In the context of inflation, was the Federal Reserve late to tighten monetary policy and hike interest rates? Most would agree the answer is yes.

But the Fed doesn’t have just one mandate of promoting price stability. It has a dual mandate of promoting both price stability and maximum employment.

Taking employment into consideration, it’s less obvious to me that the Fed was late to tighten monetary policy.

I can’t pinpoint exactly when the calls to tighten began when inflation was heating up three years ago. But we can all agree that these calls grew loudest ahead of the Fed’s first rate hike in March 2022.

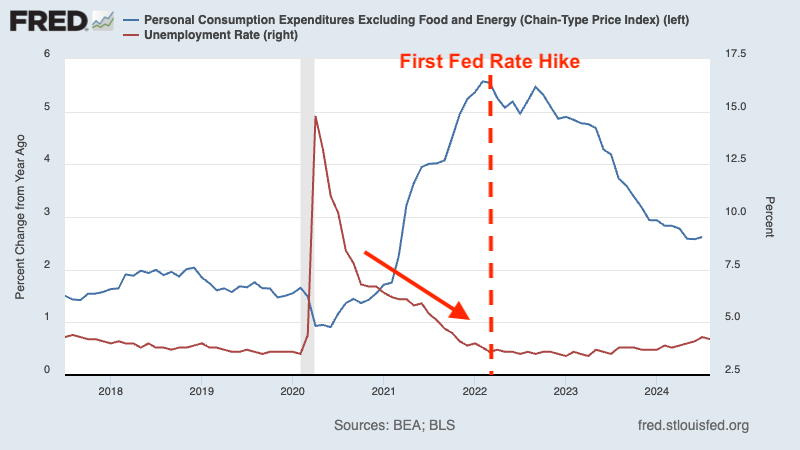

As you can see in the chart below, the core PCE price index (blue line) — the Fed’s preferred measure of inflation — was at a high of 5.5% in March 2022. Clearly, inflation was a problem.

That same month, the unemployment rate (red line) was 3.6%, the lowest level since before the pandemic.

As inflation rates rose and the Fed waited to hike rates, the unemployment rate continued to fall. BEAFRED

The unemployment rate effectively bottomed that month, mostly trending sideways as inflation rates cooled.

What If The Fed Acted Earlier?

I generally don’t like considering counterfactual scenarios because the world is complex, and no one can say with certainty what would’ve actually happened in the past if certain things had gone differently. But since we continue to hear folks casually say that we would’ve been better off if the Fed acted earlier, I’ll indulge in the thought exercise.

What if the Fed hiked rates at its January 2022 meeting? Maybe our inflation mess would’ve ended a little sooner. But the unemployment rate was higher at 4%. Would we have been okay with the unemployment rate trending at 4%? Maybe.

Upgrade to paid

What if we went back a little further, and the Fed hiked rates at its October/November 2021 meeting? The core PCE price index was increasing at about a 4.5% rate. Price-sensitive consumers would’ve been much happier to see inflation top out there. But the unemployment rate was higher at about 4.5%. Does the cost of keeping unemployment almost a full percentage point higher justify the benefit of keeping prices a bit cooler?

What if the Fed moved even sooner when the unemployment rate was even higher?

The Big Picture

Here’s my point: While it’s fair to argue the Fed hiked rates too late in the context of inflation, I don’t think it’s fair to argue they made a mistake — especially when you consider the goals of monetary policy in their entirety, which include promoting maximum employment.

While high inflation is a headache for consumers, at least some of it was the result of newly employed people finally being able to afford to purchase goods and services.

Like I said before, the world is complex. So who knows? Maybe there’s a scenario where the Fed tightened monetary policy sooner and the unemployment rate continued to fall anyway as inflation cooled.

But the likely outcome of tighter monetary policy earlier in this economic cycle would have been unemployment bottoming at a higher level than what we’ve experienced.

I’m not suggesting the Fed was right or wrong to adjust monetary policy when it did. I’m just saying that you cannot talk about how monetary policy actions affect inflation without addressing how they affect employment.

How about instead of proclaiming that the Fed was late in the context of inflation — which is not a controversial view — we instead tackle the philosophical question of how we balance the tradeoff between price stability and employment. How many people is it okay to leave unemployed if it means improving price stability?

The State Of Play

Over the past two and a half years, inflation rates have cooled significantly. And while the unemployment rate remains low by historical standards, it has been trending a bit higher.

Last month when the unemployment rate was 4.3%, Fed Chair Jerome Powell said: “We do not seek or welcome further cooling in labor market conditions.“

“The time has come for policy to adjust,” he added. It was one of the more explicit signals that rate cuts would begin soon, a development most market participants welcome.

Of course, there are also voices brushing off the rise in unemployment as they argue that the Fed should wait longer until inflation is defeated more definitively.

A version of this post was originally published on Tker.co.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.