Across the recent three months, 5 analysts have shared their insights on Voyager Therapeutics VYGR, expressing a variety of opinions spanning from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 1 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

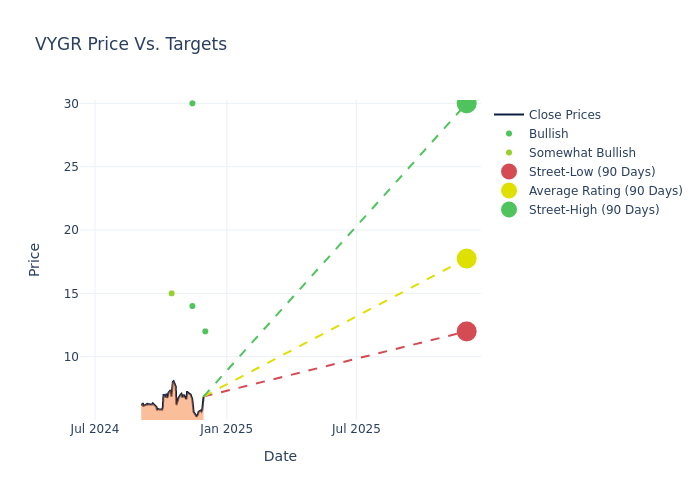

In the assessment of 12-month price targets, analysts unveil insights for Voyager Therapeutics, presenting an average target of $20.2, a high estimate of $30.00, and a low estimate of $12.00. A decline of 18.12% from the prior average price target is evident in the current average.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Voyager Therapeutics among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Samantha Semenkow | Citigroup | Announces | Buy | $12.00 | - |

| Sumant Kulkarni | Canaccord Genuity | Maintains | Buy | $14.00 | $14.00 |

| Patrick Trucchio | HC Wainwright & Co. | Maintains | Buy | $30.00 | $30.00 |

| Patrick Trucchio | HC Wainwright & Co. | Maintains | Buy | $30.00 | $30.00 |

| Lili Nsongo | Leerink Partners | Announces | Outperform | $15.00 | - |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Voyager Therapeutics. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Voyager Therapeutics compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Voyager Therapeutics's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Voyager Therapeutics's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Voyager Therapeutics analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Get to Know Voyager Therapeutics Better

Voyager Therapeutics Inc is a gene therapy company focused on developing life-changing treatments for patients suffering from severe neurological diseases. It focuses on neurological diseases where an adeno-associated virus, or AAV, gene therapy approach that either increases or decreases the production of a specific protein can slow or reduce the symptoms experienced by patients, and therefore have a clinically meaningful impact. The company's gene therapy platform TRACER enables to engineer, optimize, manufacture and deliver AAV-based gene therapies that have the potential to provide durable efficacy following a single administration. Its pipeline of programs include, Anti-tau Antibody (VY-TAU01), SOD1 Silencing Gene Therapy (siRNA), FXN Gene Therapy among others.

Financial Milestones: Voyager Therapeutics's Journey

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Positive Revenue Trend: Examining Voyager Therapeutics's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 433.79% as of 30 September, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: Voyager Therapeutics's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -36.72% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Voyager Therapeutics's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -2.72% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of -2.1%, the company showcases effective utilization of assets.

Debt Management: Voyager Therapeutics's debt-to-equity ratio is below the industry average. With a ratio of 0.14, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

What Are Analyst Ratings?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.