Zinger Key Points

- Coatue Management increased its stake in Nvidia by 893% in Q2, now holding 13.75 million shares.

- Nvidia now represents 6.61% of Coatue's portfolio, signaling strong confidence in the chipmaker's growth potential.

- Join Chris Capre on Sunday at 1 PM ET to learn the short-term trading strategy built for chaotic, tariff-driven markets—and how to spot fast-moving setups in real time.

In a move that solidifies its bullish stance on Nvidia Corp NVDA, legendary hedge fund Coatue Management LLC, led by Philippe Laffont, has dramatically increased its position in the chip giant.

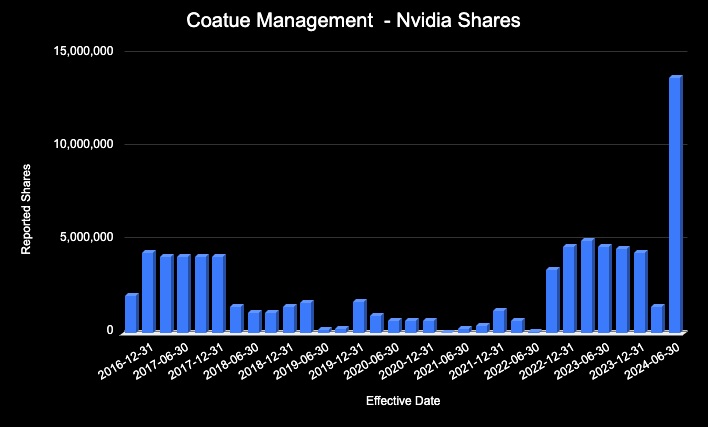

According to the latest 13F filings, Coatue boosted its stake in Nvidia by an eye-popping 893% during the second quarter of 2024. This substantial increase, from 1.39 million shares at the end of Q1 to a whopping 13.75 million shares by the end of Q2, underscores the fund’s aggressive confidence in Nvidia’s future prospects.

Chart created by author using data from SEC 13F filings

Coatue's Mega-Buy: What's Behind The Move?

Coatue's massive stock purchase comes on the heels of Nvidia’s continued dominance in the semiconductor industry, particularly in areas like artificial intelligence and high-performance computing. The firm’s decision to nearly tenfold its stake, with an investment now valued at approximately $1.7 billion, is a bold testament to the belief that Nvidia’s growth trajectory is far from slowing down.

From Doubts To Dominance

Interestingly, Coatue had previously reduced its Nvidia holdings in earlier quarters, only to make a stunning reversal this time around. The dramatic shift from holding 1.39 million shares to 13.75 million shares marks one of the most significant strategic pivots for the fund in recent memory. The question now is whether this massive bet will pay off as Nvidia continues to ride the wave of AI and gaming demand.

Read Also: Nvidia’s Rebound Rally Adds Billions To Market Value, Analysts Eye AI Growth: Report

A Historic Move For Coatue

This isn’t just any increase; it’s a historic one for Coatue. The 893% jump in ownership highlights the hedge fund’s aggressive confidence in Nvidia’s market leadership. With Nvidia being one of the primary beneficiaries of the AI boom, Coatue’s move is clearly driven by expectations of sustained, long-term growth in the sector.

Nvidia: The Crown Jewel In Coatue's Portfolio?

With this move, Nvidia now constitutes a significant portion of Coatue's portfolio, accounting for 6.61% of the fund's total holdings. This is a massive increase from just 4.91% in the previous quarter, showcasing how the chipmaker has become a central piece of Coatue's investment strategy.

The Road Ahead

While Coatue's bet on Nvidia is certainly bold, it's also calculated. Nvidia's leading position in key growth markets like AI, data centers, and gaming suggests that the stock could see even more upside in the coming months.

For Coatue, this near-tenfold increase in stake might just be the beginning of an even bigger play on the tech giant's future.

Read Next:

Photo: Shutterstock

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.