Written by Jake Smiths

AI is transforming industries across the board, but its impact on the financial world—particularly in stock market investments—has been nothing short of revolutionary. One of the companies leading this change is FINQ, a fintech platform that harnesses the power of AI to optimize stock market insights.

Recently, FINQ unveiled the highly anticipated version 2.0 of its STOCKS-AI algorithm, a solution designed to dramatically improve investment returns by leveraging sophisticated AI and machine learning techniques. So, what exactly does STOCKS-AI 2.0 bring to the table, and how does it outpace traditional stock-picking methods, including the S&P 500 index? Let's explore how cutting-edge AI like FINQ's STOCKS-AI 2.0 is shaping the future of investing.

How STOCKS-AI 2.0 Outperforms the Market

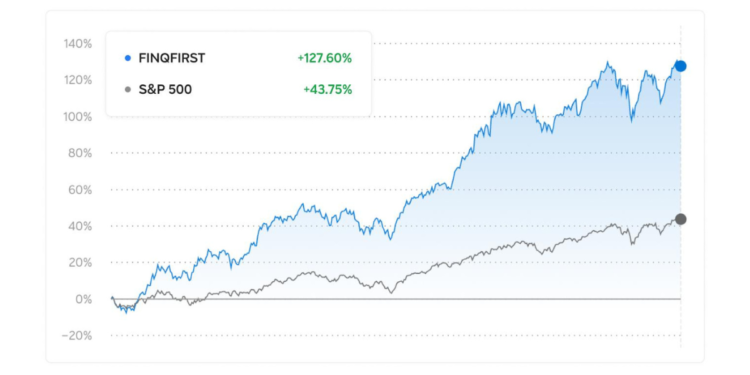

STOCKS-AI 2.0 has already garnered attention due to its impressive backtested performance. Over a two-year period from December 2022 to September 2024, the algorithm achieved an outstanding return of 127.60%, more than tripling the performance of the S&P 500, which gained 43.75% over the same period.

The key to STOCKS-AI 2.0's success lies in its ability to analyze and respond to ever-changing market conditions on a relative and continuous basis. Unlike traditional static formulas that rely on fixed metrics, FINQ continuously evolves by adapting its models based on current and historical data. The dynamic nature of this algorithm allows it to identify high-potential investment opportunities that might be overlooked by human investors or traditional methods.

"STOCKS-AI version 2.0 represents our commitment to innovation," says Eldad Tamir, Founder and CEO of FINQ. "We continuously push the boundaries of technology to empower our customers with smarter insights and better opportunities. The results speak for themselves—our AI-driven platform has proven that it can deliver returns well above traditional benchmarks like the S&P 500."

The Role of AI in Stock Market Analysis

Traditional stock-picking strategies often rely on manual research and predefined formulas to analyze market data. While effective to some extent, these methods are prone to human biases and can miss out on key insights that AI can catch.

In contrast, FINQ's STOCKS-AI 2.0 has the advantage of processing vast amounts of data at speeds that are impossible for humans to match. They can factor in hundreds of variables, including market trends, company performance metrics, economic indicators, and even sentiment analysis from news articles and social media.

Because of this, this AI-driven system can now make more informed, data-backed decisions. More than analyzing stocks in isolation, FINQ looks at the broader market context, adjusting its models as new information becomes available. This flexibility ensures that STOCKS-AI can capitalize on both short-term trends and long-term opportunities, maximizing returns while minimizing risk.

What's New in STOCKS-AI 2.0?

The latest version of STOCKS-AI introduces several new features that enhance its performance and usability for investors. Real-time adaptation is one of its standout upgrades. Unlike static models that can become outdated, STOCKS-AI 2.0 evolves with market shifts, ensuring that its stock rankings remain current and actionable. The system now also incorporates an expanded set of data, pulling from a broader range of financial, economic, and sentiment-driven sources.

Transparency is another core feature FINQ has committed to improving with this update. Customers can access more detailed performance benchmarks and insights through the FINQ platform, giving them full visibility into how the AI makes its decisions and how their portfolios are performing. It ultimately makes sure that investors stay informed about the rationale behind their portfolio's movements.

AI is continuing to expand its applications in the financial world and FINQ's STOCKS-AI 2.0 is paving the way for smarter, more efficient investment strategies that can outperform traditional methods by leveraging vast datasets and real-time analysis. Moreover, FINQ is designed to be accessible to a wide range of investors, not just financial professionals—which allows everyday investors to benefit from cutting-edge technology that was once reserved for institutional traders.

FINQ's STOCKS-AI 2.0 is a clear example of how technology can level the playing field in the financial markets, providing individual investors with the tools they need to succeed in an increasingly complex landscape.

The post How AI is Revolutionizing Stock Market Insights: A Deep Dive into FINQ's STOCKS-AI 2.0 appeared first on New York Tech Media.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.