Analog Devices, Inc. ADI posted better-than-expected third-quarter financial results on Wednesday.

The company's revenue declined 25% year-on-year to $2.31 billion, beating the analyst consensus estimate of $2.27 billion. Adjusted EPS of $1.58 beat the analyst consensus estimate of $1.50.

"Improved customer inventory levels and order momentum across most of our markets position us to grow again sequentially in our fourth quarter, increasing our confidence that we are past the trough of this cycle. However, economic and geopolitical uncertainty continues to limit the pace of the recovery," said Richard Puccio, CFO.

Analog Devices expects fourth-quarter revenue of $2.40 billion, +/- $100 million, versus the consensus of $2.38 billion. The company projects adjusted EPS of $1.63, +/-$0.10, against the consensus of $1.62.

Analog Devices shares fell 1% to trade at $225.29 on Thursday.

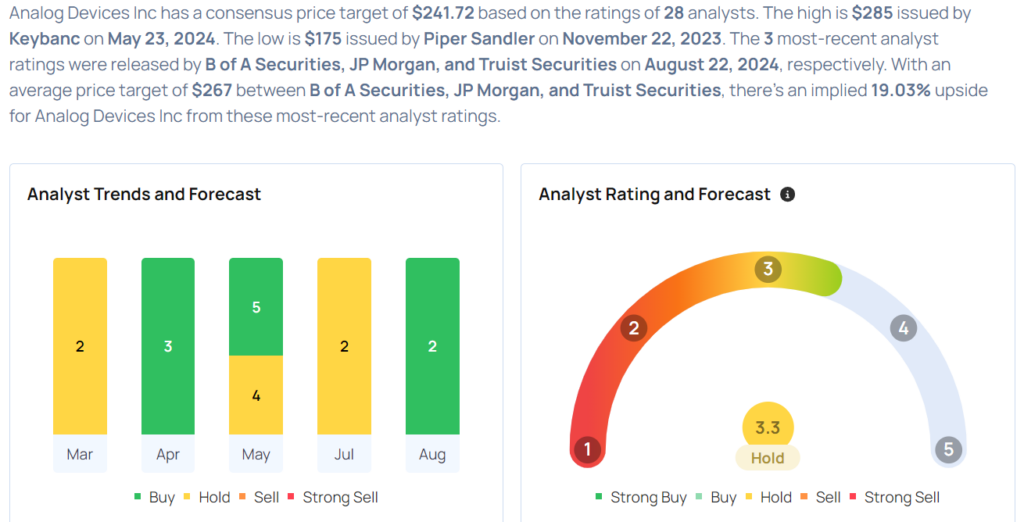

These analysts made changes to their price targets on Analog Devices following earnings announcement.

- Truist Securities analyst William Stein maintained Analog Devices with a Buy and lowered the price target from $275 to $266.

- JP Morgan analyst Harlan Sur maintained the stock with an Overweight and raised the price target from $260 to $280.

- B of A Securities analyst Vivek Arya maintained Analog Devices with a Buy and lowered the price target from $260 to $255.

Considering buying ADI stock? Here’s what analysts think:

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.