Zinger Key Points

- Tapestry reports adjusted earnings per share of $1.02, beating the consensus estimate of 95 cents.

- The Coach and Kate Spade parent company reports revenue of $1.51 billion, beating estimates of $1.47 billion.

- Get 5 stock picks identified before their biggest breakouts, identified by the same system that spotted Insmed, Sprouts, and Uber before their 20%+ gains.

Tapestry, Inc. TPR reported its fiscal 2025 first-quarter financial results on Thursday before the market opened. Here’s what you need to know.

What To Know: Tapestry posted adjusted earnings per share of $1.02, beating the consensus estimate of 95 cents, according to Benzinga Pro. The Coach and Kate Spade parent company reported revenue of $1.51 billion, beating estimates of $1.47 billion.

Tapestry generated $120 million in cash flow from operating activities, up from $75 million in the prior year, and $94 million in free cash flow during the quarter. The company ended the quarter with $7.31 billion in cash, cash equivalents and short-term investments.

Tapestry's board declared a quarterly dividend of 35 cents per share, payable on Dec. 23 to shareholders of record as of Dec. 6.

CEO Joanne Crevoiserat highlighted the first-quarter results as a demonstration of Tapestry's "brand magic and operational excellence" amidst a challenging global environment.

“We remain in a position of strength, with distinctive brands, an agile platform, and robust cash flow that provide us with strategic and financial flexibility to deliver accelerated organic growth and enhanced value creation in FY25 and for years to come,” Crevoiserat said.

Outlook: Tapestry raised its full-year fiscal 2025 guidance, now expecting revenue of over $6.75 billion. The company also anticipates earnings per share of $4.50 to $4.55, an increase from its previous guidance of $4.45 to $4.50.

Tapestry expects to generate free cash flow of approximately $1.1 billion in fiscal 2025.

Following the print, Telsey Advisory Group analyst Dana Telsey maintained Tapestry with an Outperform rating and price target of $54.

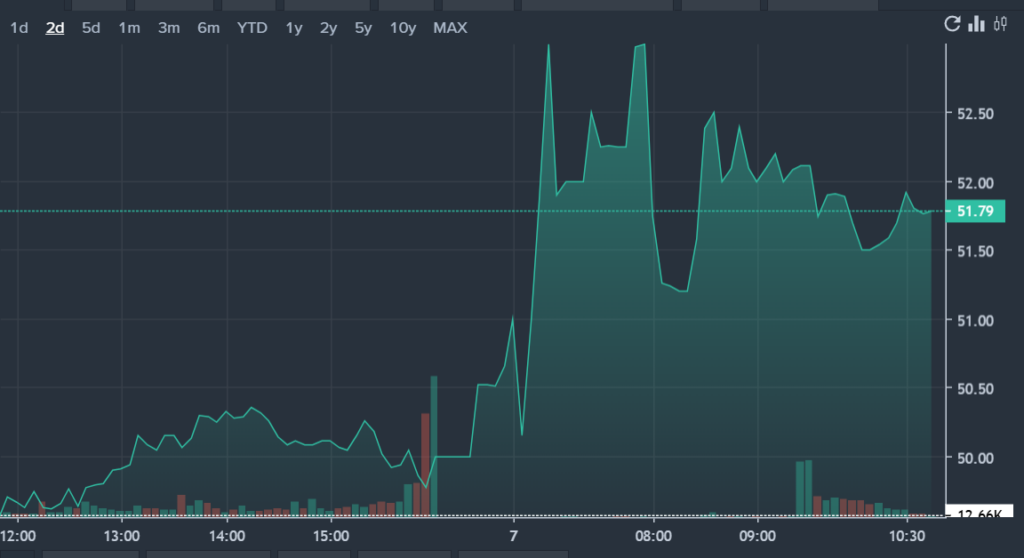

TPR Price Action: Tapestry shares were up 4.04% at $51.75 at the time of publication, according to Benzinga Pro.

Read Next:

Photo via Wikimedia Commons.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.