Just because something happened a bunch of times in the past doesn’t mean it must happen again in the future.

This is what Fed Chair Jerome Powell communicated when asked about the “Sahm Rule” recession indicator, which has revealed that recessions historically started when the three-month moving average of the unemployment rate rose 0.5 percentage points or more above its 12-month low.

“A statistical regularity is what I call it,” Powell said on Wednesday. “It's not like an economic rule, where it's telling you something must happen.”

Claudia Sahm, the economist whom the indicator is named after, would agree.

“Indicators of economic downturns like the Sahm rule are empirical regularities from the past, not laws of nature,” Sahm wrote last November.

On Friday, we learned that the unemployment rate rose to 4.3% in July. This caused the three-month moving average of the unemployment rate to breach that 0.5 percentage point threshold for the first time in this economic cycle.

Sahm has been arguing that her namesake indicator triggering could be a false positive due lingering pandemic-related economic distortions.

“The Sahm rule is likely overstating the labor market's weakening due to unusual shifts in labor supply caused by the pandemic and immigration,” Sahm recently said.

The Economy Is More Than A Few Metrics

All of this speaks to TKer’s Rule No. 1 of analyzing the economy: Don’t count on the signal of a single metric.

It’s a lesson that’s been learned following false positive recession signals from the yield curve and the Conference Board’s Leading Economic Index.

The economy is complex with countless numbers of moving parts, and sometimes some of those parts will be behaving so abnormally that it will force time-tested indicators to break down.

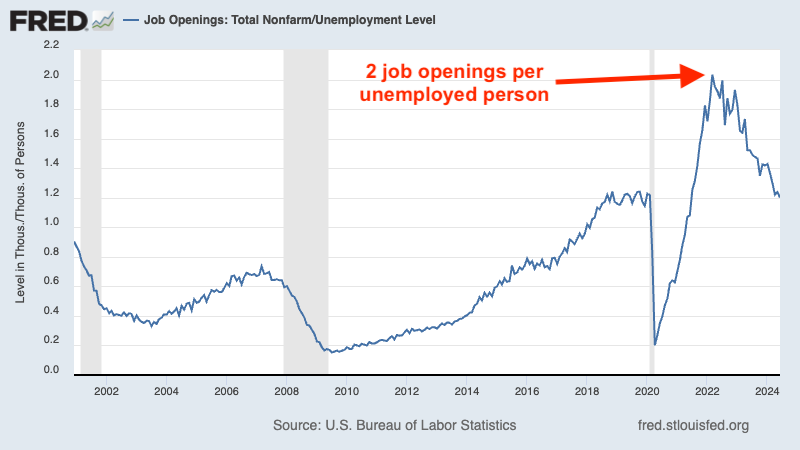

For example, the current economic cycle has come with an unusually high number of job openings: a sign of abnormally strong demand. At its peak in March 2022, there was an unprecedented two job openings per unemployed person.

The economic recovery came with unprecedented demand for labor. FRED

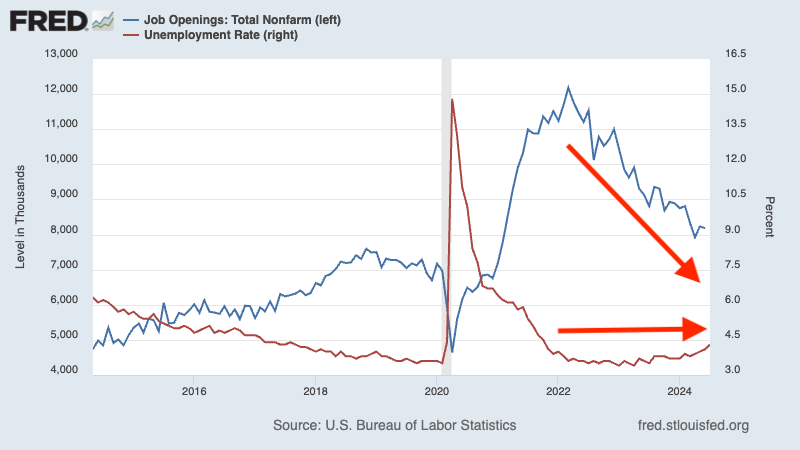

Over the past two years, this excess demand for jobs had people controversially believing that it would be possible to bring down inflation without a large rise in unemployment. Because, basically it was those extra job listings that were emboldening workers to press for higher pay, and employers obliged because of booming demand. All the Fed had to do was cool the economy just enough that demand would come down just enough for employers to take down those job listings, the argument went, which in turn would help inflation to come down.

This challenged the traditional understanding that falling job openings comes with higher unemployment — a relationship illustrated by the Beveridge curve — and that higher unemployment is needed to bring inflation down — a relationship illustrated by the Phillips curve.

As the chart below shows, it has indeed been possible to bring down those job openings without a commensurate jump in unemployment.

This key relationship in the labor has evolved favorably, with job openings falling and unemployment mostly moving sideways. (Source: FRED via TKer)

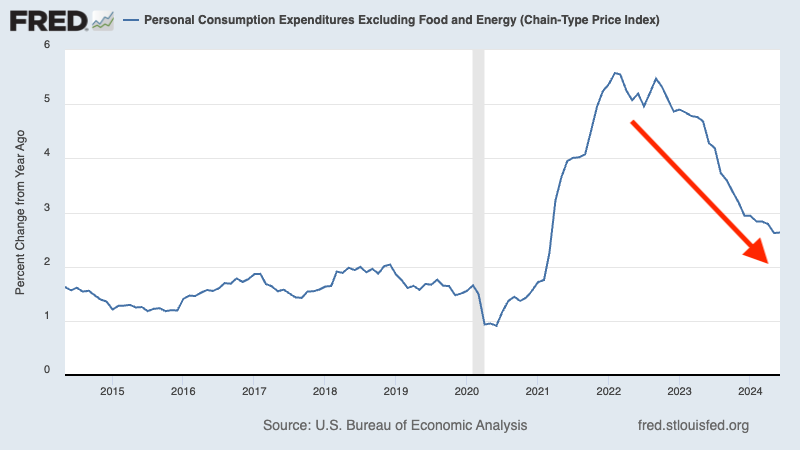

Meanwhile, we also got that drop in inflation.

The Fed’s preferred measure of inflation has come down significantly from crisis levels. FRED

This is not to say that the Sahm rule, the Beveridge curve, and the Phllips curve are all useless.

The takeaway here is to remember that the economy is complex, and we should keep an eye out for developments that may challenge what have been statistical regularities.

But Make No Mistake: The Labor Market Is Cooling

Just because popular recession indicators are sending false positives doesn’t mean the risk of recession isn’t elevated and that the economy isn’t cooling.

On the contrary, economic activity growth has been decelerating significantly, with labor market metrics normalizing.

This week we’ve learned that job creation continues to cool, the unemployment rate rose to its highest level since October 2021, and the ratio of job openings to unemployed people fell to a three-year low. The quits rate is also down, initial claims for unemployment insurance are up, wage growth is cooling, and labor market confidence is down. And manufacturers expect further deceleration in hiring.

Broadly speaking, the economy has been looking a lot less “coiled,” with many signs of excess demand fading.

All this puts increasing amounts of pressure on the Federal Reserve to loosen monetary policy to help the economy avoid recession.

While recession may not be the baseline scenario, it’s prudent to remember that they are normal and they can be rough for stocks in the near-term.

A version of this post was originally published on Tker.co.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.