Ferguson Enterprises Inc. FERG will release earnings results for its fourth quarter, before the opening bell on Tuesday, Sept. 17.

Analysts expect the Newport News, Virginia-based company to report quarterly earnings at $2.88 per share, up from $2.77 per share in the year-ago period. Ferguson projects to report quarterly revenue of $8.06 billion for the quarter, compared to $7.84 billion a year earlier, according to data from Benzinga Pro.

Ferguson shares gained 0.9% to close at $190.18 on Thursday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

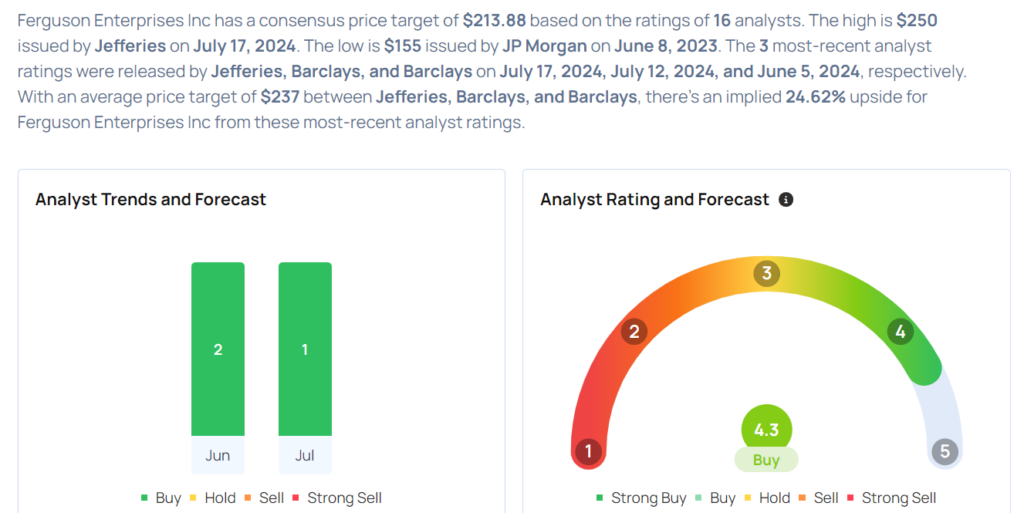

- Jefferies analyst Philip Ng maintained a Buy rating and raised the price target from $238 to $250 on July 17. This analyst has an accuracy rate of 67%.

- Barclays analyst Matthew Bouley maintained an Overweight rating and cut the price target from $232 to $229 on July 12. This analyst has an accuracy rate of 75%.

- RBC Capital analyst Mike Dahl maintained an Outperform rating and lowered the price target from $217 to $211 on June 5. This analyst has an accuracy rate of 75%.

- UBS analyst John Lovallo maintained a Buy rating and increased the price target from $225 to $236 on March 6. This analyst has an accuracy rate of 69%.

- Truist Securities Keith Hughes maintained a Buy rating and raised the price target from $197 to $230 on March 6. This analyst has an accuracy rate of 83%.

Considering buying FERG stock? Here’s what analysts think:

Read This Next:

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.