Providing a diverse range of perspectives from bullish to bearish, 4 analysts have published ratings on Ooma OOMA in the last three months.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 0 | 0 | 0 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

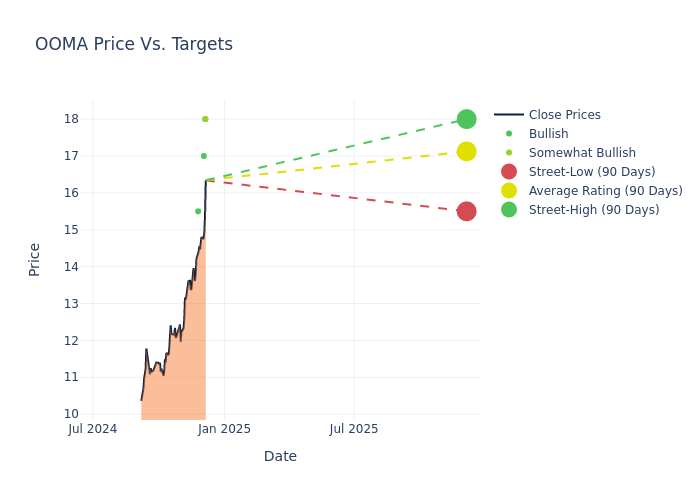

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $17.12, with a high estimate of $18.00 and a low estimate of $15.50. Surpassing the previous average price target of $14.88, the current average has increased by 15.05%.

Exploring Analyst Ratings: An In-Depth Overview

An in-depth analysis of recent analyst actions unveils how financial experts perceive Ooma. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Eric Martinuzzi | Lake Street | Raises | Buy | $18.00 | $14.00 |

| Michael Latimore | Northland Capital Markets | Raises | Outperform | $18.00 | $16.00 |

| Matthew Harrigan | Benchmark | Raises | Buy | $17.00 | $15.00 |

| Josh Nichols | B. Riley Securities | Raises | Buy | $15.50 | $14.50 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Ooma. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Ooma compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Ooma's stock. This examination reveals shifts in analysts' expectations over time.

To gain a panoramic view of Ooma's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Ooma analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering Ooma: A Closer Look

Ooma Inc is a communications services company. It is a smart software-as-a-service ("SaaS") and unified communications platform that deliver voice and collaboration features including messaging, intelligent virtual attendants and video conferencing, and residential phone service provides PureVoice high-definition voice quality, advanced functionality and integration with mobile devices. Its services rely upon the following main elements: multi-tenant cloud service, on-premise devices, desktop and mobile applications, and calling platforms. Ooma generates revenues from the sale of subscriptions and other services.

Ooma: Delving into Financials

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Positive Revenue Trend: Examining Ooma's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 9.9% as of 31 July, 2024, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of -3.33%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Ooma's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -2.62% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Ooma's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of -1.39%, the company showcases efficient use of assets and strong financial health.

Debt Management: Ooma's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.3.

The Basics of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.