Titan Machinery TITN will release its quarterly earnings report on Tuesday, 2024-11-26. Here's a brief overview for investors ahead of the announcement.

Analysts anticipate Titan Machinery to report an earnings per share (EPS) of $0.02.

The market awaits Titan Machinery's announcement, with hopes high for news of surpassing estimates and providing upbeat guidance for the next quarter.

It's important for new investors to understand that guidance can be a significant driver of stock prices.

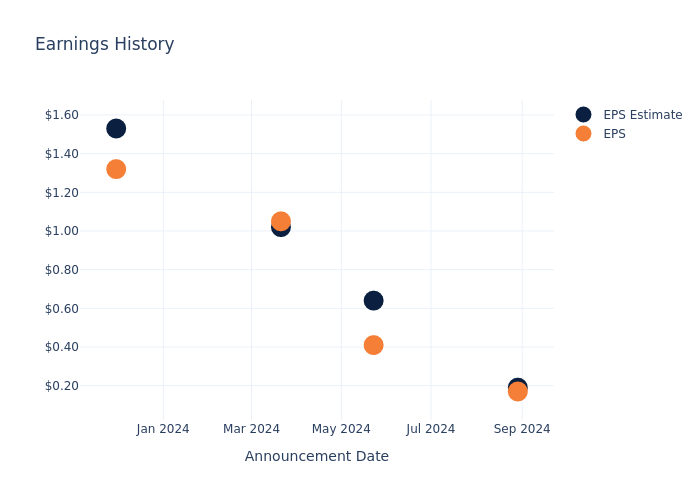

Overview of Past Earnings

The company's EPS missed by $0.02 in the last quarter, leading to a 6.11% increase in the share price on the following day.

Here's a look at Titan Machinery's past performance and the resulting price change:

| Quarter | Q2 2025 | Q1 2025 | Q4 2024 | Q3 2024 |

|---|---|---|---|---|

| EPS Estimate | 0.19 | 0.64 | 1.02 | 1.53 |

| EPS Actual | 0.17 | 0.41 | 1.05 | 1.32 |

| Price Change % | 6.0% | -6.0% | -6.0% | 8.0% |

Titan Machinery Share Price Analysis

Shares of Titan Machinery were trading at $15.14 as of November 22. Over the last 52-week period, shares are down 38.3%. Given that these returns are generally negative, long-term shareholders are likely bearish going into this earnings release.

Insights Shared by Analysts on Titan Machinery

For investors, grasping market sentiments and expectations in the industry is vital. This analysis explores the latest insights regarding Titan Machinery.

Titan Machinery has received a total of 3 ratings from analysts, with the consensus rating as Neutral. With an average one-year price target of $21.67, the consensus suggests a potential 43.13% upside.

Understanding Analyst Ratings Among Peers

The following analysis focuses on the analyst ratings and average 1-year price targets of Hudson Technologies, Alta Equipment Group and Lavoro, three prominent industry players, providing insights into their relative performance expectations and market positioning.

- The consensus among analysts is an Neutral trajectory for Hudson Technologies, with an average 1-year price target of $7.55, indicating a potential 50.13% downside.

- As per analysts' assessments, Alta Equipment Group is favoring an Neutral trajectory, with an average 1-year price target of $14.5, suggesting a potential 4.23% downside.

- The consensus outlook from analysts is an Outperform trajectory for Lavoro, with an average 1-year price target of $7.0, indicating a potential 53.76% downside.

Key Findings: Peer Analysis Summary

The peer analysis summary presents essential metrics for Hudson Technologies, Alta Equipment Group and Lavoro, unveiling their respective standings within the industry and providing valuable insights into their market positions and comparative performance.

| Company | Consensus | Revenue Growth | Gross Profit | Return on Equity |

|---|---|---|---|---|

| Titan Machinery | Neutral | -1.38% | $112.38M | -0.65% |

| Hudson Technologies | Neutral | -19.02% | $15.94M | 3.11% |

| Alta Equipment Group | Neutral | -3.73% | $124.60M | -25.71% |

| Lavoro | Outperform | 7.57% | $235.70M | -29.51% |

Key Takeaway:

Titan Machinery ranks in the middle among its peers for consensus rating. It is at the bottom for revenue growth and gross profit, while it is at the top for return on equity.

Delving into Titan Machinery's Background

Titan Machinery Inc owns and operates a network of full-service agricultural and construction equipment stores. The company sells and repairs agricultural equipment, including machinery and attachments for large-scale farming and home and gardening purposes, as well as construction equipment. It operates through the following segments: The Agriculture segment sells, services, and rents machinery and related parts and attachments, for uses ranging from large-scale farming to home and garden use, The construction segment sells, services, and rents machinery, and related parts and attachments, for uses ranging from heavy construction to light industrial machinery use, and the Europe and Australia segments.

Titan Machinery: Financial Performance Dissected

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Negative Revenue Trend: Examining Titan Machinery's financials over 3 months reveals challenges. As of 31 July, 2024, the company experienced a decline of approximately -1.38% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Titan Machinery's net margin is impressive, surpassing industry averages. With a net margin of -0.68%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Titan Machinery's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of -0.65%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Titan Machinery's ROA excels beyond industry benchmarks, reaching -0.2%. This signifies efficient management of assets and strong financial health.

Debt Management: Titan Machinery's debt-to-equity ratio surpasses industry norms, standing at 2.03. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

To track all earnings releases for Titan Machinery visit their earnings calendar on our site.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.