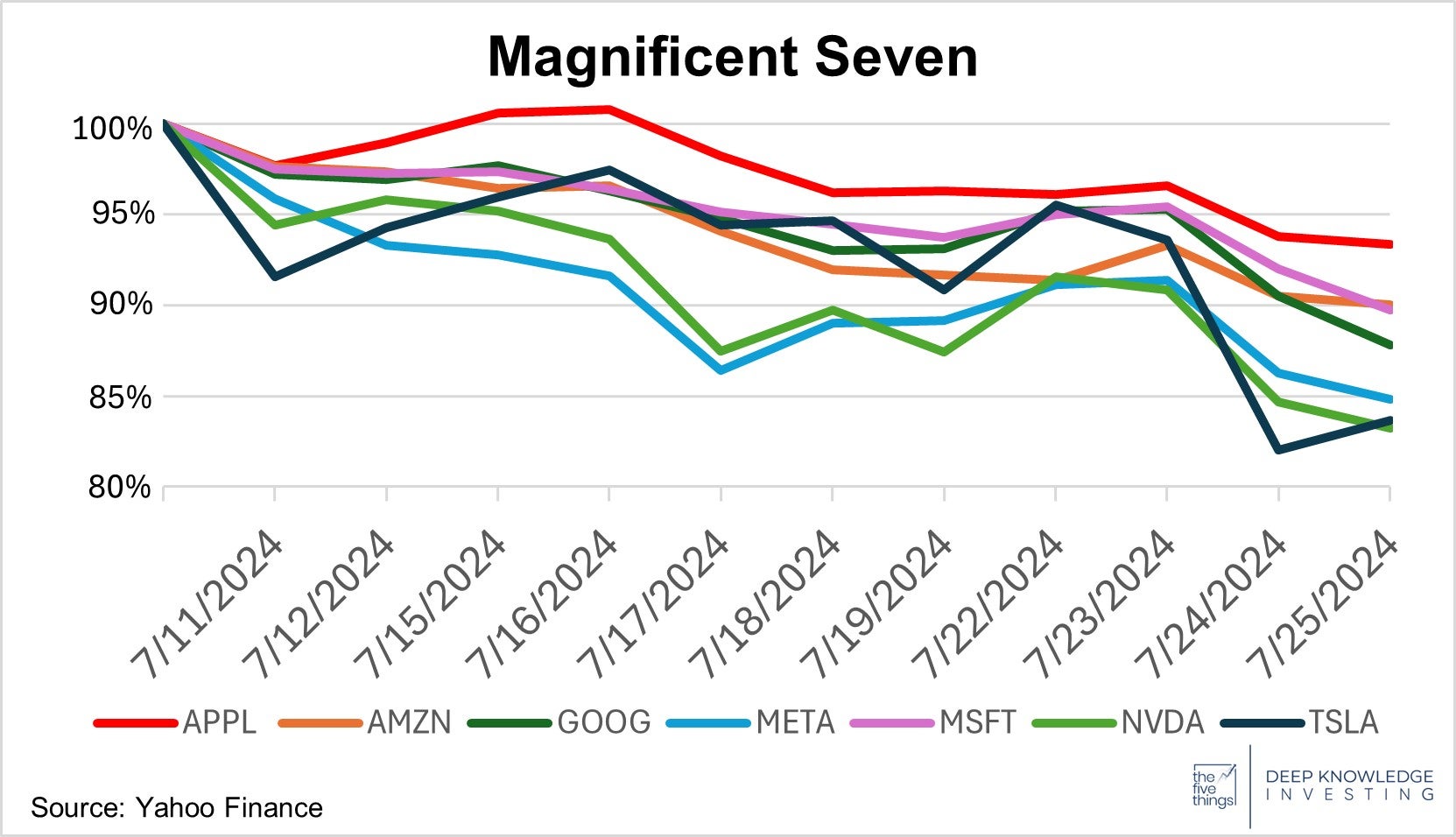

Last week, the decline in the Magnificent 7’s (Mag 7) mega-cap sector was primarily driven by macroeconomic conditions and political factors. This week, the Mag 7 experienced further declines following disappointing earnings reports. Alphabet $GOOG, Google’s parent company, missed estimates for YouTube’s advertising revenue, leading to a drop in its stock price. Tesla $TSLA reported lower-than-expected earnings and a 45% decline in profits. Verizon $VZ, not part of the Mag 7, reported earnings below estimates, with a significant loss of 624,000 pay-as-you-go plans. This decline is particularly notable as it coincides with the drying up of stimulus funds from the Affordable Connectivity Program (ACP), a stimulus initiative aimed at assisting low-income households, which ended in April. DKI has been writing consistently about government spending on consumption.

$NVDA, $TSLA, and $META all down 15%+ in two weeks.

DKI Takeaway: The Verizon earnings highlight how dependent our economy is on governmental stimulus spending. While artificial intelligence excitement has fueled a market boom, some of the high-performing mega cap tech companies were priced for perfection. $GOOG earnings weren’t bad. It just doesn’t take a lot of disappointment right now to cause stock price declines. On last week’s 5 Things video version, I expressed concern about declining unit sales at Apple $APPL. Nvidia’s $NVDA earnings report next week will provide the market a lot of direction about current AI expectations. This is also your regular reminder that massive numbers of Nvidia GPUs will require massive amounts of electricity. Do you own enough power generation and uranium in your portfolio?

- High GDP and Rate Cuts?:

Second quarter GDP came in at 2.8%. That’s both a healthy number and much higher than the 2.0% estimate. Does that mean we have a healthy economy? DKI has been emphasizing for a year and a half that we have a bifurcated economy. The private sector and many Americans are struggling. Private market job growth is nonexistent and people are having difficulty affording food, gas, and insurance. The government has been spraying trillions of dollars of inflation-causing consumption-focused stimulus into the economy which is the reason for this better-than-expected GDP print. Almost all job growth is coming in government positions or in industries funded by government. This spending is also causing inflation.

It’s a decent quarter, but so much of that is debt-funded govt. spending.

DKI Takeaway: The market is still assuming a near-100% probability of a September rate cut. While I acknowledge the Fed may choose to cut rates then, I continue to believe the probability of a rate cut that soon remains well under 100%. Many smart people, including economist and DKI Board Member, Michael “Mish” Shedlock @MishGEA, correctly point out that the private sector of the economy indicates we’re already in a recession. I agree with Mish. Most Americans aren’t doing well financially. However, Congressional stimulus overspending is leading to high GDP growth and continued inflation. That could cause the Fed to move more slowly than the market hopes and expects. This potential action will cause many in Congress to complain, but they’re not even considering cutting spending and have no one to blame but themselves.

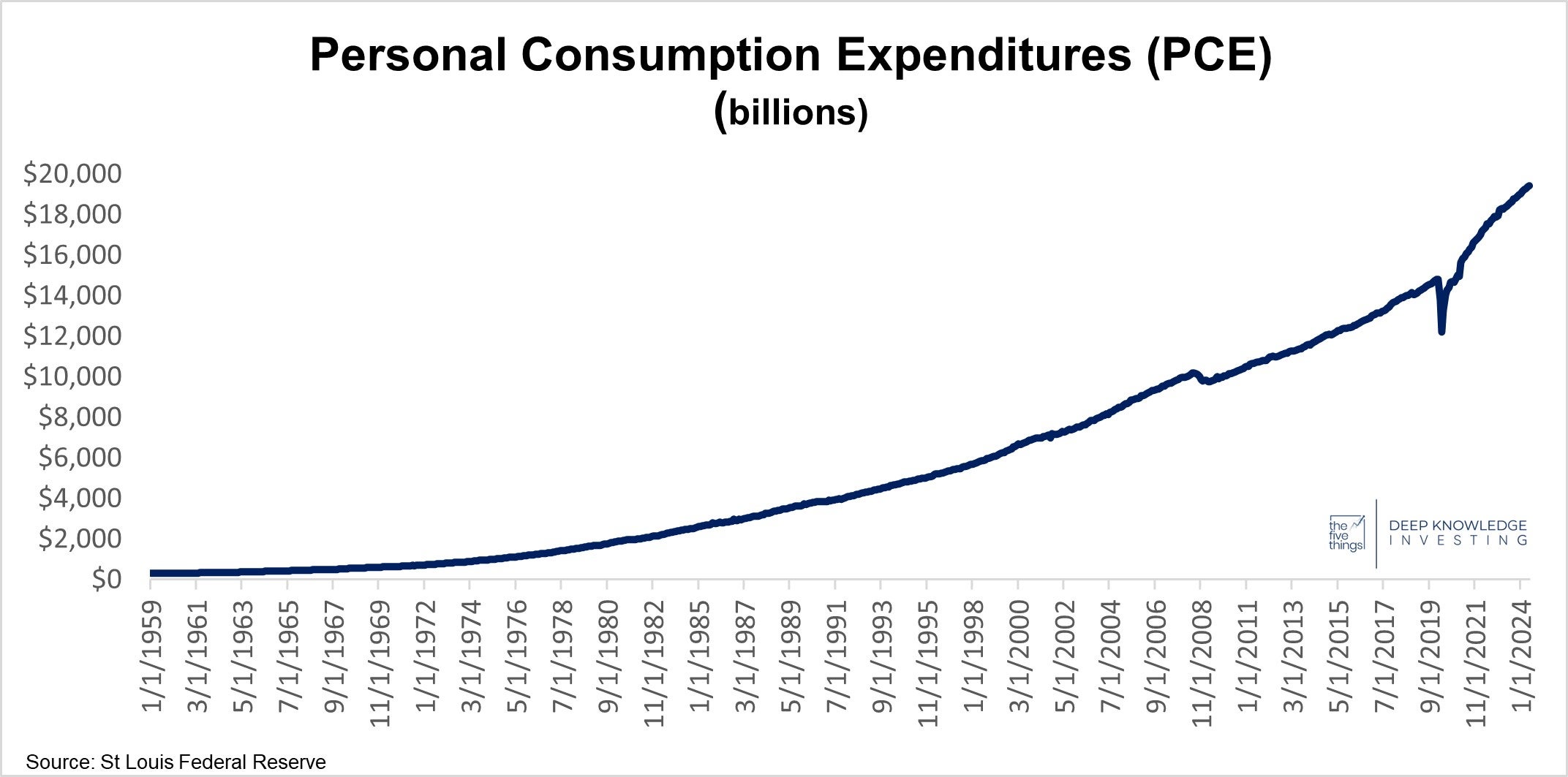

- The PCE Comes in Slightly Higher than Expected:

Friday’s PCE report came in a little higher than expected. PCE stands for Personal Consumption Expenditures and it’s the preferred inflation metric used by the Fed. The annual increase of 2.5% was down 0.1% from last month and was above expectations for 2.4%. The Core PCE, which excludes food and energy, was flat at 2.6%. That was also above expectations of 2.5%. the report shows a continuation of prior trends with income rising slightly slower than inflation. Again, goods pricing was down a bit while sticky services prices were up 3.9% vs last year. The report also says food prices are up 1.4% vs last year. Is your grocery bill up only 1% this year?

Not a disaster, but also not declining as quickly as hoped.

To the economists who think Americans should be more grateful for disinflation: This is why people are upset about price levels.

DKI Takeaway: As of now, the market is still saying there’s an almost 100% probability of a September rate cut. That could happen, but I think the probability of that is below 100% for four reasons; continued inflation above 2%, aggregate GDP numbers that are still strong due to massive government stimulus spending that’s causing inflation, market participants have been predicting rate cuts for over two years and have been wrong (it’s not a predictive metric), and when the market is assigning a 100% probability of something, it’s easy to take the under. Higher for longer (probably!).

- Alex Goes to the Bitcoin Conference – Meets People:

DKI Intern, Alex Petrou, made his first trip to the US this week, and due to a fire in the JFK (New York) airport, had an unexpected layover. Fortunately, I live nearby and had the opportunity to host Alex on Wednesday night. He was up at 4:30am on Thursday and made his flight to Nashville where he connected with @Peruvian_Bull (PB). I’m a fan of PB’s work, and Alex interned for him last year. At the conference, Alex attended a panel including PB, Dylan LeClair, known for his role in MetaPlanets’ Bitcoin strategy, and Allen Farrington, a writer from Scotland. One of these luminaries helped get Alex’s conference pass upgraded, and he was able to check out everything from new cold storage solutions to Bitcoin hot sauce stands. I understand cold storage, but am mystified regarding the concept of Bitcoin hot sauce. Many of you may feel the opposite. At these exhibits, Alex met Davinci Jeremie who publicly suggested people put at least a very small amount of their assets in Bitcoin – 11 years ago!

DKI Takeaway: I believe Alex is DKI’s 9th Intern. In many ways, learning to invest is much easier now than it was when I was in college. There are videos, presentations, an active Fin-X community, and incredible access to the detailed thinking of top money managers and economists. Each one of these young people has spent hundreds of hours in their free time to educate themselves and learn about investing outside of their classrooms. They have drive and integrity. They expect to work for everything they receive. Every one of them has graduated with a real job in finance and I’m proud of each of them. Alex and Andrew Brown both have an advanced understanding of the problems inherent in fiat currency and understand how more government control of our money leads to inflation, lower living standards, and reduced freedom. I’m thrilled to see Alex at the Bitcoin conference connecting with and learning from other Bitcoiners. It wouldn’t surprise me to see him become a speaker there one day. A note of appreciation from DKI to @Peruvian_Bull, Dylan LeClair, Allen Farrington, and Davinci Jeremie for warmly welcoming and educating those who came after them. I’m writing this on Saturday morning and many expect President Trump to announce a Bitcoin Strategic Reserve should he win the election in November. My home state of Michigan just announced it has $6.6MM of Bitcoin in its pension funds. I think we’re going to see more of these announcements in the next few years. DKI’s response: hodl.

Information contained in this report, and in each of its reports, is believed by Deep Knowledge Investing (“DKI”) to be accurate and/or derived from sources which it believes to be reliable; however, such information is presented without warranty of any kind, whether express or implied. DKI makes no representation as to the completeness, timeliness, accuracy or soundness of the information and opinions contained therein or regarding any results that may be obtained from their use. The information and opinions contained in this report and in each of our reports and all other DKI Services shall not obligate DKI to provide updated or similar information in the future, except to the extent it is required by law to do so.

The information we provide in this and in each of our reports, is publicly available. This report and each of our reports are neither an offer nor a solicitation to buy or sell securities. All expressions of opinion in this and in each of our reports are precisely that. Our opinions are subject to change, which DKI may not convey. DKI, affiliates of DKI or its principal or others associated with DKI may have, taken or sold, or may in the future take or sell positions in securities of companies about which we write, without disclosing any such transactions.

None of the information we provide or the opinions we express, including those in this report, or in any of our reports, are advice of any kind, including, without limitation, advice that investment in a company’s securities is prudent or suitable for any investor. In making any investment decision, each investor should consult with and rely on his or its own investigation, due diligence and the recommendations of investment professionals whom the investor has engaged for that purpose.

In no event shall DKI be liable, based on this or any of its reports, or on any information or opinions DKI expresses or provides for any losses or damages of any kind or nature including, without limitation, costs, liabilities, trading losses, expenses (including, without limitation, attorneys’ fees), direct, indirect, punitive, incidental, special or consequential damages.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.