JM Smucker SJM will release its quarterly earnings report on Tuesday, 2024-11-26. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate JM Smucker to report an earnings per share (EPS) of $2.49.

Anticipation surrounds JM Smucker's announcement, with investors hoping to hear about both surpassing estimates and receiving positive guidance for the next quarter.

New investors should understand that while earnings performance is important, market reactions are often driven by guidance.

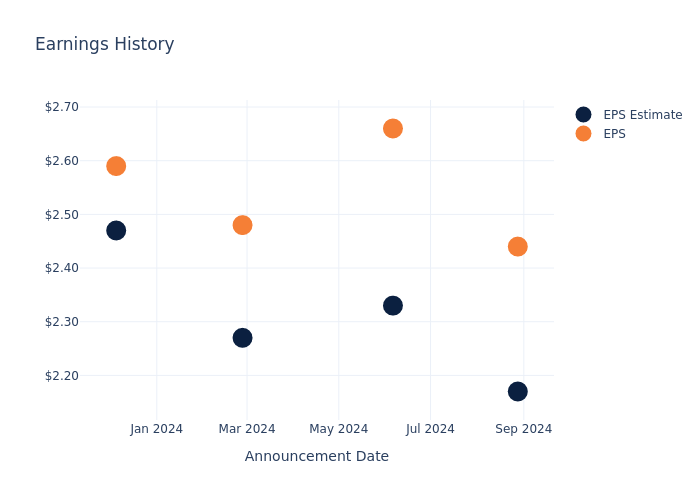

Performance in Previous Earnings

Last quarter the company beat EPS by $0.27, which was followed by a 0.82% drop in the share price the next day.

Here's a look at JM Smucker's past performance and the resulting price change:

| Quarter | Q1 2025 | Q4 2024 | Q3 2024 | Q2 2024 |

|---|---|---|---|---|

| EPS Estimate | 2.17 | 2.33 | 2.27 | 2.47 |

| EPS Actual | 2.44 | 2.66 | 2.48 | 2.59 |

| Price Change % | -1.0% | -0.0% | -1.0% | 1.0% |

Performance of JM Smucker Shares

Shares of JM Smucker were trading at $113.3 as of November 21. Over the last 52-week period, shares are up 3.39%. Given that these returns are generally positive, long-term shareholders are likely bullish going into this earnings release.

Analysts' Perspectives on JM Smucker

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding JM Smucker.

The consensus rating for JM Smucker is Neutral, based on 7 analyst ratings. With an average one-year price target of $126.71, there's a potential 11.84% upside.

Analyzing Analyst Ratings Among Peers

The below comparison of the analyst ratings and average 1-year price targets of Pilgrims Pride, Lamb Weston Hldgs and Conagra Brands, three prominent players in the industry, gives insights for their relative performance expectations and market positioning.

- Pilgrims Pride received a Neutral consensus from analysts, with an average 1-year price target of $47.0, implying a potential 58.52% downside.

- Lamb Weston Hldgs received a Neutral consensus from analysts, with an average 1-year price target of $74.36, implying a potential 34.37% downside.

- The consensus outlook from analysts is an Neutral trajectory for Conagra Brands, with an average 1-year price target of $31.75, indicating a potential 71.98% downside.

Comprehensive Peer Analysis Summary

The peer analysis summary provides a snapshot of key metrics for Pilgrims Pride, Lamb Weston Hldgs and Conagra Brands, illuminating their respective standings within the industry. These metrics offer valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| JM Smucker | Neutral | 17.72% | $797.20M | 2.39% |

| Pilgrims Pride | Neutral | 5.16% | $683.97M | 8.82% |

| Lamb Weston Hldgs | Neutral | -0.67% | $356M | 7.03% |

| Conagra Brands | Neutral | -3.76% | $739.30M | 5.45% |

Key Takeaway:

JM Smucker ranks at the top for Revenue Growth among its peers. It is in the middle for Gross Profit. For Return on Equity, JM Smucker is at the bottom.

Get to Know JM Smucker Better

J.M. Smucker is a packaged food company that primarily sells through the US retail channel (78% of fiscal 2024 revenue came through its retail pet foods, coffee, and frozen handheld/spreads segments), with the remaining share consisting of Hostess and international (primarily Canada). Retail coffee is its largest category (33% of sales) with brands Folgers and Dunkin'. Pet foods (22% of sales) holds leading brands like Milk-Bone and Meow Mix. Of its remaining, approximately 22% comes from consumer foods, primarily peanut butter and jelly, through brands Jif and Smucker's. The company acquired Hostess Brands in fiscal 2024 to boost its snack and convenience store presence.

JM Smucker: A Financial Overview

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Over the 3 months period, JM Smucker showcased positive performance, achieving a revenue growth rate of 17.72% as of 31 July, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Staples sector.

Net Margin: JM Smucker's net margin excels beyond industry benchmarks, reaching 8.71%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): JM Smucker's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 2.39%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): JM Smucker's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.91%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: JM Smucker's debt-to-equity ratio stands notably higher than the industry average, reaching 1.11. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

To track all earnings releases for JM Smucker visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.